- United States

- /

- IT

- /

- NYSE:BBAI

BigBear.ai (BBAI): Valuation Check After C Speed Defense Partnership and Middle East Expansion Push

Reviewed by Simply Wall St

BigBear.ai Holdings (BBAI) is back on traders radar after unveiling a new partnership with C Speed that plugs its ConductorOS AI engine into C Speed radar systems for real time defense threat detection.

See our latest analysis for BigBear.ai Holdings.

That C Speed deal lands after a choppy stretch where dilution worries and the Ask Sage acquisition weighed on sentiment, yet BigBear.ai still sports a punchy year to date share price return and a triple digit one year total shareholder return. This hints that long term momentum remains intact even if near term volatility stays elevated.

If defense focused AI is on your radar after this news, it could be a good moment to explore other aerospace and defense stocks that are attracting attention for similar reasons.

Yet with the stock already up more than 100 percent over the past year and trading at only a small discount to Wall Street targets, investors have to ask: Is there still upside left, or is the market already pricing in BigBear.ai’s next growth leg?

Most Popular Narrative: 6.1% Undervalued

With BigBear.ai last closing at 6.26 dollars against a narrative fair value of 6.67 dollars, the story leans toward modest upside driven by long term expansion and AI rollouts.

The analysts have a consensus price target of 5.833 for BigBear.ai Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of 8.0, and the most bearish reporting a price target of just 3.5.

Want to see what justifies stretching profitability from deep losses to healthy margins, while still assigning a towering future earnings multiple? The narrative breaks down the revenue runway, margin rebuild and share count assumptions that hold this valuation together, step by step.

Result: Fair Value of $6.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent contract delays and lumpy government revenue could quickly undermine the optimistic airport rollout and international expansion story that underpins today’s valuation.

Find out about the key risks to this BigBear.ai Holdings narrative.

Another View: Rich on Sales, Despite Narrative Upside

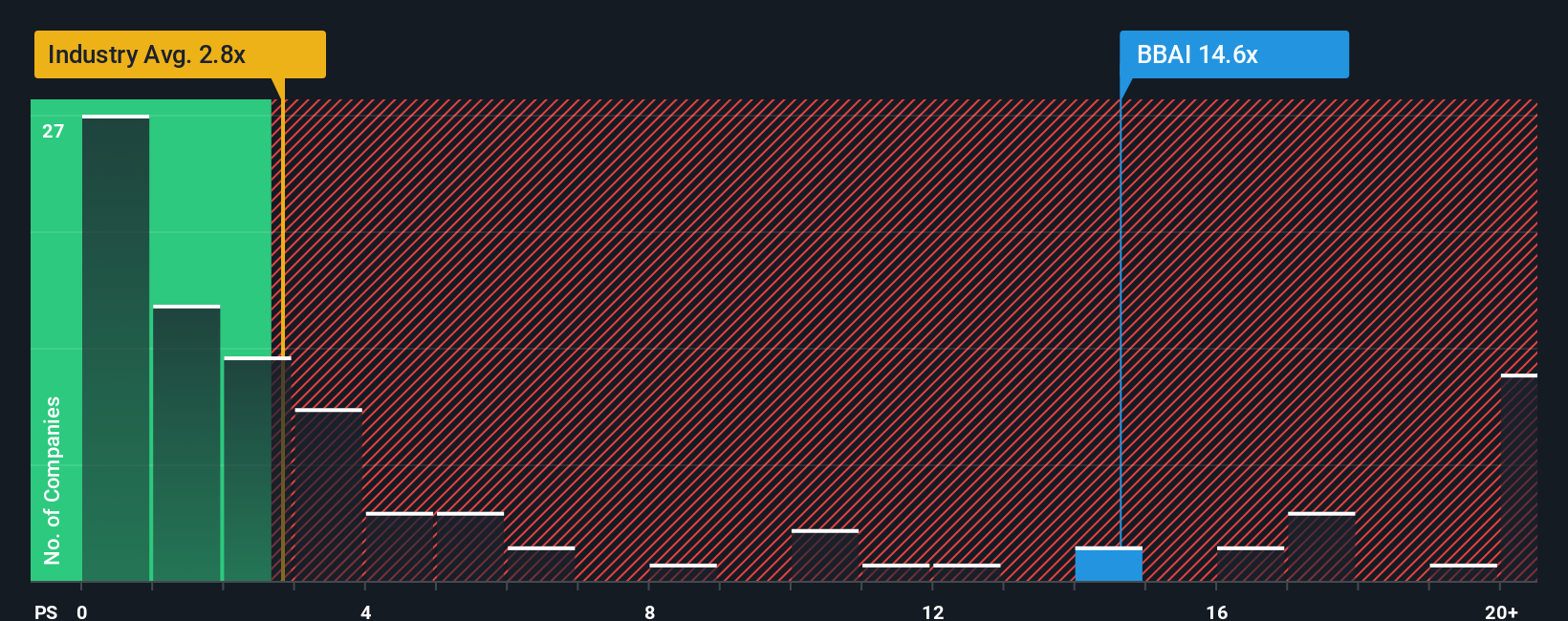

That modest 6.1 percent discount to narrative fair value clashes with how the market prices BigBear.ai on revenue. At about 19 times sales versus a US IT industry average of 2.1 times and a fair ratio of 2.4 times, the stock looks heavily loaded with expectation.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BigBear.ai Holdings Narrative

If this perspective does not fully align with your own, you can dive into the numbers yourself, shape a personalized view, and Do it your way in under three minutes.

A great starting point for your BigBear.ai Holdings research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, explore fresh opportunities by using the Simply Wall Street Screener to uncover stocks that match your strategy and help you stay ahead.

- Consider potential mispricings by targeting these 913 undervalued stocks based on cash flows that could rerate as the market adjusts.

- Explore the next wave of innovation by focusing on these 24 AI penny stocks contributing to advances in automation, analytics and intelligent infrastructure.

- Strengthen your income stream by concentrating on these 13 dividend stocks with yields > 3% that may help support long term, compounding returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if BigBear.ai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBAI

BigBear.ai Holdings

Provides artificial intelligence-powered decision intelligence solutions.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion