- United States

- /

- Software

- /

- NYSE:CRM

Salesforce (NYSE:CRM) Expands Board with Tech Innovators and Integrates Datassential Plugin

Reviewed by Simply Wall St

Salesforce (NYSE:CRM) recently appointed Amy Chang and David Kirk to its Board of Directors and launched the Datassential Salesforce Plugin, enhancing its CRM capabilities. Over the last quarter, the company's stock price increased by 3%, aligning with a generally positive market trend driven by high-performing technology stocks. Despite global market fluctuations and tariff uncertainties, Salesforce's expansion efforts and new partnerships, including with PepsiCo and ACI Infotech, complemented the market's buoyancy. These developments may have supported their quarter performance against a backdrop of ongoing AI-driven enthusiasm, akin to advances seen in companies like Nvidia.

We've spotted 1 risk for Salesforce you should be aware of.

Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

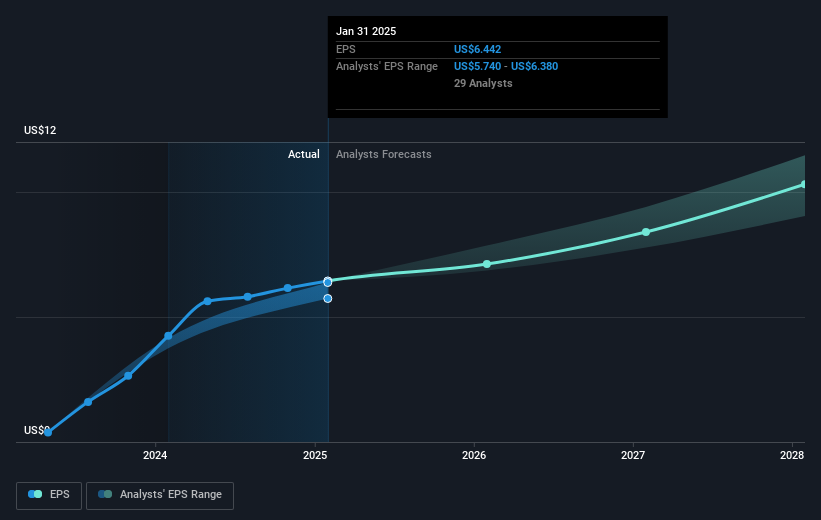

The recent additions to Salesforce's Board, Amy Chang and David Kirk, and the introduction of the Datassential Salesforce Plugin, aim to enhance its CRM capabilities. These developments could bolster Salesforce's narrative of expanding AI adoption across industries, driving potential revenue growth through new partnerships. While these moves have promising implications, they also align with a gradual shift towards consumption-based pricing models, which may impact future earnings forecasts by potentially stabilizing revenue streams. The company's plans to leverage AI and data products might further align with analyst expectations of a 9.0% annual revenue growth over the next three years, contributing positively to forecasts.

Over the past three-year period, Salesforce's total return, including share price and dividends, was 65.96%, offering substantial returns to shareholders. In comparison, over the last year, Salesforce's performance did not surpass the US Software industry, which saw a 20.2% return. This disparity might highlight investor concerns about competitive pressures or economic headwinds affecting short-term gains. With its current share price at $273.36, Salesforce’s price target of $364.65 suggests potential upside, reflecting a consensus view among analysts about the company's growth trajectory based on future earnings. These factors combined with the company's strategic initiatives and market positioning may enhance Salesforce's attractiveness and align its performance with market expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRM

Salesforce

Provides customer relationship management technology that connects companies and customers together worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion