- United States

- /

- Software

- /

- NYSE:CRM

Salesforce (NYSE:CRM) Expands AI Footprint with PepsiCo and UChicago Medicine Collaborations

Reviewed by Simply Wall St

Salesforce (NYSE:CRM) recently announced two impactful initiatives: PepsiCo's adoption of Agentforce to enhance operational efficiency and customer support, and UChicago Medicine's implementation of Agentforce for Health, aimed at improving patient experiences. These developments underscore the company's commitment to AI integration in diverse industries. Last week, Salesforce's share price rose 4.5%, notably outpacing the broader market's 1.9% climb. The favorable reception of these client announcements, along with the recent launch of Agentforce 3, seemingly reinforced investor confidence, adding weight to the positive market trend during the same period.

Be aware that Salesforce is showing 1 risk in our investment analysis.

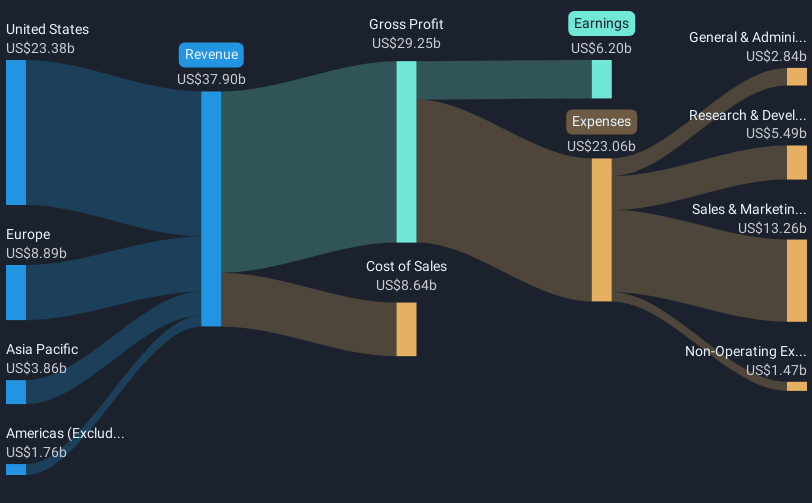

Salesforce’s announcement of Agentforce’s integration by PepsiCo and UChicago Medicine could bolster its narrative of driving AI adoption across industries. These partnerships may enhance Salesforce's operational efficiency and customer experiences, potentially leading to increased demand for its AI-driven solutions. The company's revenue and earnings forecasts could see upward revisions as these initiatives gain traction, aligning with analysts' expectations of revenue reaching $49.1 billion and earnings rising to $9.9 billion by 2028.

In the longer term, Salesforce shares delivered a 60.33% total return over the past three years. However, they underperformed the US Software industry’s 19.7% gain over the last year. This indicates a significant rebound in shareholder value after a period of challenge, although shorter-term performance suggests room for improvement.

Currently, Salesforce shares trade at US$273.36, reflecting a discount of around 30.2% to the consensus price target of US$353.19. If earnings meet projected growth rates and profit margins improve, this price target may be attainable. However, risks like competitive pressures and reliance on external partnerships exist, which could impact the forecasts and valuation assumptions. As always, it's crucial to assess these elements against your own evaluations and market expectations.

Review our growth performance report to gain insights into Salesforce's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRM

Salesforce

Provides customer relationship management (CRM) technology that connects companies and customers together worldwide.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives