- United States

- /

- Software

- /

- NYSE:AI

C3.ai (AI) Valuation Check After a Difficult Year for Shareholders

Reviewed by Simply Wall St

Assessing C3.ai stock after a difficult year

C3.ai (AI) has quietly slipped to around 14 dollars after a rough year for shareholders, with the stock down about 60% year to date and over 60% in the past year.

See our latest analysis for C3.ai.

The latest close at 13.82 dollars caps a tough stretch, with a steep year to date share price return and a similarly weak one year total shareholder return, even though the three year total shareholder return is still positive. This suggests earlier enthusiasm has largely cooled.

If you are weighing where to look next in the AI space, this could be a good moment to explore other high growth tech and AI stocks that might offer stronger momentum.

With modest revenue growth, persistent losses, and shares trading only slightly below analyst targets, investors are left wondering if today’s depressed price reflects deep undervaluation or if the market already anticipates any future growth.

Most Popular Narrative Narrative: 5.8% Undervalued

With the most popular narrative putting fair value just above the 13.82 dollars close, the story hinges on how quickly growth and margins can shift.

The rapid expansion of AI deployments across manufacturing, chemicals, defense, and government clients, as demonstrated by fresh enterprise-wide commitments from Nucor, Qemetica, HII, and U.S. Army projects, signals accelerating enterprise adoption of advanced AI platforms. This is expected to drive strong, multi-year revenue growth as adoption moves from pilots to broad production rollouts.

Curious how modest growth today could evolve into scaled enterprise rollouts with materially higher margins and earnings power over time, according to this narrative? The full story unpacks how revenue expansion, margin lift, and a rich future earnings multiple all work together to justify that fair value.

Result: Fair Value of $14.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sharper revenue declines and ongoing execution missteps could easily derail this upside case and force a rethink on both growth and valuation assumptions.

Find out about the key risks to this C3.ai narrative.

Another View: Multiples Point to a Richer Valuation

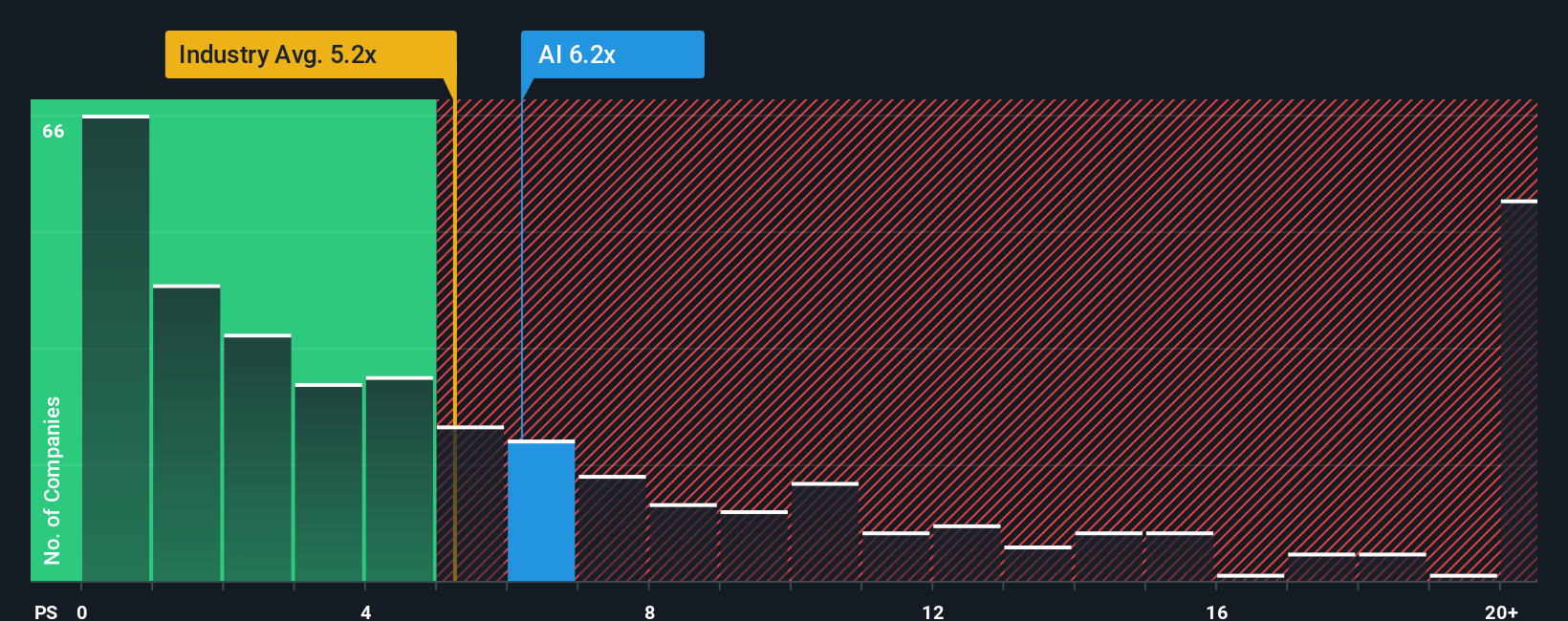

While the narrative suggests C3.ai is 5.8% undervalued, its price to sales ratio of 5.5 times appears elevated compared with the US software industry at 4.9 times, peers at 2.6 times, and a fair ratio of 2.3 times. This comparison implies meaningful downside risk if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own C3.ai Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a complete view in just minutes: Do it your way.

A great starting point for your C3.ai research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now and use the Simply Wall Street Screener to spot fresh opportunities, compare them side by side, and avoid missing tomorrow’s strongest performers.

- Target tomorrow’s potential market leaders by scanning these 24 AI penny stocks built around transformative artificial intelligence breakthroughs.

- Lock in potential cash flow and income stability with these 13 dividend stocks with yields > 3% that can complement growth focused positions.

- Capitalize on market mispricing by hunting through these 916 undervalued stocks based on cash flows that strong cash flow analysis still flags as bargains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AI

C3.ai

Operates as an enterprise artificial intelligence application software company.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion