- United States

- /

- Software

- /

- NYSE:DLB

Dolby Laboratories (DLB): Evaluating Valuation Following Industry Backing of Dolby Vision 2 Innovation

Reviewed by Simply Wall St

Dolby Laboratories (DLB) just unveiled Dolby Vision 2, capturing fresh attention from investors and the broader tech industry. With new features like an upgraded image engine, AI-driven content optimization, and novel motion control tools, Dolby is positioning itself at the cutting edge of home entertainment. The immediate support from big names such as Hisense and CANAL+ underscores how quickly major players are lining up behind this next-generation technology. This suggests that industry adoption could move faster than many expected.

This announcement comes at a dynamic point for Dolby’s stock. While the company saw moderate annual gains of nearly 8% over the past year, momentum has tempered recently, with shares giving up some ground and drifting lower in the year to date. Still, the broader view is one of steady if unspectacular growth, helped along by strong revenue and profit trends and consistent product innovation. Against this mixed backdrop, Dolby’s ambitions in TV tech are drawing a lot of interest as both a potential growth driver and a test of what the market is willing to pay for premium innovation.

This leaves investors with a familiar but pressing question: Is Dolby’s current share price underestimating the leap forward offered by Dolby Vision 2, or is the market already pricing in every bit of future growth?

Most Popular Narrative: 23.5% Undervalued

The prevailing view among analysts is that Dolby Laboratories is trading significantly below its projected fair value, with optimism centered on its expanded footprint in immersive entertainment.

Dolby's expanding partnerships with leading auto OEMs (Audi, Porsche, Cadillac, Tata, Mahindra) and rising integration of Dolby Atmos/Vision in new vehicle models, including electric vehicles, signal long-term growth as demand for premium in-car entertainment accelerates globally. This supports both revenue and margin expansion.

Curious why analysts expect so much upside? The fair value calculation isn’t just built on hope. Underneath is a bold set of forecasts for Dolby’s growth, such as top-line acceleration, stronger margins, and a profit scenario that pushes the limits for tech sector valuations. Want to see which surprising future projections are driving this price target?

Result: Fair Value of $95.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing device commoditization and macroeconomic uncertainty could shrink Dolby’s addressable market and undermine the optimistic growth projections that analysts currently favor.

Find out about the key risks to this Dolby Laboratories narrative.Another View: DCF Model

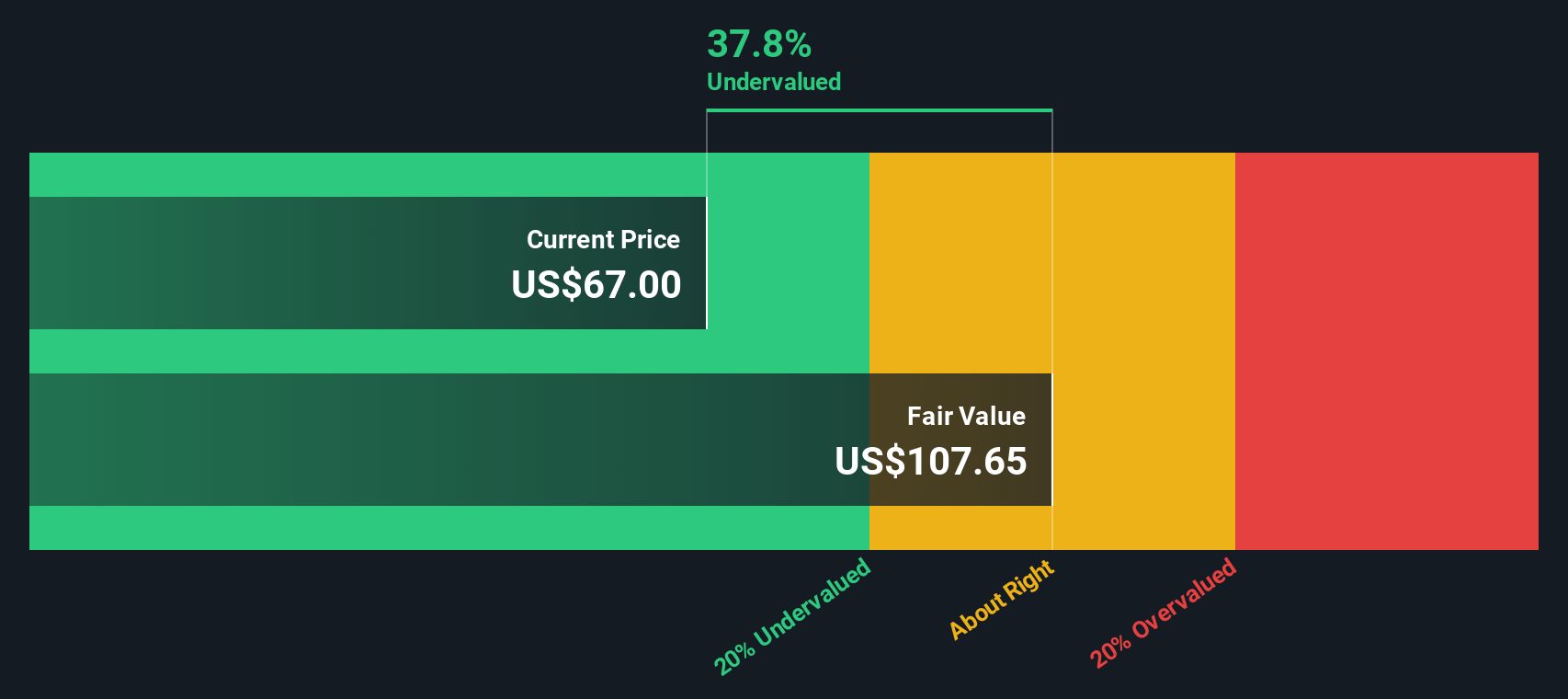

Looking through the lens of our DCF model, Dolby also appears undervalued. However, this perspective is based on different cash flow assumptions compared to the analyst consensus. Will both views prove correct, or could reality surprise?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dolby Laboratories for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dolby Laboratories Narrative

If you have your own perspective or want to dig into the numbers yourself, it’s easy to piece together your own take in just a few minutes. Do it your way

A great starting point for your Dolby Laboratories research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors never stop at one idea. Make the most of your strategy by checking out these hand-picked stock lists for a fresh edge and timely opportunities before the rest catch on.

- Capitalize on tomorrow’s artificial intelligence breakthroughs with AI penny stocks. See which innovators may be positioned for significant growth.

- Secure steady cash flows by exploring dividend stocks with yields > 3%. This highlights stocks with yields above 3% that could enhance your income strategy.

- Find value stocks flying under the radar with undervalued stocks based on cash flows. Discover hidden gems based on their future cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:DLB

Dolby Laboratories

Engages in the design and manufacture of audio, imaging, accessibility, and other hardware and software solutions for television, broadcast, and live entertainment industries in the United States and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion