- United States

- /

- Software

- /

- NYSE:AYX

It's Down 38% But Alteryx, Inc. (NYSE:AYX) Could Be Riskier Than It Looks

The Alteryx, Inc. (NYSE:AYX) share price has fared very poorly over the last month, falling by a substantial 38%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 46% share price drop.

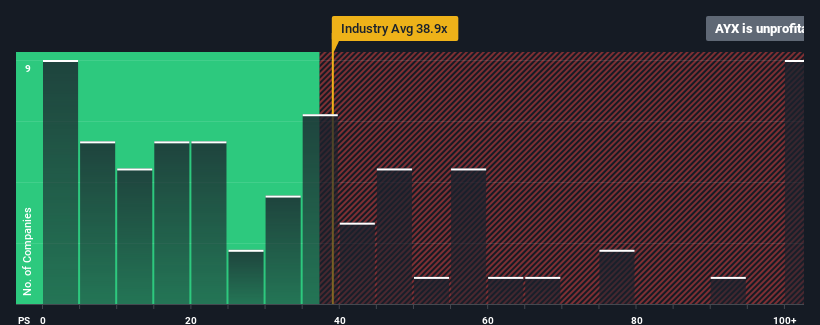

Since its price has dipped substantially, Alteryx's price-to-earnings (or "P/E") ratio of -8.3x might make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 15x and even P/E's above 29x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Alteryx hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Alteryx

Is There Any Growth For Alteryx?

In order to justify its P/E ratio, Alteryx would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 21%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 19% per year during the coming three years according to the analysts following the company. With the market only predicted to deliver 11% per annum, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Alteryx's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Alteryx's P/E?

Having almost fallen off a cliff, Alteryx's share price has pulled its P/E way down as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Alteryx's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Plus, you should also learn about these 3 warning signs we've spotted with Alteryx.

If these risks are making you reconsider your opinion on Alteryx, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AYX

Alteryx

Alteryx, Inc., together with its subsidiaries, operates in the analytics automation business in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives