- United States

- /

- IT

- /

- NYSE:BBAI

Will BigBear.ai’s (BBAI) Biometric Rollout Shape Its Long-Term Defense Edge?

Reviewed by Sasha Jovanovic

- BigBear.ai announced the recent deployment of its veriScan™ biometric identity platform to support U.S. Customs and Border Protection's Enhanced Passenger Processing program at Chicago O'Hare International Airport, in partnership with the Chicago Department of Aviation.

- This rollout leverages AI-enabled biometrics to accelerate and secure entry for U.S. citizens, reportedly reducing passenger processing times from one minute to just ten seconds across multiple airports.

- We'll examine how BigBear.ai's expanding government partnerships, including the biometric veriScan deployment, shapes the company's investment narrative in defense and border security AI.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

BigBear.ai Holdings Investment Narrative Recap

For shareholders in BigBear.ai, belief in the company's ability to convert its expanding government connections into sustainable, long-term contracts is central. The recent deployment of veriScan at Chicago O'Hare underscores its traction in AI-driven border security but may not materially alter the most immediate catalyst: the upcoming Q3 earnings, which remain pivotal for assessing business momentum. Persistent risks like lumpy revenue tied to government contracts and timing delays are still a key consideration for near-term results.

One announcement closely tied to this development is the rollout of Enhanced Passenger Processing at Nashville International Airport, reinforcing BigBear.ai's growing reach in AI-powered identity solutions across U.S. ports of entry. With increased adoption in government programs, these deployments serve as real-world proof points that could help drive upcoming contract wins, potentially supporting the company’s efforts to stabilize variable revenues and improve business predictability.

Yet, in contrast, investors should be aware of how recurring delays in government procurement and contract timing can lead to...

Read the full narrative on BigBear.ai Holdings (it's free!)

BigBear.ai Holdings' narrative projects $162.2 million revenue and $10.3 million earnings by 2028. This requires 2.1% yearly revenue growth and a $454.2 million earnings increase from current earnings of $-443.9 million.

Uncover how BigBear.ai Holdings' forecasts yield a $5.83 fair value, a 7% downside to its current price.

Exploring Other Perspectives

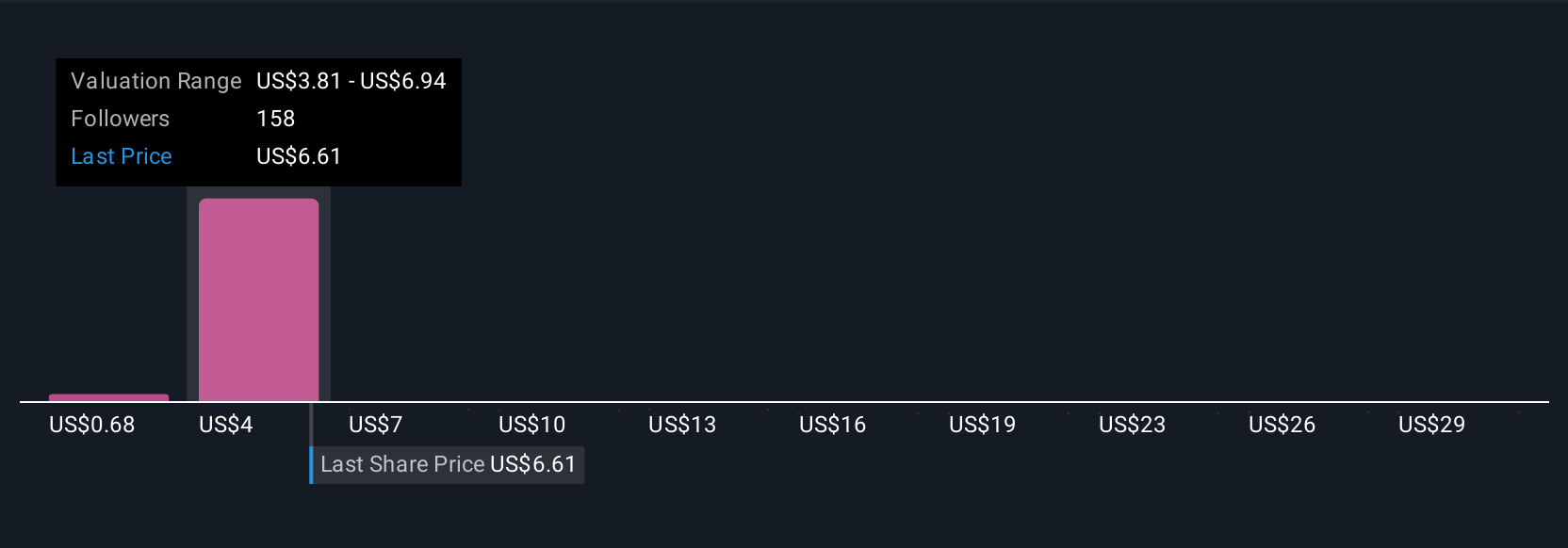

Thirty-three members of the Simply Wall St Community estimate BigBear.ai’s fair value from as low as US$0.68 to as high as US$15.26 per share. While opinions diverge, government funding delays remain a key risk affecting future revenue stability, making it essential to consider multiple viewpoints before any decision.

Explore 33 other fair value estimates on BigBear.ai Holdings - why the stock might be worth less than half the current price!

Build Your Own BigBear.ai Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BigBear.ai Holdings research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free BigBear.ai Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BigBear.ai Holdings' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BigBear.ai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBAI

BigBear.ai Holdings

Provides artificial intelligence-powered decision intelligence solutions.

Flawless balance sheet with low risk.

Market Insights

Community Narratives