- United States

- /

- Software

- /

- OTCPK:CTKY.Y

What Type Of Returns Would CooTek (Cayman)'s(NYSE:CTK) Shareholders Have Earned If They Purchased Their SharesYear Ago?

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the CooTek (Cayman) Inc. (NYSE:CTK) share price slid 11% over twelve months. That's well below the market return of 20%. CooTek (Cayman) hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. The share price has dropped 30% in three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

View our latest analysis for CooTek (Cayman)

CooTek (Cayman) wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year CooTek (Cayman) saw its revenue grow by 107%. That's well above most other pre-profit companies. The share price drop of 11% over twelve months would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our brains have evolved to think in linear fashion, so there's value in learning to recognize exponential growth. We are, in some ways, simply the wisest of the monkeys.

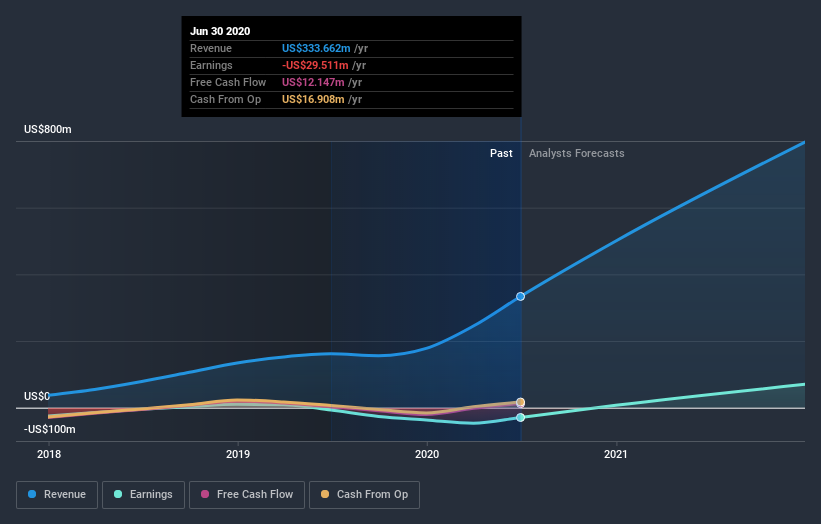

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling CooTek (Cayman) stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Given that the market gained 20% in the last year, CooTek (Cayman) shareholders might be miffed that they lost 11%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Notably, the loss over the last year isn't as bad as the 30% drop in the last three months. So it seems like some holders have been dumping the stock of late - and that's not bullish. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for CooTek (Cayman) that you should be aware of.

We will like CooTek (Cayman) better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading CooTek (Cayman) or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OTCPK:CTKY.Y

CooTek (Cayman)

Operates as a mobile internet company in the United States and the People's Republic of China.

Moderate and slightly overvalued.

Market Insights

Community Narratives