- United States

- /

- IT

- /

- NYSE:ACN

Is Accenture’s (ACN) Expanded Cloud Partnerships Accelerating Its AI Transformation Strategy?

Reviewed by Sasha Jovanovic

- In October 2025, Accenture announced expanded collaborations with both Amazon Web Services (AWS) and Google Cloud to deliver advanced generative AI and cloud solutions for public sector, defense, and enterprise clients. These partnerships aim to develop AI-powered services that boost productivity, operational efficiency, and digital transformation across diverse industries.

- Accenture's commitment to scaling agentic AI and cloud solutions underscores its position as a central player in the enterprise integration of next-generation technologies.

- We'll explore how Accenture's expanded AWS and Google Cloud partnerships further reinforce its AI-driven transformation and future growth prospects.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Accenture Investment Narrative Recap

To be a shareholder in Accenture right now, you need to believe in the company's ability to remain an essential partner for enterprise-scale AI and digital transformations, leveraging advanced cloud partnerships to drive growth. The recent expansions with AWS and Google Cloud have the potential to reinforce Accenture’s central role in large-scale digital and AI-driven reinventions, but they do not meaningfully shift the immediate pace of revenue growth, which is still pressured by policy-driven federal sector headwinds and margin compression risks.

Among the recent announcements, Accenture's new collaboration with AWS stands out as directly relevant, it targets public sector and defense clients with AI and cloud-based offerings built to reduce costs and improve operational agility. This expands the company’s reach into mission-critical government workloads and may incrementally strengthen its profile as federal revenue faces cyclical uncertainty.

However, it is important to recognize that while high-profile partnerships can be catalysts for growth, contrasts remain around the unpredictability of public sector demand and the possibility that new business wins may not...

Read the full narrative on Accenture (it's free!)

Accenture's outlook anticipates $81.5 billion in revenue and $10.0 billion in earnings by 2028. This projection is based on a 6.0% annual revenue growth rate and a $2.1 billion increase in earnings from the current $7.9 billion.

Uncover how Accenture's forecasts yield a $278.32 fair value, a 11% upside to its current price.

Exploring Other Perspectives

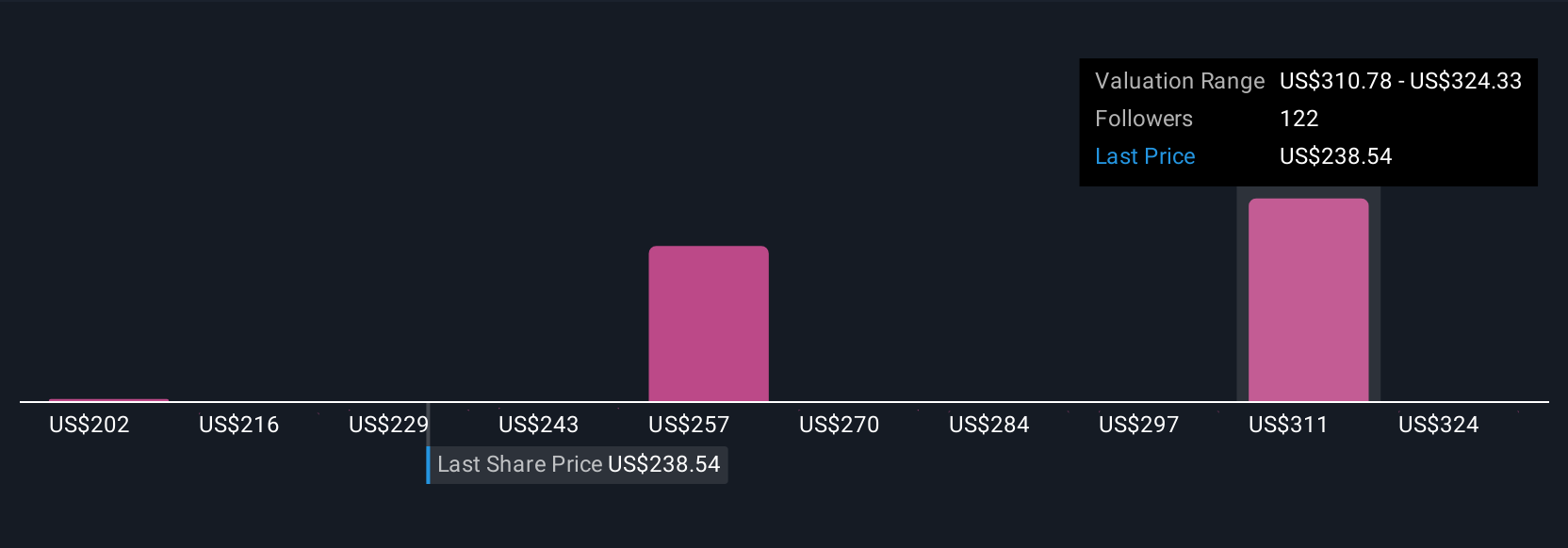

Simply Wall St Community members offered 13 fair value opinions ranging from US$202 to US$278 per share, showing substantial divergence in outlook. Some see substantial growth ahead, yet ongoing federal revenue uncertainty could factor into your long-term view. Explore several alternative viewpoints within the Community for broader context.

Explore 13 other fair value estimates on Accenture - why the stock might be worth as much as 11% more than the current price!

Build Your Own Accenture Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Accenture research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Accenture research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Accenture's overall financial health at a glance.

No Opportunity In Accenture?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives