- United States

- /

- Software

- /

- NYSE:ASAN

Did Strong Earnings and Easing Tensions Just Shift Asana's (ASAN) Investment Narrative?

Reviewed by Sasha Jovanovic

- In the past week, Asana was among several technology and software companies whose stocks rose following a wave of positive news, including strong corporate earnings, signs of easing political and trade tensions, and growing optimism about potential interest rate cuts.

- This surge in confidence across the sector highlighted the influence of broader economic and geopolitical factors on investor sentiment for software platforms like Asana, especially amid hopes for an end to the U.S. government shutdown and renewed momentum in U.S.-China relations.

- We'll explore how improved market sentiment, driven by robust earnings and easing uncertainties, impacts Asana's investment narrative going forward.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Asana Investment Narrative Recap

For investors considering Asana, the core belief is in the company's ability to grow by embedding AI-driven automation into enterprise workflows, increasing demand for its platform even as competition intensifies. The recent sector rally highlights improved investor optimism, but these broader tailwinds do not significantly change the most important short term catalyst, continued adoption of new AI features by large enterprise customers, or the major risk, which remains the potential for lower net retention rates as major contracts come up for renewal.

Among recent developments, the rollout of AI Teammates stands out for its direct relevance to this wave of optimism, as it aims to make Asana’s platform more essential for enterprise-scale clients seeking productivity gains. If these AI offerings deliver value and drive larger deployments, they could help offset pressures from shifting customer behaviors or tough macro conditions.

By contrast, not all tailwinds can mitigate the challenge if renewal downgrades accelerate, which is something investors should be aware of as...

Read the full narrative on Asana (it's free!)

Asana's narrative projects $966.9 million revenue and $126.6 million earnings by 2028. This requires 9.4% yearly revenue growth and a $358.4 million earnings increase from -$231.8 million today.

Uncover how Asana's forecasts yield a $16.38 fair value, a 12% upside to its current price.

Exploring Other Perspectives

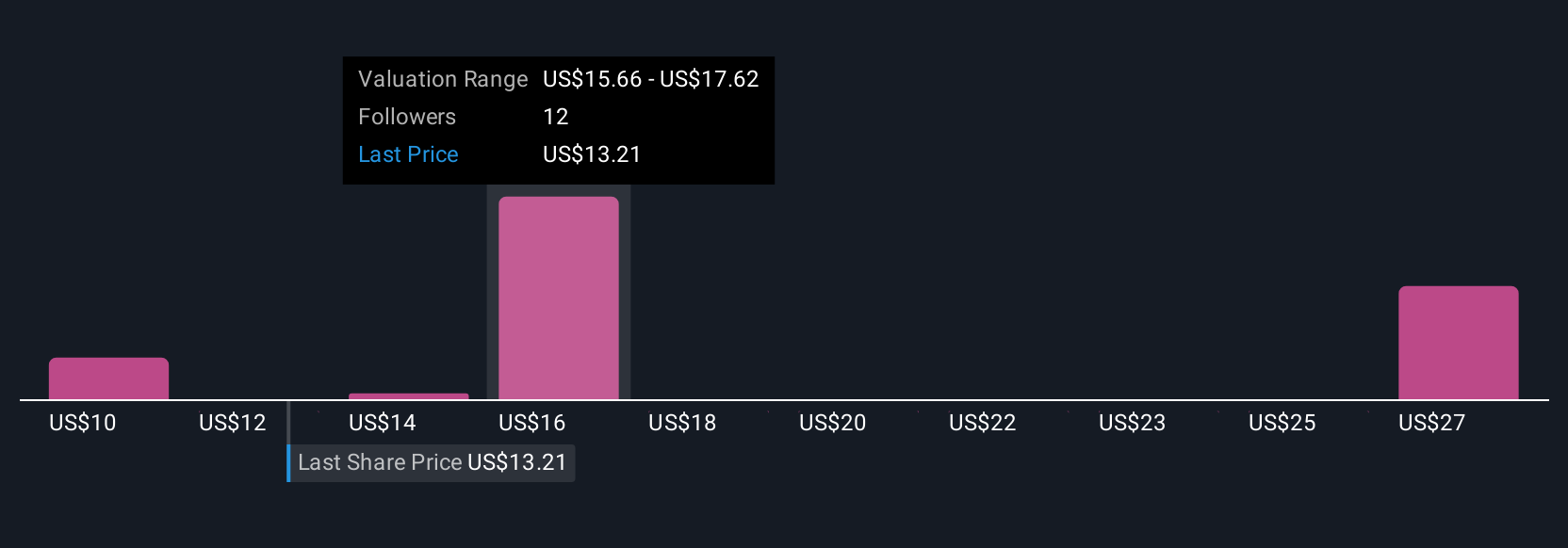

Seven Simply Wall St Community members have estimated Asana’s fair value between US$9.79 and US$29.47 per share. While optimism is building around AI innovation, the risk of declining net retention rates in the face of enterprise renewals remains a key factor shaping the company’s long-term success.

Explore 7 other fair value estimates on Asana - why the stock might be worth over 2x more than the current price!

Build Your Own Asana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Asana research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Asana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Asana's overall financial health at a glance.

No Opportunity In Asana?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASAN

Asana

Operates a work management software platform for individuals, team leads, and executives in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives