- United States

- /

- Professional Services

- /

- NYSE:DAY

Should You Use Ceridian HCM Holding's (NYSE:CDAY) Statutory Earnings To Analyse It?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether Ceridian HCM Holding's (NYSE:CDAY) statutory profits are a good guide to its underlying earnings.

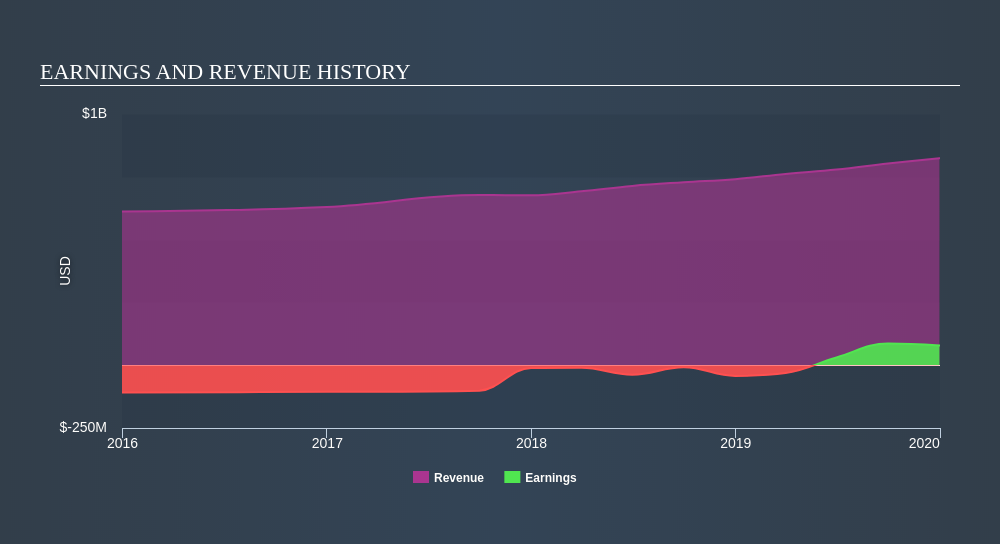

It's good to see that over the last twelve months Ceridian HCM Holding made a profit of US$78.7m on revenue of US$824.1m. The chart below shows that revenue has improved over the last three years, and, even better, the company has moved from unprofitable to profitable.

Check out our latest analysis for Ceridian HCM Holding

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. Therefore, today we will consider the nature of Ceridian HCM Holding's statutory earnings with reference to its dilution of shareholders and the impact of unusual items. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. In fact, Ceridian HCM Holding increased the number of shares on issue by 25% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out Ceridian HCM Holding's historical EPS growth by clicking on this link.

How Is Dilution Impacting Ceridian HCM Holding's Earnings Per Share? (EPS)

Ceridian HCM Holding was losing money three years ago. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). So you can see that the dilution has had a fairly significant impact on shareholders.

If Ceridian HCM Holding's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

How Do Unusual Items Influence Profit?

Alongside that dilution, it's also important to note that Ceridian HCM Holding's profit suffered from unusual items, which reduced profit by US$23m in the last twelve months. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. If Ceridian HCM Holding doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On Ceridian HCM Holding's Profit Performance

To sum it all up, Ceridian HCM Holding took a hit from unusual items which pushed its profit down; without that, it would have made more money. But unfortunately the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). That will weigh on earnings per share, even if it is not reflected in net income. Based on these factors, it's hard to tell if Ceridian HCM Holding's profits are a reasonable reflection of its underlying profitability. If you want to do dive deeper into Ceridian HCM Holding, you'd also look into what risks it is currently facing. Our analysis shows 4 warning signs for Ceridian HCM Holding (1 is a bit concerning!) and we strongly recommend you look at these bad boys before investing.

Our examination of Ceridian HCM Holding has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:DAY

Dayforce

Operates as a human capital management (HCM) software company in the United States, Canada, Australia, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives