- United States

- /

- Software

- /

- NYSE:CRCL

Is Circle Internet Group’s Recent 22% Surge Justified After New Payments Partnerships?

Reviewed by Bailey Pemberton

- If you are wondering whether Circle Internet Group is still worth buying after its run up, you are not alone. This stock has quickly moved onto a lot more radar screens.

- The share price has jumped 15.3% over the last week and 22.0% over the past month, even though it is only up 4.5% year to date. This combination hints at shifting expectations and a possible re rating story.

- Recent headlines have zeroed in on Circle Internet Group expanding its footprint in digital payments infrastructure and securing new strategic partnerships, which helps explain the sudden pick up in investor enthusiasm. At the same time, increased regulatory attention on stablecoins has kept a layer of risk in the background. The latest rally is as much about confidence in Circle Internet Group position as it is about the broader crypto narrative.

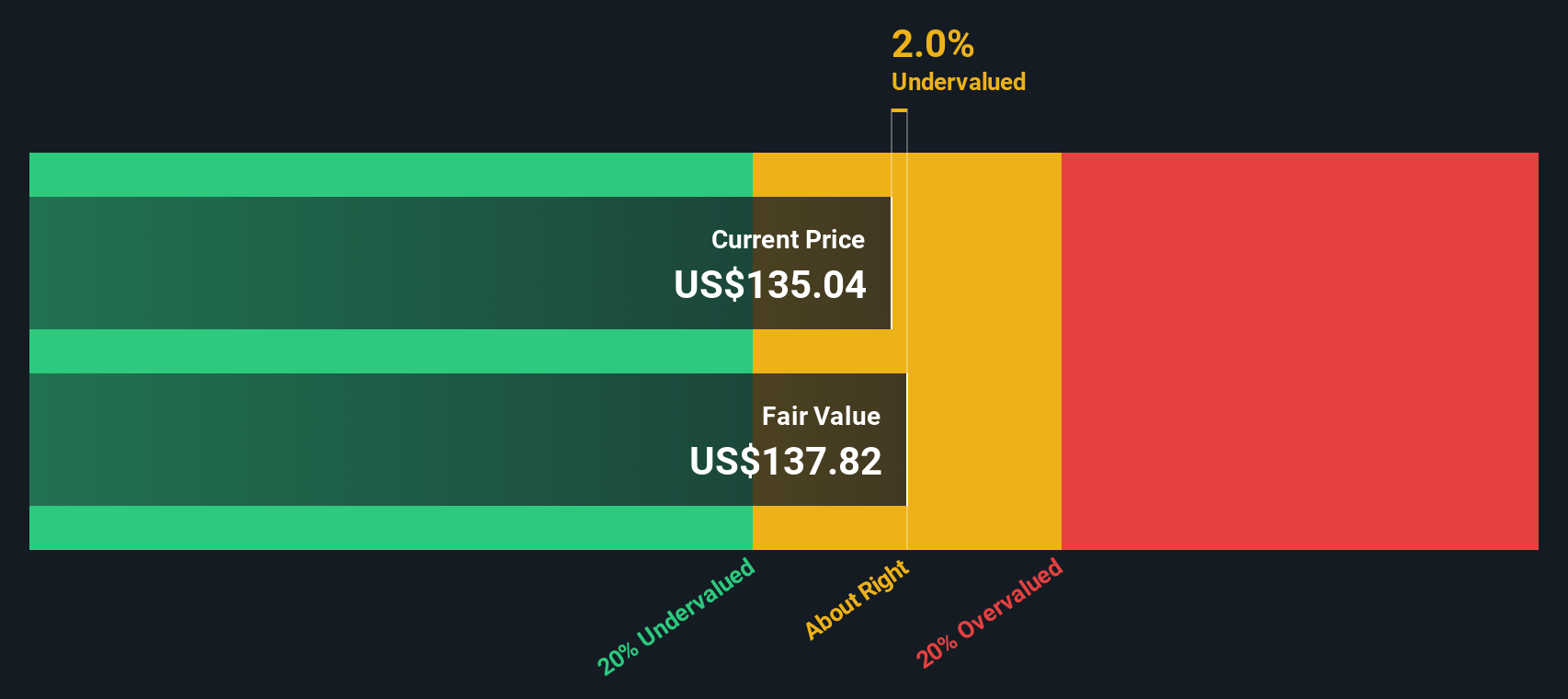

- Right now, Circle Internet Group posts a valuation score of 3 out of 6, suggesting it screens as undervalued on half of our core checks. The rest of this article will unpack those methods one by one while hinting at a smarter, narrative driven way to think about value that we will come back to at the end.

Approach 1: Circle Internet Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a business is worth by projecting its future cash flows and then discounting them back to today value using a required rate of return. For Circle Internet Group, the model used is a 2 stage Free Cash Flow to Equity approach, which allows for faster growth in the early years and slower, more mature growth later on.

Circle currently generates around $329.2 Million in free cash flow, and analysts, along with Simply Wall St extrapolations, see this rising steadily over the coming decade. By 2035, projected free cash flow reaches roughly $2.1 Billion, with the interim years showing a strong ramp up as the company scales its digital payments and stablecoin infrastructure.

When all of these projected cash flows are discounted back to today, the model arrives at an intrinsic value of about $111.75 per share. Compared to the current share price, this implies the stock is trading at a 22.1% discount, which indicates potential undervaluation if the cash flow projections are realized.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Circle Internet Group is undervalued by 22.1%. Track this in your watchlist or portfolio, or discover 899 more undervalued stocks based on cash flows.

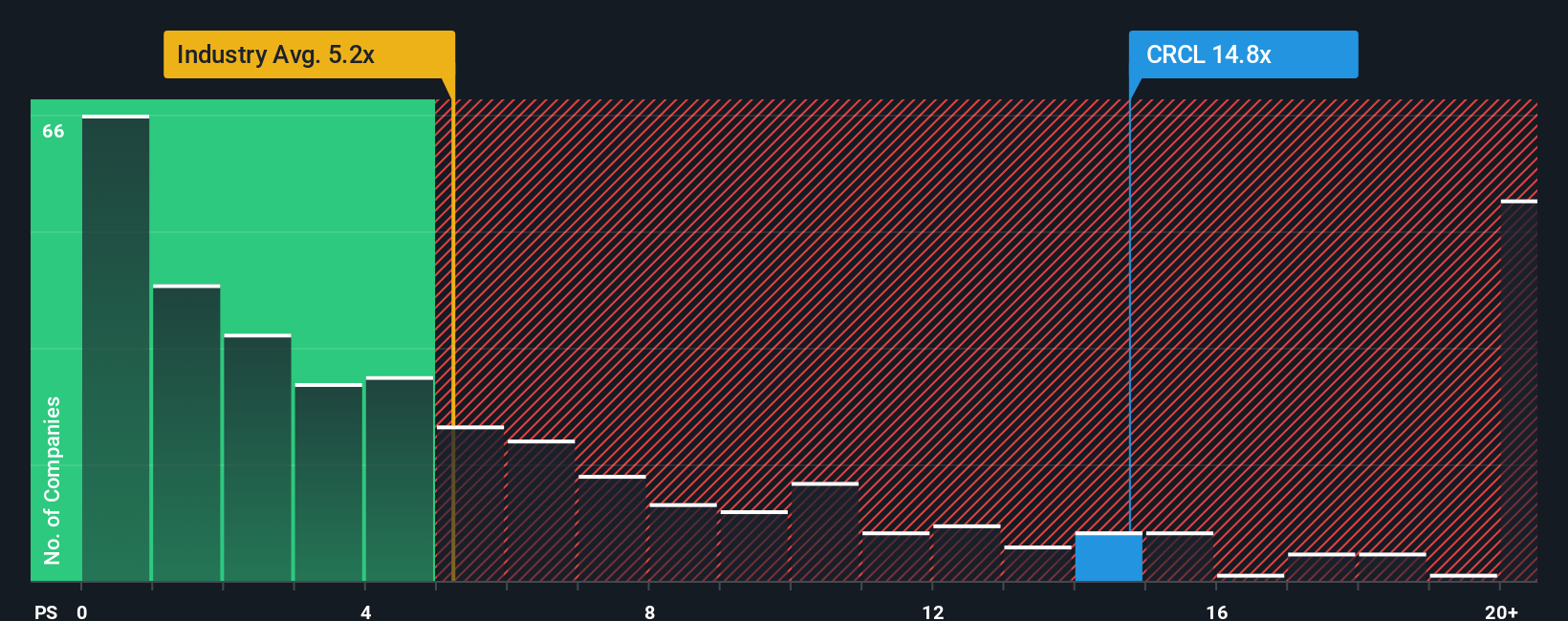

Approach 2: Circle Internet Group Price vs Sales

For a high growth fintech like Circle Internet Group that is still being valued more on its revenue potential than on steady profits, the price to sales ratio is a practical way to benchmark what investors are willing to pay for each dollar of current sales. In general, faster growth and stronger competitive positioning can justify a higher price to sales multiple, while higher risk or thinner margins should pull that multiple down.

Circle currently trades on a price to sales multiple of 8.49x. That sits above the broader Software industry average of 4.92x, but actually below the 11.61x average of its closer peers. To move beyond these blunt comparisons, Simply Wall St uses a Fair Ratio, a proprietary estimate of what Circle sales multiple should be once you factor in its growth outlook, profitability profile, risk, industry and market cap. This Fair Ratio for Circle is 4.28x, which suggests that, adjusted for these fundamentals, the shares are trading richer than is warranted by our framework.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1458 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Circle Internet Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company story with the numbers you expect it to deliver, like future revenue, earnings, margins and ultimately fair value.

A Narrative is your joined up thesis. It ties together what you believe about Circle Internet Group competitive strengths, risks and growth drivers with a concrete financial forecast and a resulting fair value per share.

On Simply Wall St, Narratives live inside the Community page and are designed to be easy to use. You can browse different perspectives from other investors, see their assumptions and fair values, and quickly compare them to the current share price to decide whether a Narrative implies buy, hold or sell.

Because Narratives are updated dynamically when new information arrives, such as earnings, macro news or regulatory changes, your fair value and thesis stay current without you having to rebuild models from scratch.

For example, one Circle Internet Group Narrative might see stablecoin adoption and regulatory clarity supporting a fair value of around $326 per share, while a more cautious Narrative, focused on interest rate and competitive risks, could land closer to $122. This gives you a clear sense of where your own view fits on the spectrum.

Do you think there's more to the story for Circle Internet Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRCL

Circle Internet Group

Operates as a platform, network, and market infrastructure for stablecoin and blockchain applications.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion