- United States

- /

- Software

- /

- NYSE:CRCL

Circle (CRCL): Reassessing Valuation After a 16% One-Month Rebound and Recent Stablecoin Sentiment Shift

Reviewed by Simply Wall St

Circle Internet Group (CRCL) has quietly outperformed over the past month, climbing about 16% even as its past 3 months remain sharply negative. This setup has traders reassessing its long term stablecoin story.

See our latest analysis for Circle Internet Group.

The recent rebound, including a roughly 16% 30 day share price return after a weak 90 day patch, suggests sentiment toward Circle’s stablecoin strategy is stabilizing even as the year to date share price performance still looks muted.

If Circle’s move has you watching crypto infrastructure more closely, it is worth exploring high growth tech and AI stocks for other high potential names shaping the next phase of digital finance.

With Circle’s shares still down over the past quarter despite strong revenue and income growth, is the market underestimating its stablecoin upside or already baking in the bulk of its long term expansion story?

Most Popular Narrative: 33.7% Undervalued

With Circle last closing at $80.99 versus a narrative fair value of $122.10, the gap reflects a bold long term income and growth blueprint.

At the time of writing, Circle (CRCL) trades at $241 per share. Based on a discounted cash flow (DCF) model with the following assumptions:

• Revenue growth of 20% per year for the next five years

• Net margins reaching 18% by year five

• A 10% discount rate, I estimate a fair value of $326 per share.

Want to see how sustained double digit growth, expanding margins, and a premium future multiple combine into that fair value gap? The full narrative lays it bare.

Result: Fair Value of $122.1 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained rate cuts and Tether’s lighter regulatory regime could rapidly erode Circle’s yield-driven model, forcing investors to rethink the bullish narrative.

Find out about the key risks to this Circle Internet Group narrative.

Another Take on Value

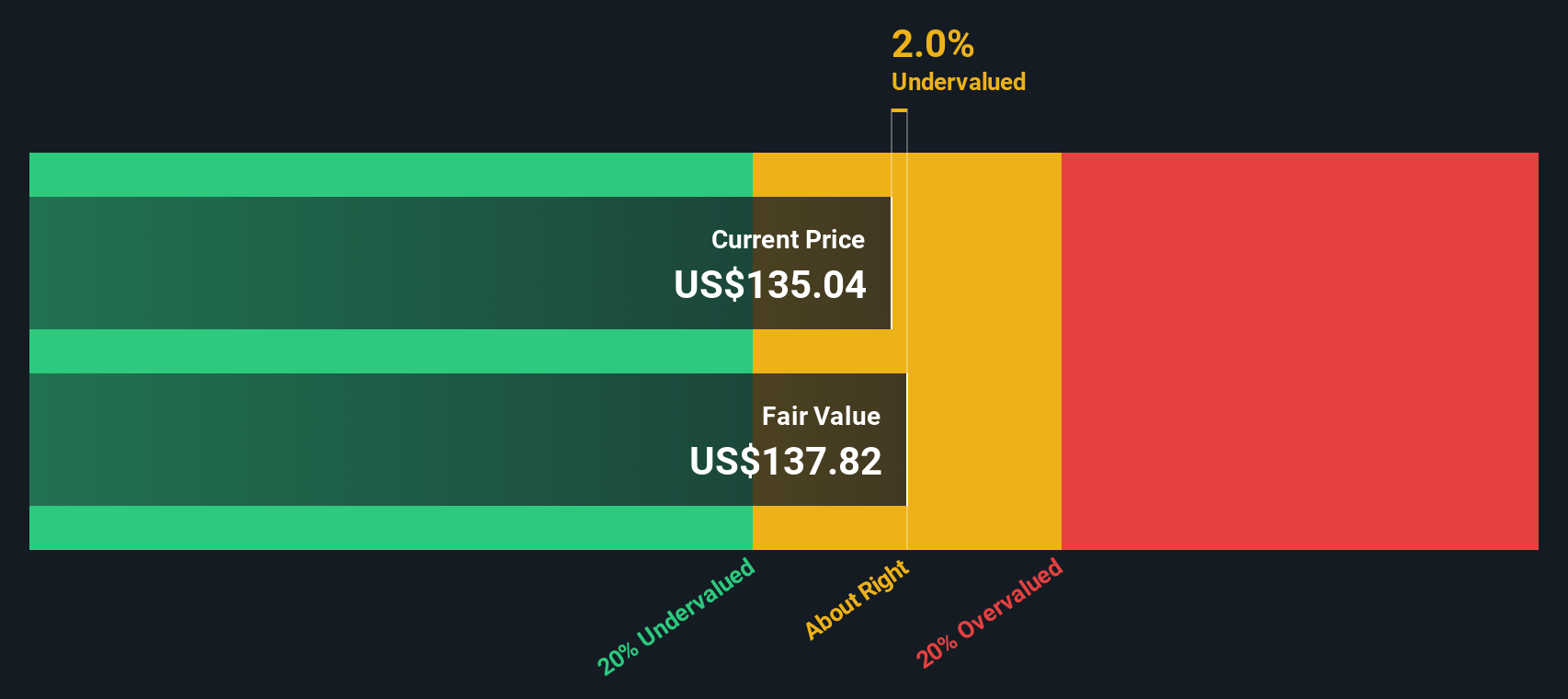

That narrative fair value paints Circle as clearly undervalued, but our SWS DCF model is more cautious. It points to a fair value of $111.99 versus today’s $80.99. It still suggests upside, just with a narrower margin. Which set of assumptions feels more realistic to you?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Circle Internet Group Narrative

If you see the outlook differently or simply want to dig into the numbers yourself, you can build a complete narrative in minutes using Do it your way.

A great starting point for your Circle Internet Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next smart idea with targeted screeners that surface stocks matching your style, so real opportunities never slip past you.

- Capture early stage potential by scanning these 3610 penny stocks with strong financials that already back their promise with solid financial underpinnings.

- Ride structural trends in automation, data, and machine learning by zeroing in on these 24 AI penny stocks reshaping how entire industries operate.

- Strengthen your income strategy by targeting these 13 dividend stocks with yields > 3% offering reliable cash yields that can support long term portfolio returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRCL

Circle Internet Group

Operates as a platform, network, and market infrastructure for stablecoin and blockchain applications.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion