- United States

- /

- Software

- /

- NYSE:AYX

Alteryx (NYSE:AYX investor three-year losses grow to 73% as the stock sheds US$130m this past week

As an investor, mistakes are inevitable. But really big losses can really drag down an overall portfolio. So take a moment to sympathize with the long term shareholders of Alteryx, Inc. (NYSE:AYX), who have seen the share price tank a massive 73% over a three year period. That would be a disturbing experience. The more recent news is of little comfort, with the share price down 32% in a year. Shareholders have had an even rougher run lately, with the share price down 44% in the last 90 days.

After losing 4.7% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Alteryx

SWOT Analysis for Alteryx

- Debt is well covered by earnings.

- Shareholders have been diluted in the past year.

- Forecast to reduce losses next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Good value based on P/S ratio compared to estimated Fair P/S ratio.

- Debt is not well covered by operating cash flow.

- Not expected to become profitable over the next 3 years.

Given that Alteryx didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Alteryx saw its revenue grow by 23% per year, compound. That is faster than most pre-profit companies. So on the face of it we're really surprised to see the share price down 20% a year in the same time period. The share price makes us wonder if there is an issue with profitability. Ultimately, revenue growth doesn't amount to much if the business can't scale well. If the company is low on cash, it may have to raise capital soon.

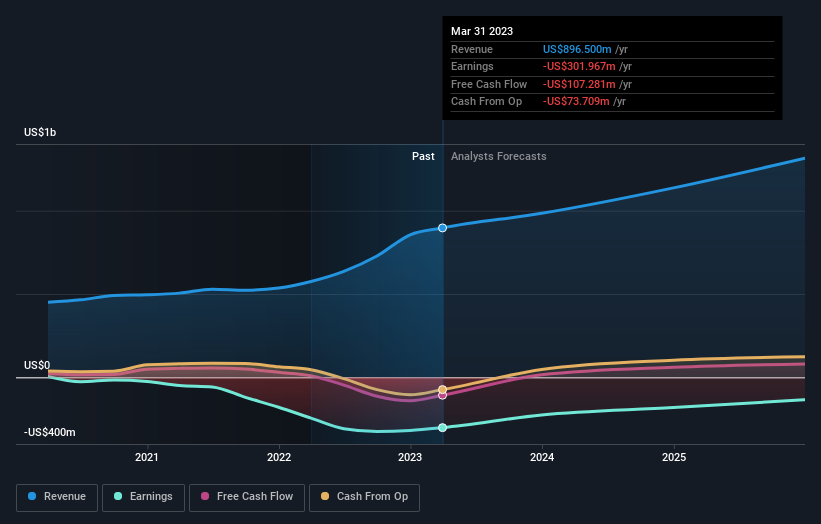

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Alteryx is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

Alteryx shareholders are down 32% for the year, but the market itself is up 2.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 1.8% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Alteryx that you should be aware of.

But note: Alteryx may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AYX

Alteryx

Alteryx, Inc., together with its subsidiaries, operates in the analytics automation business in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives