- United States

- /

- Software

- /

- NYSE:ATEN

A10 Networks (ATEN): Earnings Growth Beats Five-Year Trend, Reinforcing Margin Optimism

Reviewed by Simply Wall St

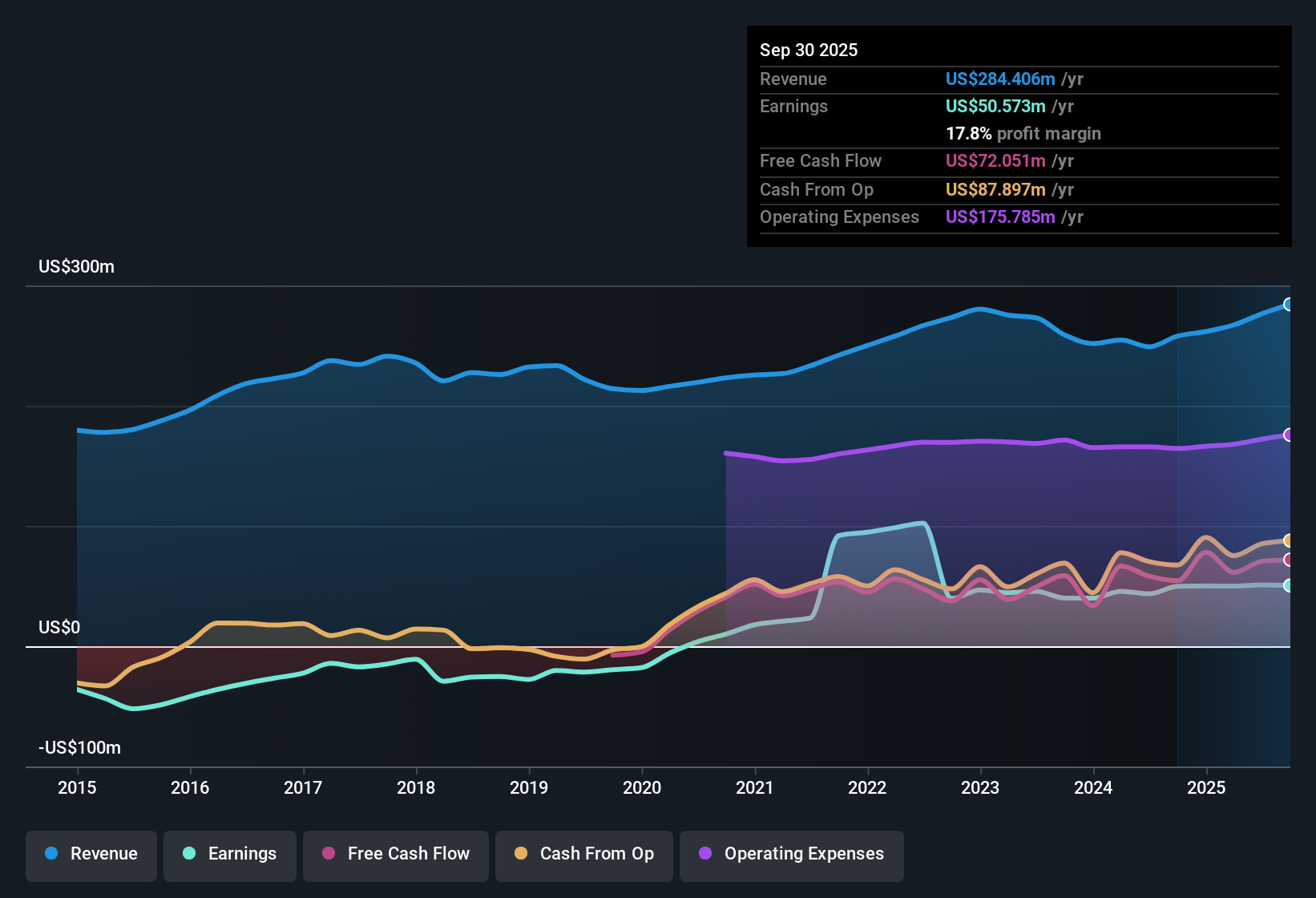

A10 Networks (ATEN) delivered earnings growth of 17% over the past year, outpacing its five-year average of 2.5% per year, with net profit margins improving to 18.5% from 17.5% last year. Looking ahead, earnings are forecast to grow 19.7% annually, topping the expected US market rate of 16% and the company’s own revenue growth outlook of 7% per year, which lags the broader market pace of 10.5%. With high-quality earnings and shares trading at a 25.5x price-to-earnings ratio, which is below both peer (40.9x) and industry (35.2x) averages, investors are focusing on constructive margin progress and standout relative value.

See our full analysis for A10 Networks.With the headline numbers in focus, the next step is to see how these latest results stack up against the most widely followed narratives and investor expectations.

See what the community is saying about A10 Networks

Recurring Revenue Surges Above 90% Renewal

- Contract renewal rates now top 90%, and deferred revenue is climbing, reflecting greater stability and stickier customer relationships for A10 Networks as it leans into services and subscription business models.

- Analysts' consensus view highlights how the surge in recurring revenue reduces risk and supports higher gross margins. However, a key tension is that this durability depends heavily on large enterprises and service providers choosing to renew and expand. High rates today could reverse quickly if just a few major accounts shift priorities or spread spending across competitors.

- On one hand, over 90% renewal rates and strong deferred revenue growth are cited as evidence that A10 is building long-term customer lock-in and better earnings visibility.

- Yet consensus notes that heavy reliance on major customers remains a structural risk if a single large client, such as a telco or cloud leader, defers spending or churns, creating potential for sudden drops in revenue or profitability.

- See how the analysts balance these tailwinds and customer risks in the full narrative. 📊 Read the full A10 Networks Consensus Narrative.

Profit Margins Poised For Further Expansion

- Analysts expect profit margins to rise from 18.5% today to 21.3% within three years, as higher margin software, security, and AI-driven services make up a growing share of sales.

- Pushing margins higher supports the consensus that A10 is uniquely positioned in networking and security. This upside, however, depends on continued momentum from global AI infrastructure projects and expansions in cybersecurity budgets.

- Rapid AI adoption and complex cybersecurity threats are driving increased demand for A10’s advanced solutions. These tailwinds, if sustained, could unlock the forecasted margin uplift.

- But consensus cautions that product adoption for new AI environments remains in early phases and competition among networking and security vendors is fierce, so capturing these margin gains may prove harder in practice than the model suggests.

Share Price Trades At Discount To Both Targets And Peers

- With a current PE ratio of 25.5x and a share price of $18.13, A10 Networks is priced at a notable discount to the US software industry average PE (35.2x) and consensus analyst price target of $23.00.

- Consensus narrative emphasizes that the below-peer valuation stands out given A10’s margin trajectory and above-market earnings growth outlook.

- Notably, to reach the analyst target, A10 would need to grow earnings to $71.9 million and trade at 27.7x PE by 2028, which remains below industry norms. This offers a potential 27% upside from current levels if the consensus scenario plays out.

- However, reliance on ongoing execution and resilience in enterprise spending leaves A10 exposed if broader economic or sector-specific trends turn, making this discount an opportunity but not a guarantee.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for A10 Networks on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the results? Share your perspective and build your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding A10 Networks.

See What Else Is Out There

Although A10 Networks is delivering margin gains and undervaluation, its heavy dependence on a handful of major clients and sectors poses risks of sudden setbacks if customer spending or market conditions shift.

If you want more reliable, all-weather portfolios, focus on predictable performers by seeking out stable growth stocks screener (2073 results) with a track record of steady growth regardless of who their top customers are.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATEN

A10 Networks

Provides security and infrastructure solutions in the United States, rest of the Americas, Japan, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion