- United States

- /

- Software

- /

- NYSE:CRM

Did New AI Partnerships on Emergent's GSA Contract Just Shift Salesforce's (CRM) Investment Narrative?

Reviewed by Simply Wall St

- In August 2025, Emergent, LLC announced the addition of Salesforce solutions to its active GSA Contract, while key partners Seismic and NiCE unveiled integrations leveraging AI-driven platforms such as Agentforce to enhance federal and enterprise customer experiences.

- These recent collaborations highlight Salesforce's momentum in expanding AI-powered capabilities across both government and commercial sectors, strengthening its partner ecosystem and platform reach.

- We'll examine how Salesforce's growing network of AI-focused partnerships could reshape its investment narrative and future revenue potential.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Salesforce Investment Narrative Recap

To be a Salesforce shareholder, you need to believe that its AI-centric strategy, platform unification, and growing partner ecosystem, exemplified by recent public sector wins, are enough to power continued revenue and earnings growth, despite intensifying competition and market shifts. The latest government and enterprise collaborations reinforce Salesforce’s focus on scaling Agentforce and Data Cloud, yet the short-term catalyst remains product adoption and successful uptake of its consumption-based pricing model. Any impacts from these announcements do not materially change the most significant near-term risk: uncertainty around consumption-based pricing revenue predictability.

Among the new developments, the Emergent partnership stands out as highly relevant, amplifying Salesforce’s federal footprint by making Agentforce solutions accessible to government buyers. This access could accelerate adoption in a market where digital transformation is urgent, directly tying in with Salesforce’s catalyst of scaling new product revenues and supporting the case for their future earnings trajectory.

However, against these growth ambitions, investors should be aware that the transition to consumption-based pricing brings its own set of risks if realized consumption falls short of expectations...

Read the full narrative on Salesforce (it's free!)

Salesforce's outlook anticipates $50.8 billion in revenue and $10.2 billion in earnings by 2028. This hinges on a 9.6% annual revenue growth rate and a $4.0 billion earnings increase from the current $6.2 billion.

Uncover how Salesforce's forecasts yield a $344.61 fair value, a 39% upside to its current price.

Exploring Other Perspectives

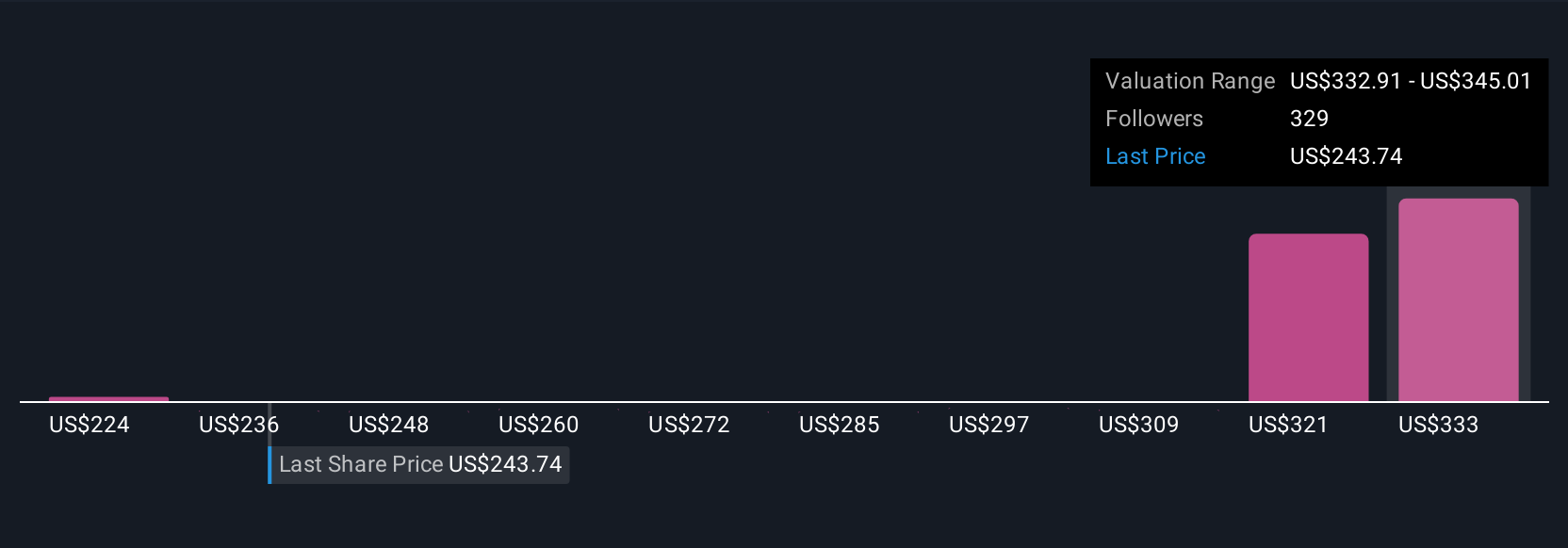

Thirty-six unique fair value estimates from the Simply Wall St Community put Salesforce stock between US$223.99 and US$354, reflecting wide-ranging outlooks. Amid these opinions, ongoing product adoption and pricing model changes could influence future revenue growth, reminding you there’s much more than one perspective to consider.

Explore 36 other fair value estimates on Salesforce - why the stock might be worth as much as 43% more than the current price!

Build Your Own Salesforce Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Salesforce research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Salesforce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Salesforce's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRM

Salesforce

Provides customer relationship management (CRM) technology that connects companies and customers together worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives