- United States

- /

- Software

- /

- NYSE:AI

C3.ai (AI): Evaluating Valuation After Withdrawn Guidance, CEO Change, and Legal Scrutiny

Reviewed by Simply Wall St

C3.ai (AI) just delivered a tough set of quarterly results, reporting revenue and profitability that fell short of expectations and withdrawing its full-year guidance. The company also named a new CEO, Stephen Ehikian, while at the same time facing a wave of class action lawsuits alleging it misled investors about its financial health and the effects of leadership changes. For investors, these events paint a picture of a company in the midst of major upheaval and raise fresh questions about its path forward.

All of this has weighed heavily on C3.ai’s share price. Over the past year, the stock has dropped around 29%, with a sharper retreat in the past 3 months. The latest results have only deepened negative sentiment, as cautious investors digest not just missed numbers but also broader uncertainty about C3.ai’s competitive positioning and execution after a high-profile executive transition. The combination of sagging revenue, legal scrutiny, and aggressive rivals has clearly shifted the narrative around this stock in recent months.

So after a year of significant decline and heightened doubt, is the current share price a bargain or are markets accurately bracing for further challenges ahead?

Most Popular Narrative: Fairly Valued

According to the most popular narrative, C3.ai is fairly valued, with new analysis reflecting a sharp reset in expectations for growth and future profitability.

"C3.ai withdrew full-year fiscal 2026 guidance in light of CEO transition and sales/service restructuring. The company now provides Q2 fiscal 2026 revenue guidance of $72-80 million. Stephen Ehikian was appointed Chief Executive Officer, succeeding Thomas M. Siebel, who will remain Executive Chairman. The transition follows Siebel's diagnosis with an autoimmune disease and significant visual impairment."

Curious about the dramatic shifts in C3.ai's value? Analysts have overhauled major assumptions, with future growth and profit forecasts taking center stage. What numbers are really driving this fair value call? Is it steady cash flow, new leadership traction, or something else entirely? Get ready for some surprises if you dig into the full narrative behind this market verdict.

Result: Fair Value of $16.25 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent revenue declines and ongoing dependence on partner-led sales could undermine C3.ai’s growth story and could weigh on future profitability.

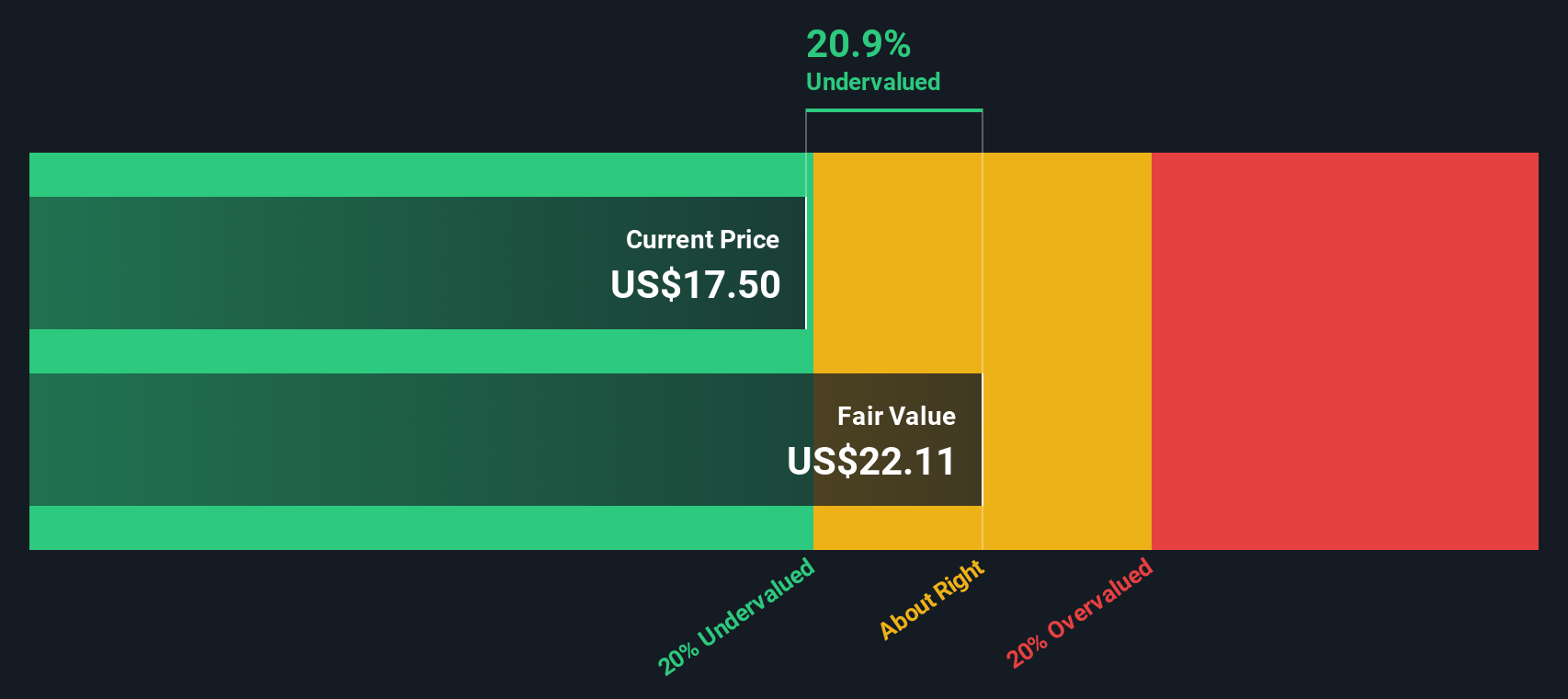

Find out about the key risks to this C3.ai narrative.Another View: What Does Our DCF Model Say?

While the first approach relies on price-to-sales ratios, our DCF model tells a different story. This method suggests that fair value could be even further out of reach than the multiple implies. Could this signal a bigger problem, or perhaps an overlooked opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own C3.ai Narrative

If you have a different perspective or want to dive into the numbers yourself, you can build your own C3.ai story in just a few minutes with our tools. Then make it your own Do it your way.

A great starting point for your C3.ai research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take charge of your portfolio by searching for stocks tailored to your goals. Don’t miss out on other opportunities that could put you ahead of the market.

- Uncover hidden potential in companies that are trading well below their worth, using our undervalued stocks based on cash flows for value-driven gains.

- Spot market leaders using advanced healthcare technology and artificial intelligence by accessing our healthcare AI stocks, perfect for future-focused investors.

- Boost your income strategy by targeting firms offering strong, consistent yields with our dividend stocks with yields > 3%. Let your money work harder for you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AI

C3.ai

Operates as an enterprise artificial intelligence application software company.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives