- United States

- /

- Software

- /

- NYSE:CRCL

Evaluating Circle Internet Group (CRCL): Is Recent Growth Reflected in Today’s Valuation?

Reviewed by Simply Wall St

See our latest analysis for Circle Internet Group.

Over the past year, momentum for Circle Internet Group has swung back and forth. The recent 1-day and 7-day share price returns of -6.85% and -5.51% signal that short-term sentiment is cooling, although the year-to-date share price return remains notable at 47.43%. Many investors are now questioning whether this pullback is simply a pause in a longer trend or a sign that risk perception is shifting as the company grows.

If you want to see what the market’s top movers look like outside the headlines, this is a great opportunity to discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analysts’ targets despite strong revenue and profit growth, investors must ask themselves: is Circle Internet Group undervalued, or has the market already priced in the company’s future potential?

Most Popular Narrative: 50% Overvalued

Circle Internet Group recently closed at $122.71. According to BlackGoat’s popular narrative, the fair value sits far below the market price. This disconnect has created a heated debate over what is driving such a lofty valuation and whether current investors are betting too much on future growth.

This structure makes Coinbase the primary economic beneficiary of USDC’s growth, not Circle. As USDC adoption rises, distribution costs will rise as well. In fact, we are already seeing signs that distribution costs may outpace income. In Q1 2024, they grew by 51% year over year, potentially overtaking revenue growth itself.

If you think Circle’s story is all about breakneck growth, think again. There is a controversial earnings engine beneath the surface and some gutsy forecasts fueling that steep price tag. Curious which bold predictions about future profit margins and financial discipline are behind this showdown between valuation and reality? Dig into the full narrative to reveal the numbers that challenge market expectations.

Result: Fair Value of $61 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming questions about regulatory changes and heavy reliance on short-term interest rates could quickly change the outlook for Circle Internet Group’s future performance.

Find out about the key risks to this Circle Internet Group narrative.

Another View: DCF Suggests a Different Story

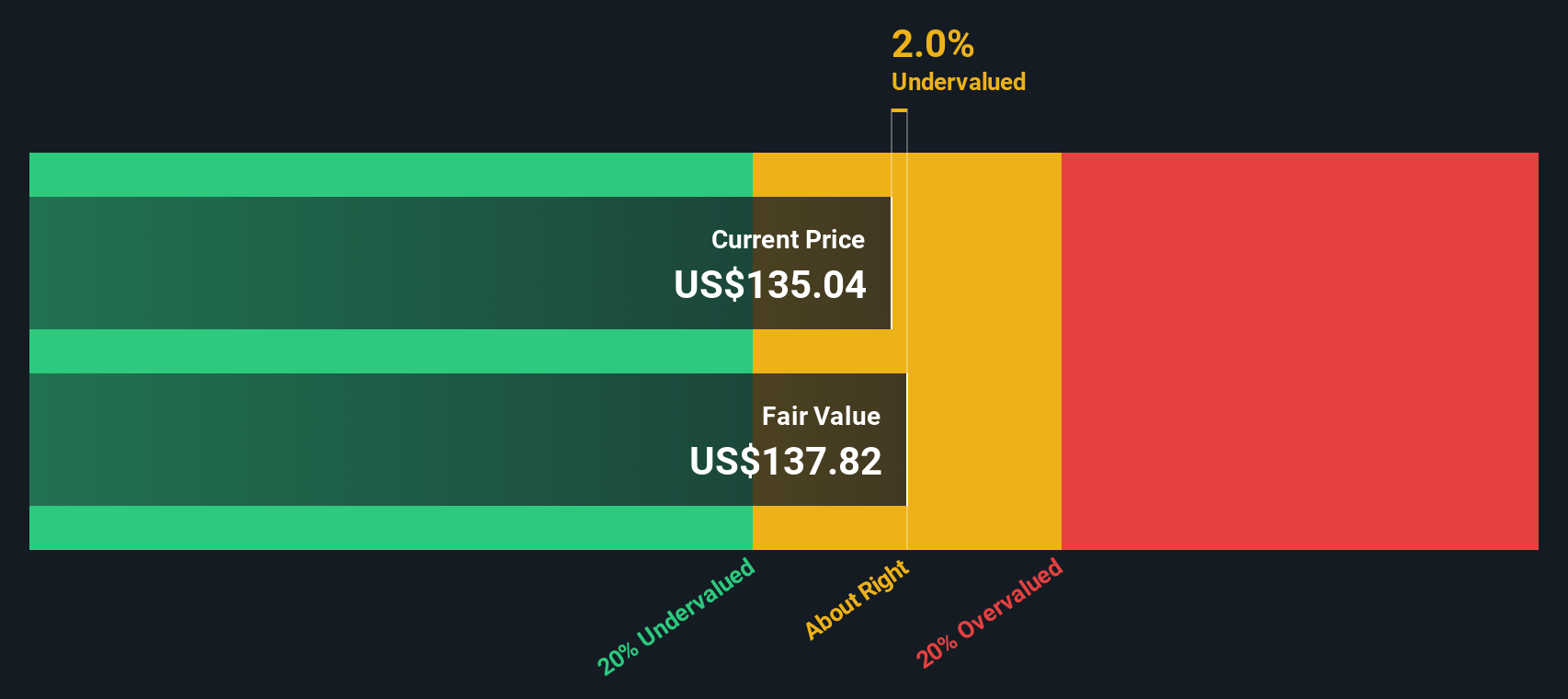

While the popular outlook says Circle Internet Group is overvalued, our SWS DCF model actually points in a different direction. According to this approach, shares are trading about 10% below fair value. This result hints at potential upside if growth estimates play out. Can forward-looking models really outmaneuver market doubts?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Circle Internet Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 850 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Circle Internet Group Narrative

Don’t see eye to eye with these results, or want to put the numbers to the test yourself? Building your own case can take less than three minutes, so Do it your way.

A great starting point for your Circle Internet Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want your portfolio to stand out, now’s the moment to target tomorrow’s leaders before they hit the headlines. Find opportunities others might overlook. These screens were built to help you invest smarter before the crowd catches on.

- Capitalize on powerful advances in artificial intelligence by checking out these 26 AI penny stocks that are setting the pace in smart automation and machine learning.

- Boost your search for attractive yields with these 23 dividend stocks with yields > 3% featuring stocks that deliver more income and robust fundamentals.

- Jump into the digital asset revolution with these 81 cryptocurrency and blockchain stocks and uncover companies driving progress in blockchain, security, and next-generation payments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRCL

Circle Internet Group

Operates as a platform, network, and market infrastructure for stablecoin and blockchain applications.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives