- United States

- /

- Software

- /

- NYSE:CRM

The Bull Case For Salesforce (CRM) Could Change Following Broad Agentforce 360 Wins Across Key Sectors

Reviewed by Sasha Jovanovic

- In recent days, Salesforce announced multiple Agentforce 360 deployments and integrations, including major agreements with Novartis, AstraZeneca, DeVry University, Vonage, ZS, and the U.S. Department of Transportation to modernize engagement and operations using its AI-powered CRM and data platforms.

- Together, these wins point to growing, real-world usage of Salesforce’s AI and data stack across healthcare, education, government, and contact centers, addressing earlier investor doubts about whether its AI tools would translate into meaningful, paid adoption.

- We’ll now examine how the expanded Novartis rollout of Agentforce Life Sciences could reshape Salesforce’s AI-led investment narrative and long-term thesis.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Salesforce Investment Narrative Recap

To own Salesforce today, you have to believe its AI and Agentforce platform will deepen its role as the core system of record and engagement for large enterprises, offsetting macro caution and tougher competition from hyperscalers. The recent wave of Agentforce 360 wins highlights real adoption, but does not fully resolve the key near term question of whether AI features can sustain higher pricing and expansion before IT budgets tighten further.

The expanded Novartis rollout of Agentforce Life Sciences is especially relevant here, because it commits a top tier pharmaceutical company to a multi year, global Agentforce 360 deployment across marketing, medical, and patient services. For investors watching AI monetization, this is an example of Salesforce embedding AI agents and Data 360 into mission critical, highly regulated workflows where switching costs and compliance demands can reinforce both stickiness and pricing power if execution stays on track.

Yet even with these wins, investors should not ignore the risk that hyperscalers bundling AI and CRM into existing suites could still...

Read the full narrative on Salesforce (it's free!)

Salesforce's narrative projects $51.9 billion revenue and $10.3 billion earnings by 2028. This requires 9.6% yearly revenue growth and about a $3.6 billion earnings increase from $6.7 billion today.

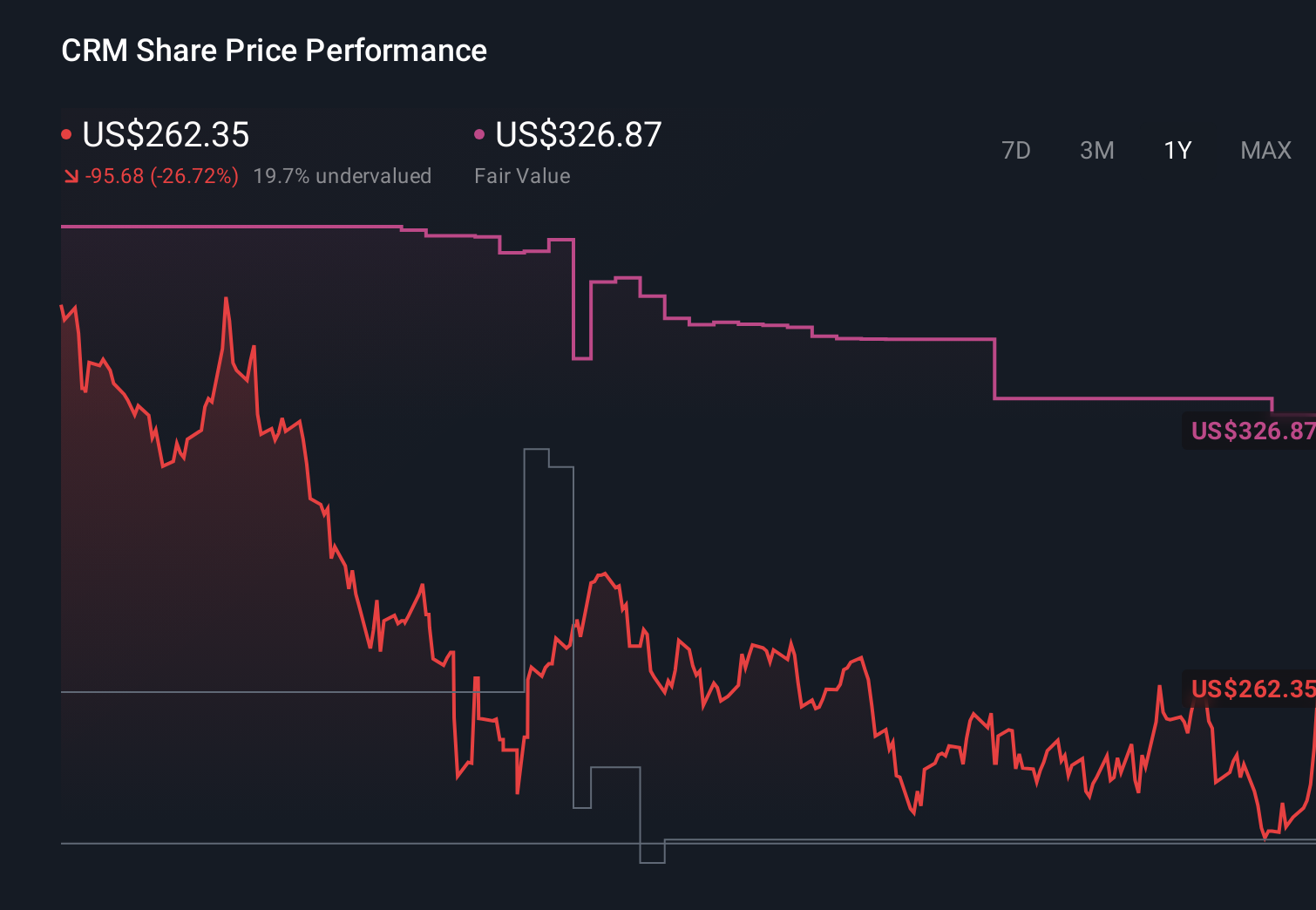

Uncover how Salesforce's forecasts yield a $326.87 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members place Salesforce’s fair value between US$223.99 and US$430 across 44 views, so you are seeing a very wide spread of expectations. That diversity sits alongside the core catalyst that Salesforce’s Agentforce and Data 360 adoption must keep proving AI can drive paid expansion, not just bundled features, which has clear implications for growth and competitive resilience.

Explore 44 other fair value estimates on Salesforce - why the stock might be worth 13% less than the current price!

Build Your Own Salesforce Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Salesforce research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Salesforce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Salesforce's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRM

Salesforce

Provides customer relationship management technology that connects companies and customers together worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion