- United States

- /

- Software

- /

- NYSE:BILL

Does BILL Holdings’ Recent Rebound Signal a Compelling 2025 Valuation Opportunity?

Reviewed by Bailey Pemberton

- If you are wondering whether BILL Holdings is a beaten down opportunity or a value trap at around $55 a share, you are not alone. This piece will unpack what the current price is really telling us.

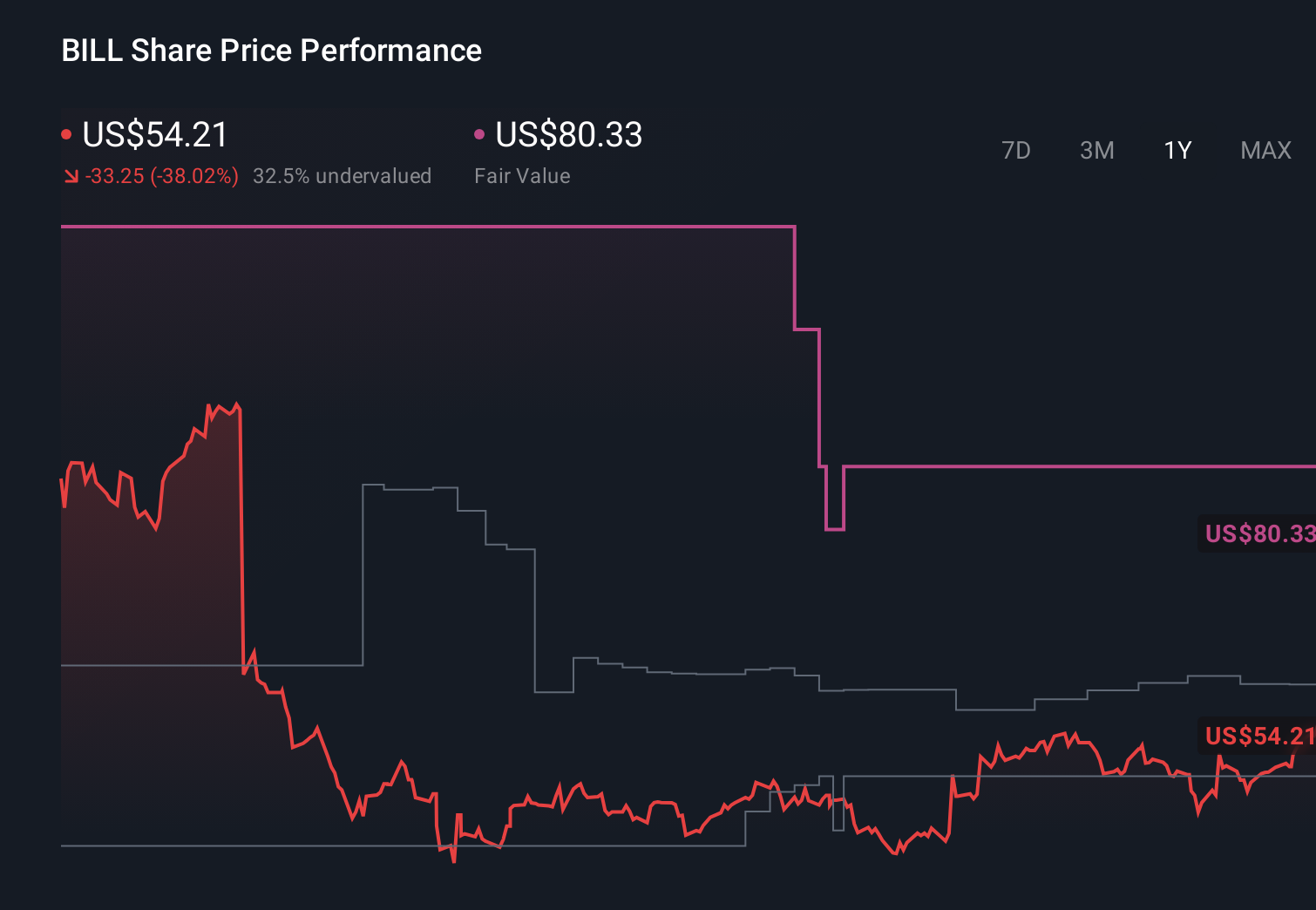

- Despite a tough longer term picture with the stock down 37.5% over the last year and 62.3% over five years, the recent momentum has flipped. Shares are up 2.6% over the past week and 16.2% over the last month, even though the year to date return is still a 33.4% decline.

- That swing in sentiment has come alongside a broader rebound in high growth software names and renewed interest in digital payments platforms, as investors rotate back into select fintech and workflow automation plays. In addition, ongoing product enhancements and partnerships in the small business payments space have reminded the market that BILL is still building out a sizable ecosystem, even if opinions on its long term growth runway remain divided.

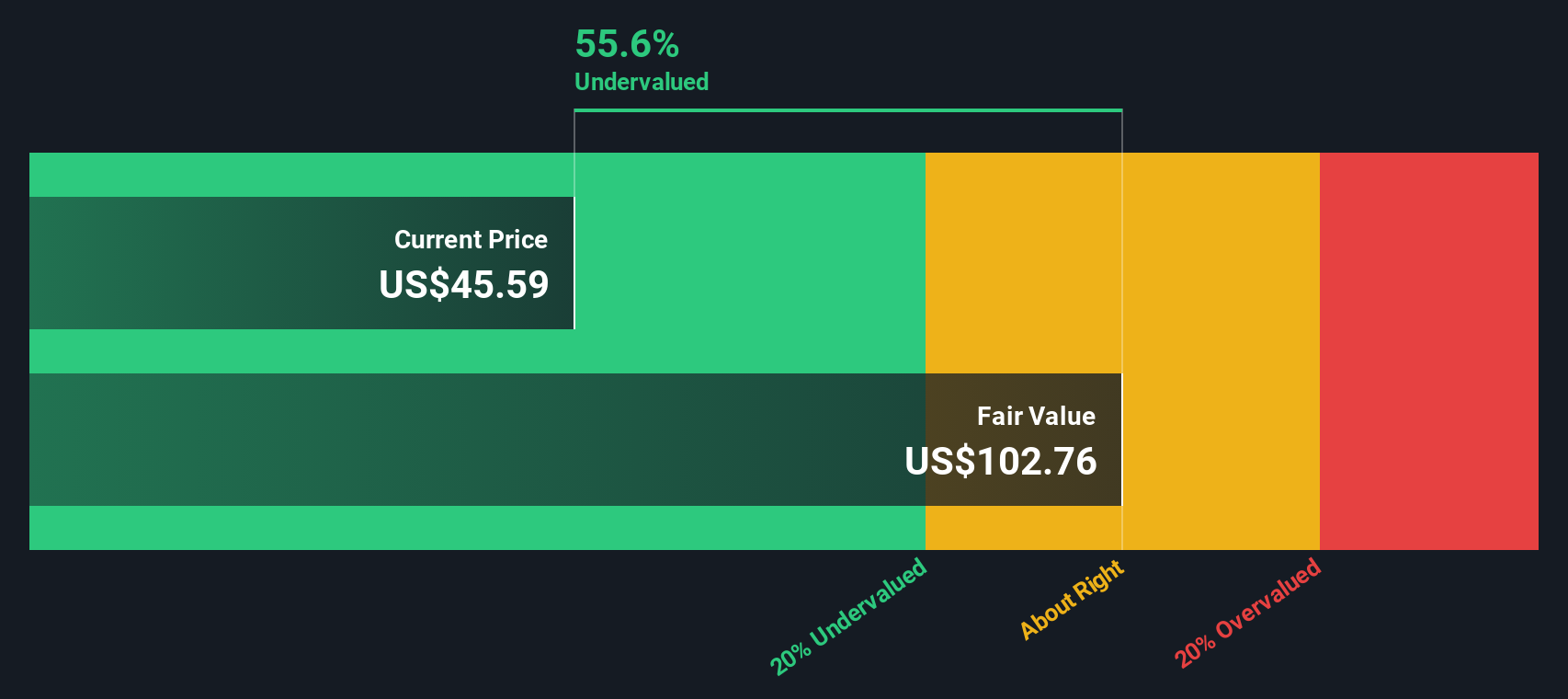

- On our framework, BILL scores 5 out of 6 on valuation checks, signaling it screens as undervalued on most metrics. You can see the breakdown in this valuation score of 5. In the sections that follow we will walk through different valuation approaches and introduce an even more insightful way to think about what the stock may be worth by the end of the article.

Find out why BILL Holdings's -37.5% return over the last year is lagging behind its peers.

Approach 1: BILL Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth today by projecting the cash it can generate in the future and then discounting those dollars back into today’s terms.

For BILL Holdings, the latest twelve month Free Cash Flow is about $320.6 million, providing a solid base for the model. Analysts and extrapolated estimates see that Free Cash Flow rising to around $498.6 million by 2028, and then continuing to climb to roughly $828.2 million by 2035 as the business scales its payments platform and workflow software.

Using a 2 Stage Free Cash Flow to Equity model built on these projections, the intrinsic value for BILL comes out at roughly $92.28 per share. With the stock trading near $55, the DCF implies the shares are about 39.3% undervalued. This points to a gap between the market price and the long term cash flow potential currently being modeled.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BILL Holdings is undervalued by 39.3%. Track this in your watchlist or portfolio, or discover 911 more undervalued stocks based on cash flows.

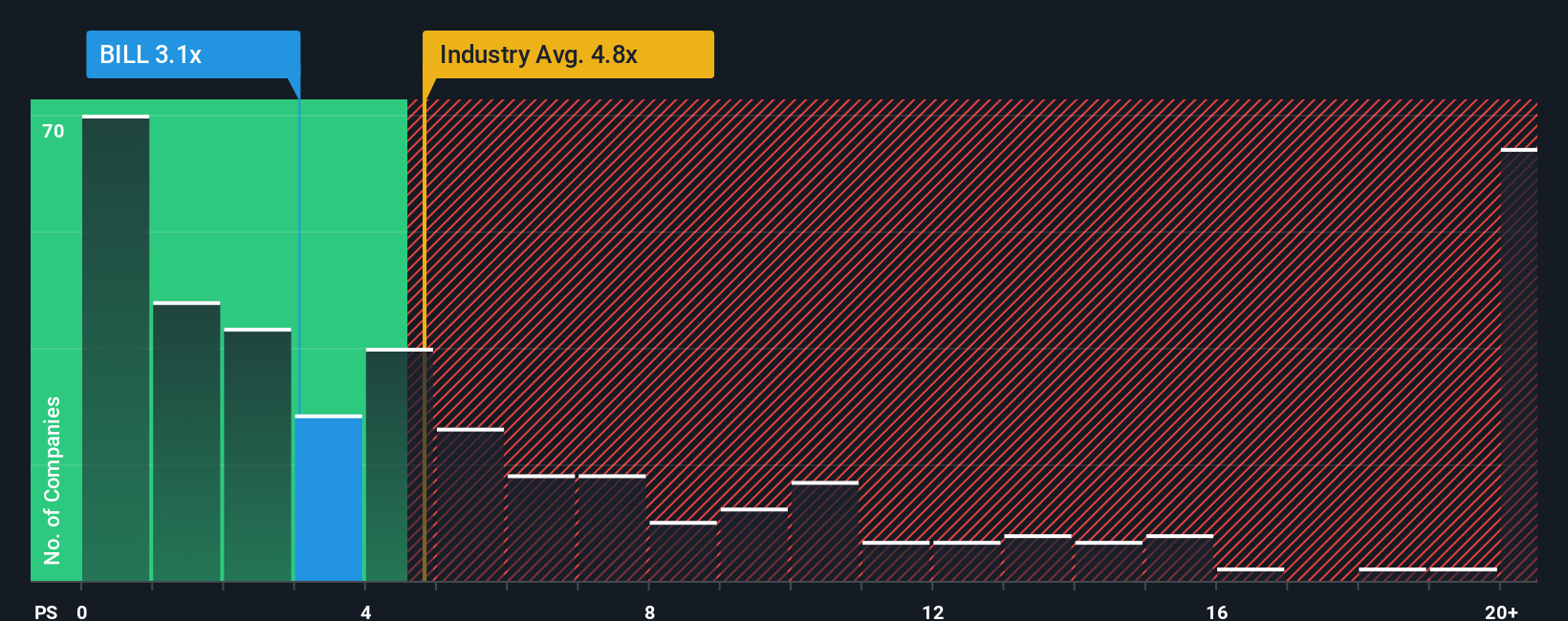

Approach 2: BILL Holdings Price vs Sales

For growth focused, still maturing software companies, the Price to Sales ratio is often the cleanest way to compare valuations because revenues are less volatile and less easily distorted by accounting choices than earnings.

In general, faster revenue growth and lower perceived risk justify paying a higher sales multiple, while slower growth, thinner margins, or greater uncertainty should pull a “normal” multiple down. BILL currently trades on a Price to Sales ratio of about 3.7x, below both the Software industry average of roughly 4.9x and the broader peer group average of around 11.2x. This suggests the market is assigning it a discount relative to many software and fintech names.

Simply Wall St’s Fair Ratio framework estimates what a reasonable Price to Sales multiple should be for BILL, at about 6.8x, after factoring in its growth outlook, business quality, profit profile, size, and specific risk characteristics. This company specific view is more informative than a simple peer or sector comparison because it directly ties the multiple to BILL’s own fundamentals rather than assuming lookalikes are fairly priced. With the current 3.7x sitting well below the 6.8x Fair Ratio, the multiple based lens also points to BILL being undervalued at present levels.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BILL Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you attach a story and your view on BILL’s future revenue, earnings and margins to a concrete financial forecast and resulting fair value. It then automatically compares that fair value to the current share price and keeps it updated as news or earnings arrive. For example, one investor might build a bullish BILL Narrative around AI driven product innovation, embedded finance partnerships and activist driven improvements, which supports a fair value closer to the high analyst target of about $89. A more cautious investor might emphasize competitive pressures, macro risks and reliance on volatile transaction revenues, and therefore anchor their Narrative’s fair value nearer the low target of roughly $42. This gives both investors a clear, numbers backed guide to whether BILL looks like a buy, hold or sell at today’s price.

Do you think there's more to the story for BILL Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BILL Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BILL

BILL Holdings

Provides financial operations platform for small and midsize businesses worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion