- United States

- /

- Software

- /

- NYSE:CXM

The Bull Case For Sprinklr (CXM) Could Change Following Its Expanded SAMY Partnership And Diageo Win

Reviewed by Sasha Jovanovic

- In November 2025, Sprinklr announced an expanded global partnership with SAMY that combines its Unified-CXM platform with SAMY’s social-first marketing capabilities to help brands translate real-time customer insights into coordinated execution across channels.

- A key example is their joint Foresight System for Diageo, which uses Sprinklr’s social listening to turn emerging cultural and consumption trends into actionable product, marketing, and innovation decisions worldwide.

- Next, we’ll examine how this deeper SAMY partnership, alongside expectations for Sprinklr’s upcoming earnings, may influence its investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Sprinklr Investment Narrative Recap

To own Sprinklr, you need to believe its Unified-CXM platform can stay central to how large brands run AI-driven customer engagement, despite slowing revenue growth expectations and intensifying competition from bigger suites. The expanded SAMY partnership reinforces Sprinklr’s role in turning real-time social data into action, but the near term catalyst remains the upcoming earnings report, where any signs of pressure on growth or margins could matter more than this announcement for now.

Among recent announcements, the upcoming Q3 2026 earnings release on 3 December 2025 is the most relevant, as it offers the first read on how management is executing while integrating advanced AI features and absorbing higher cloud and LLM costs. That update will sit alongside the SAMY news in shaping how investors judge Sprinklr’s ability to balance AI-driven product investment with maintaining healthy gross margins and subscription profitability.

But investors should also be aware that rising AI infrastructure costs could pressure margins just as...

Read the full narrative on Sprinklr (it's free!)

Sprinklr's narrative projects $1.0 billion revenue and $36.8 million earnings by 2028.

Uncover how Sprinklr's forecasts yield a $11.00 fair value, a 46% upside to its current price.

Exploring Other Perspectives

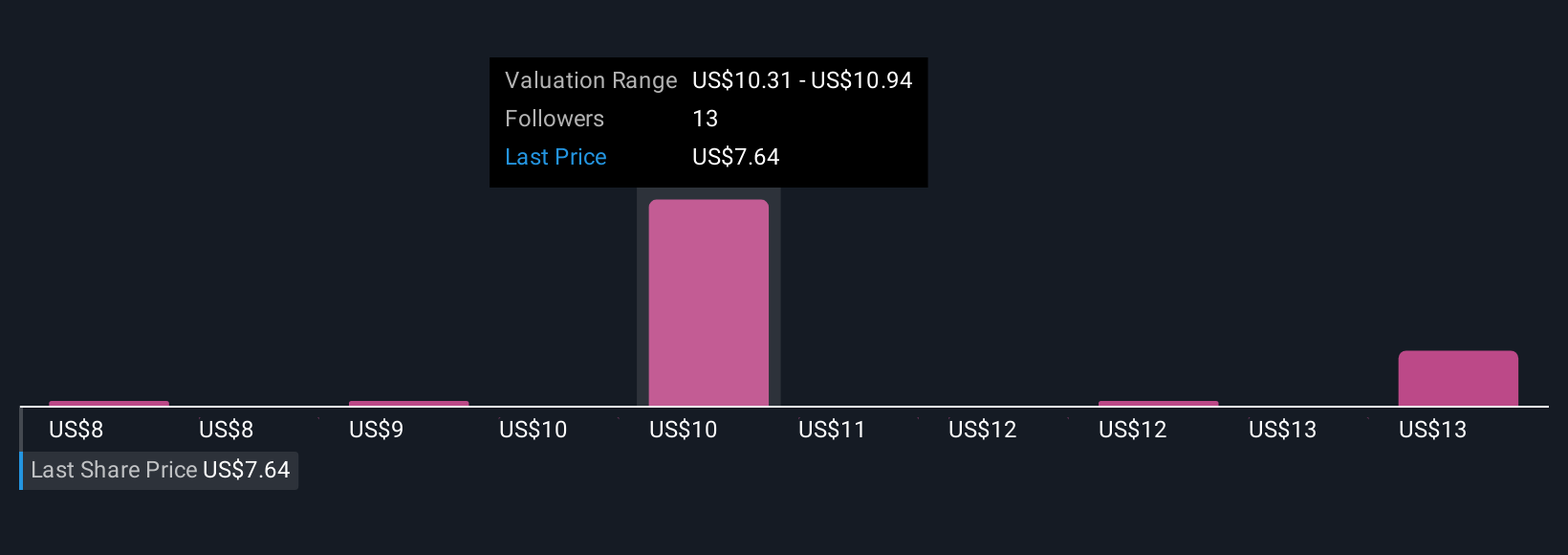

Four members of the Simply Wall St Community currently see Sprinklr’s fair value between US$7.79 and US$12.20, underscoring how far views can diverge. Against that backdrop, concerns about higher cloud and LLM expenses squeezing margins give you a concrete lens to compare those valuations and explore several alternative viewpoints on Sprinklr’s longer term earnings power.

Explore 4 other fair value estimates on Sprinklr - why the stock might be worth as much as 62% more than the current price!

Build Your Own Sprinklr Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sprinklr research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sprinklr research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sprinklr's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CXM

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026