- United States

- /

- Software

- /

- NYSE:ASAN

Insiders are sticking with Asana, Inc. (NYSE:ASAN) despite Volatility

Asana’s Inc’s ( NYSE:ASAN ) stock price has had a wild ride ever since the company became publicly listed in October 2020. It’s fallen as much as 70% in the last three months, including a 23% fall last Wednesday.

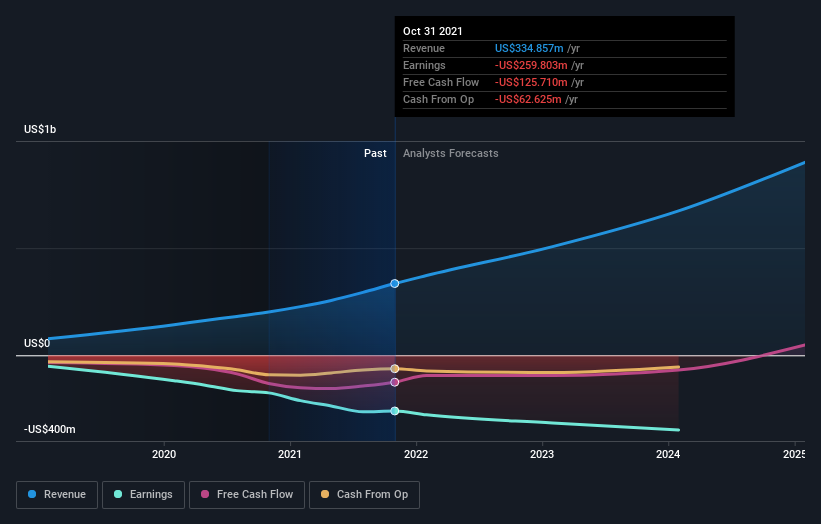

Asana is growing revenue steadily, but like a lot of software companies, revenue growth is being prioritized over profitability. In fact, analysts are expecting the company’s net loss to widen in the coming years, as Asana continues to invest in growth.

Placing a value on a business like this can be challenging as there isn’t a clear path to positive cash flows. In instances like this, it’s worth looking at the ownership structure and specifically what insiders are doing.

View our latest analysis for Asana

Who owns Asana?

The graphic below reflects quite an unusual ownership structure. Insiders own 51% of the company which is very high for a company of this size. In particular, the CEO, Dustin Moskovitz owns 46% of the company and has been buying stock continually over the last year. (These purchases are not reflected on our list of insider transactions as they are part of a Rule 10b5-1 trading plan , rather than open market transactions).

The list of insiders includes Dustin Moskovitz and other members of the management team, and several prominent venture capital funds. It’s notable that these funds, which have owned shares in Asana since it was private, have held onto their shares over the last 12 months, while the share price rose from $33 to $147 and then fell back to $60.

Other shareholders

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So, they generally do consider buying larger companies that are included in the relevant benchmark index.

As you can see, institutional investors have a fair amount of stake in Asana. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Asana, (below). Of course, keep in mind that there are other factors to consider, too.

Individual shareholders own just 15% of Asana’s shares. This is quite low but may change if the company’s performance starts to stand out.

The bottom line on Asana’s ownership structure

Investing in Asana requires one to take a long-term view, as positive cash flows are likely some way off. But, investors can take some comfort from the fact that the CEO is buying shares and other insiders are holding on to their shares.

There are two points to keep in mind though:

- Insiders currently own more than 51% of the shares, which means they have significant control over the company.

- Shareholders have been diluted in the past, and are likely to be further diluted in the future. Likely long-term returns need to be weighed up against the rate of dilution.

This article is not intended to be a comprehensive analysis of Asana, but rather to highlight the fact that insiders are holding and even increasing their stake . If you are interested in understanding the company at a deeper level, take a look at Asana’s company page on Simply Wall St .

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NYSE:ASAN

Asana

Operates a work management software platform for individuals, team leads, and executives in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026