- United States

- /

- IT

- /

- NYSE:ASGN

Is Rising Fed Rate Cut Hopes Shifting the Investment Case for ASGN (ASGN)?

Reviewed by Simply Wall St

- Following the recent Consumer Price Index (CPI) report, expectations of a Federal Reserve interest rate cut increased, lifting sentiment across a range of stocks including ASGN.

- This market reaction highlights how macroeconomic factors, such as anticipated changes in monetary policy, can influence investor sentiment for companies beyond their individual operational performance.

- We'll explore how investor optimism around potential interest rate cuts may impact ASGN's investment narrative and future growth expectations.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

ASGN Investment Narrative Recap

To be a shareholder in ASGN, you need to believe in the company’s ability to capture long-term demand for tech-driven consulting and staffing solutions, while managing risks from sector downturns and competitive pressures. The recent CPI report and heightened expectations for Fed rate cuts have improved sentiment for the stock, but the short-term catalyst, sustained demand for high-margin consulting and government tech contracts, remains unchanged, while exposure to macroeconomic slowdowns is still a significant near-term risk.

Among recent announcements, ASGN’s ECS division received an awardable status for its Blue Dawn AI/ML solution in the DoD’s Tradewinds Marketplace, expanding its reach in federal technology procurement. This move underscores the company's ongoing push into higher-value, tech-enabled government contracts, which aligns with its biggest catalyst: growing a pipeline of recurring federal revenues less sensitive to cyclical swings in private sector activity.

However, investors should also be mindful that, in contrast, ASGN’s commercial segment revenues continue to reflect exposure to cyclical slowdowns and...

Read the full narrative on ASGN (it's free!)

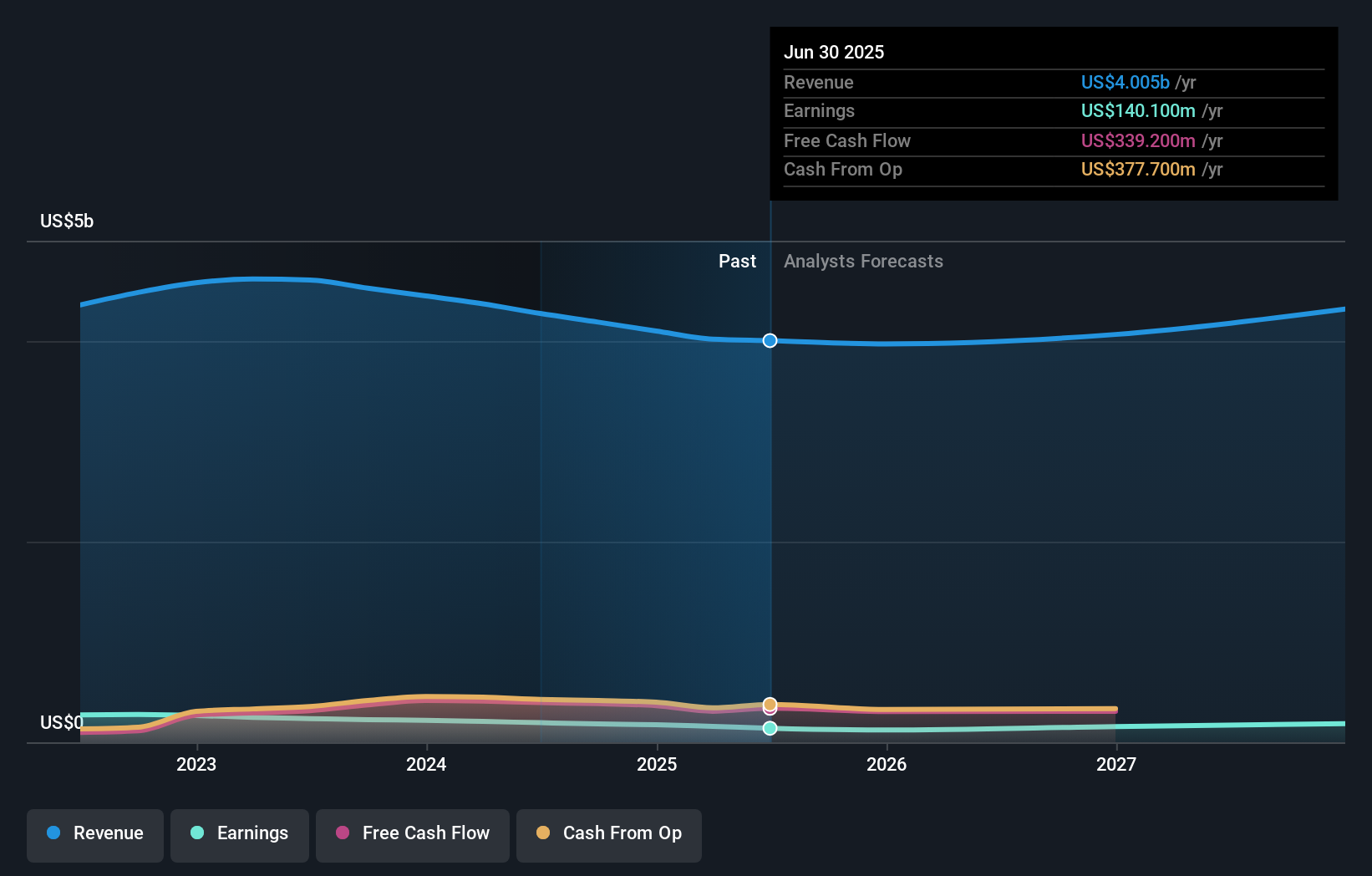

ASGN's narrative projects $4.3 billion revenue and $193.8 million earnings by 2028. This requires 2.5% yearly revenue growth and a $53.7 million earnings increase from the current $140.1 million.

Uncover how ASGN's forecasts yield a $57.50 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members place fair value for ASGN between US$30.33 and US$79.22 per share. While some see opportunity, others may weigh recent softness in commercial segment revenues as a sign of lingering caution.

Explore 3 other fair value estimates on ASGN - why the stock might be worth as much as 54% more than the current price!

Build Your Own ASGN Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ASGN research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ASGN research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ASGN's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASGN

ASGN

Engages in the provision of information technology (IT) services and solutions in the technology, digital, and creative fields for commercial and government sectors in the United States, Canada, and Europe.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives