- United States

- /

- Software

- /

- NYSE:AI

Does the Recent 40% Drop Offer a Fresh Opportunity in C3.ai Stock?

Reviewed by Simply Wall St

If you have been watching C3.ai’s stock lately and wondering whether now is the right time to jump in or cut your losses, you are not alone. After a dramatic run-up during the initial AI stock boom, the company's share price has experienced some sharp turns, and not always in the direction investors hoped. Over the past year, C3.ai’s stock has seen a decrease of about 32%, and it's down more than 40% in the last month alone. These kinds of moves can stir up plenty of questions about risk, growth potential, and whether the market might finally be mispricing a high-profile AI tech name.

At today’s closing price of $16.94, C3.ai trades at a discount of approximately 28% compared to analyst targets. Its current value score is 2 out of 6, meaning the company only passes two of the classic undervaluation tests. For a company in such a competitive, fast-evolving sector, that mixed mark tells us there is a lot more to the story than just sticker price. Some see huge upside if the company’s AI bets pay off, while others worry that disappointing earnings trends and tough sector competition are weighing on perceptions of fair value.

So how do you make sense of it all? Next, let’s break down exactly how C3.ai measures up across multiple valuation approaches and discover which frameworks best unlock the real picture. In fact, there might be a smarter way to judge a stock like this than any single number can show. We will get to that before we are done.

C3.ai delivered -31.8% returns over the last year. See how this stacks up to the rest of the Software industry.Approach 1: C3.ai Cash Flows

The Discounted Cash Flow (DCF) model works by projecting a company's future cash flows and then discounting them back to the present to estimate what the stock should be worth today. This approach gives investors a sense of the company’s true value, factoring in both current performance and future expectations.

For C3.ai, last year’s Free Cash Flow stood at negative $82.7 million, reflecting the company's ongoing investment phase and growth efforts. Over the coming decade, analysts expect a turnaround with annual cash flows growing from losses to a projected $277.2 million by 2035. This long-term forecast highlights optimism around C3.ai’s business ramping up as artificial intelligence adoption grows.

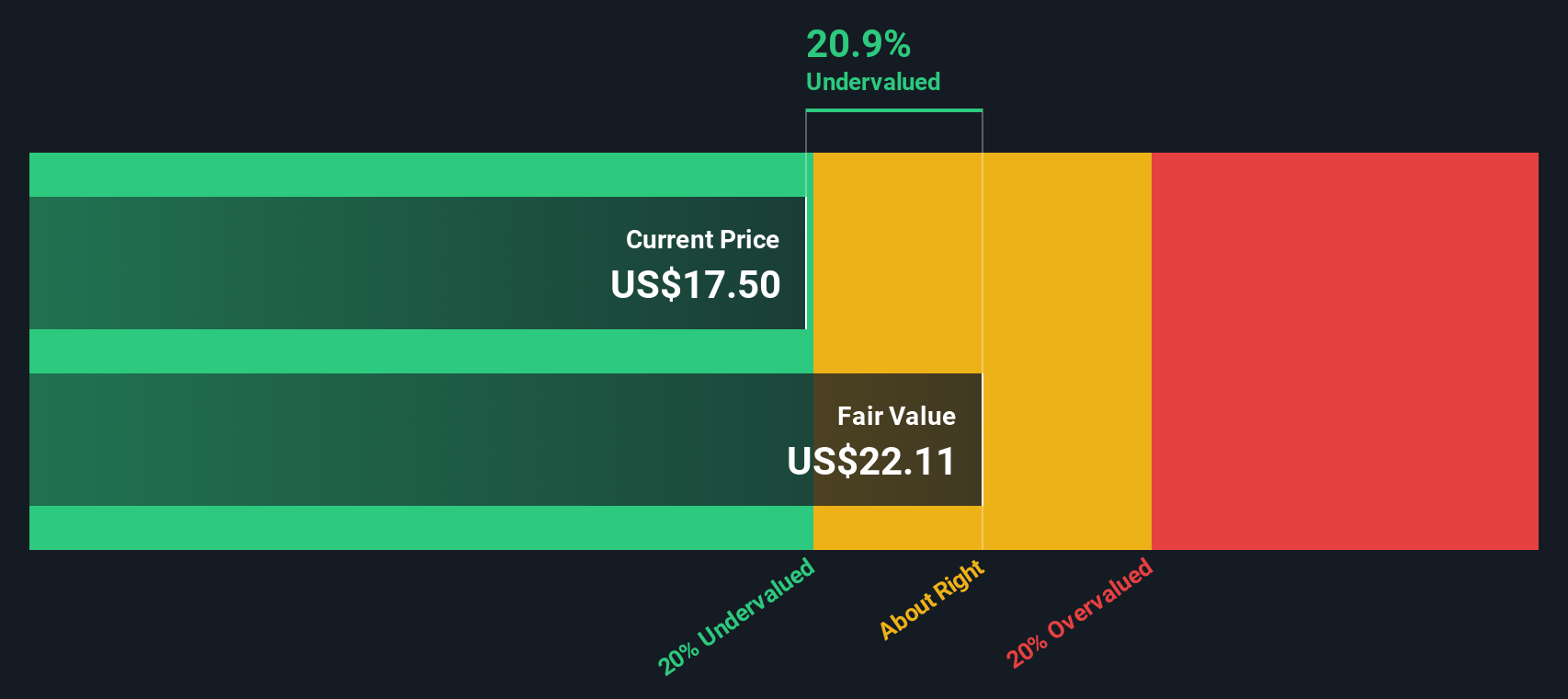

Based on these projections and the DCF model, the fair value estimate is $22.61 per share. With the current market price at $16.94, the stock appears about 25% undervalued compared to its intrinsic value. In summary, the market seems to be pricing in significant caution, which could present potential upside for investors who have a long-term outlook on the company’s cash flow story.

Result: UNDERVALUED

Approach 2: C3.ai Price vs Sales

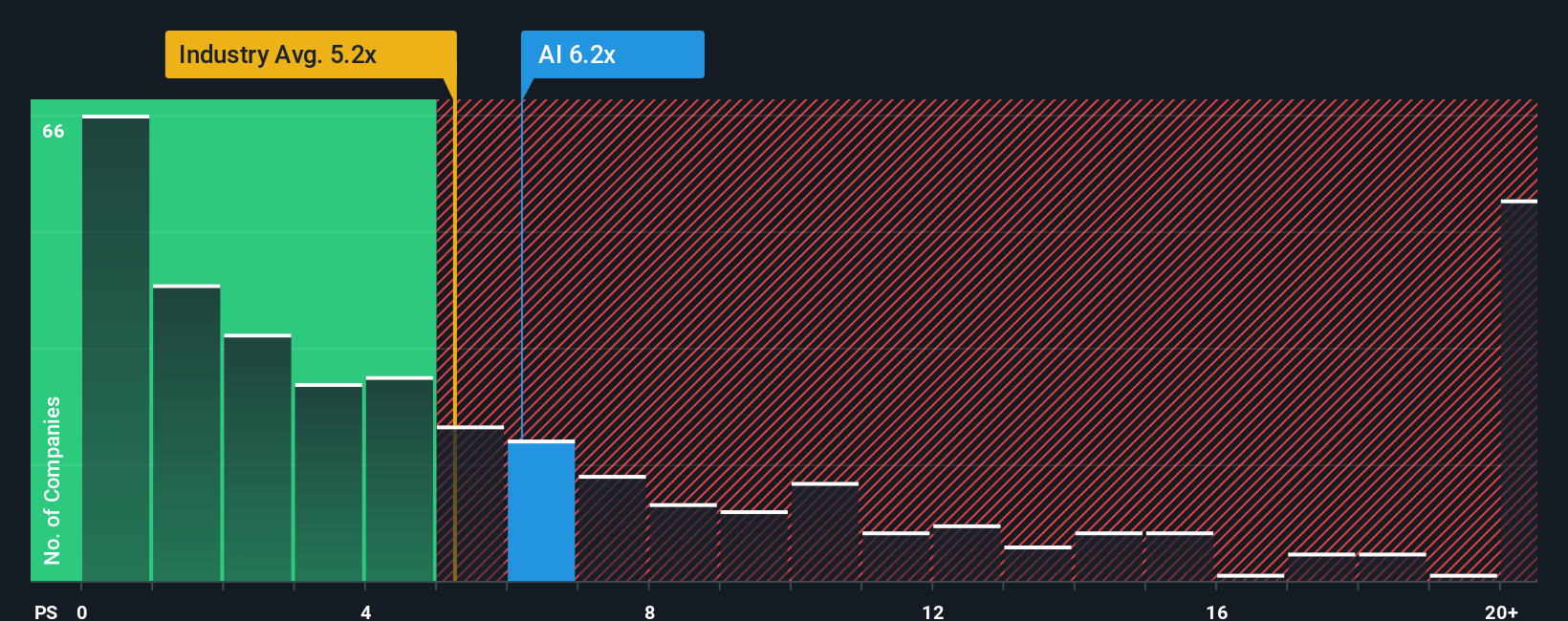

The Price-to-Sales (P/S) ratio is a widely used valuation metric, especially for technology firms that are not yet consistently profitable. It helps investors assess how much they are paying for each dollar of the company’s sales. This is particularly relevant for C3.ai, given its current lack of positive earnings but continued top-line growth. High-growth tech firms often command elevated P/S multiples when investors believe future expansion will ultimately turn sales into profits.

Currently, C3.ai’s P/S ratio stands at 5.85x. This places it above the peer average of 2.70x and also above the software industry average of 4.84x. While a premium valuation can suggest optimism about a company's growth prospects, it may also reflect higher perceived risk or the company being in an earlier stage of its business lifecycle. To account for all these factors, Simply Wall St’s Fair Ratio combines elements like growth trajectory, risks, and industry margins to estimate what a balanced P/S multiple should look like. For C3.ai, the Fair Ratio is 4.15x.

When comparing the Fair Ratio to the actual ratio, C3.ai’s stock is currently valued somewhat above what would be considered “fair” for its fundamentals. The difference suggests that the shares may be running ahead of themselves in terms of sales expectations, which may warrant some caution when assessing the current price.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your C3.ai Narrative

Narratives are straightforward stories investors create to explain what they believe about a company’s future, connecting their own assumptions about revenue, earnings, and margins to a specific estimate of fair value and future potential.

Unlike traditional metrics, Narratives make it easy to turn your personal expectations and research—such as expected partnerships, technology shifts, or sector trends—into actionable forecasts that you can directly compare with a company’s current share price.

On the Simply Wall St platform, Narratives are an accessible and powerful tool embraced by a community of millions. This allows investors at all levels to clarify their thinking and test their convictions by updating forecasts as new news or quarterly earnings emerge.

By building your own C3.ai Narrative, you can see instantly if your view suggests the stock is overvalued or undervalued compared to current trading levels. This can help you decide when to buy, hold, or sell with greater confidence.

For example, looking at C3.ai, one Narrative expects the stock could climb to $40 if partnerships and AI adoption accelerate dramatically, while another argues a fair value is just $13 if challenges persist. This demonstrates how your unique perspective shapes your investment path.

Do you think there's more to the story for C3.ai? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AI

C3.ai

Operates as an enterprise artificial intelligence application software company.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion