- United States

- /

- IT

- /

- NYSE:ACN

A Fresh Look at Accenture (ACN) Valuation: Is the Market Missing Something?

Reviewed by Kshitija Bhandaru

Accenture (ACN) shares saw only modest movement today, trading near $244. At the same time, broader market forces continued to weigh on tech consulting firms. Investors watching Accenture's recent performance may be evaluating both its growth and its valuation metrics.

See our latest analysis for Accenture.

Accenture’s share price has largely drifted sideways in recent months, with a slightly negative total shareholder return of about -0.3% over the past year. This muted movement follows a period of market pressure for tech consulting firms, suggesting that investors remain hesitant until stronger growth signals or a shift in sentiment emerge.

If you’re keeping an eye on shifts in tech services, it could be a great moment to explore other standout technology and AI stocks using our discovery tool: See the full list for free.

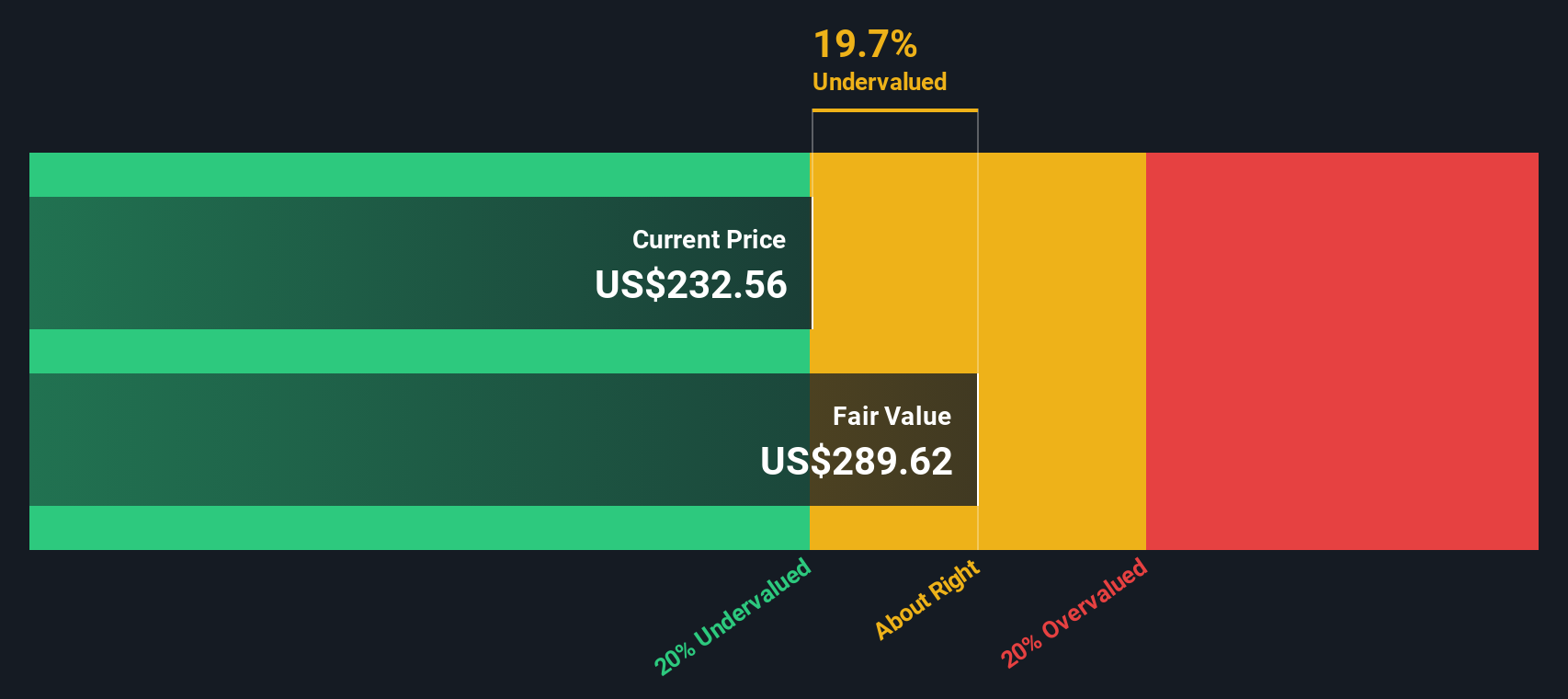

But with shares lagging and fundamentals still solid, investors may wonder whether Accenture is currently offering value that the market is overlooking, or if its share price already reflects hopes for a rebound in growth. Is there a buying opportunity here?

Most Popular Narrative: 20.7% Overvalued

According to FCruz, Accenture’s latest close at $244.34 stands notably below their narrative’s fair value estimate. The story is driven by more than just recent price swings.

After a sector de-rating, ACN trades around its long-run average multiple with superior profitability and returns on capital for a services name. EPS growth and margin expansion are intact; execution is visible despite a more selective demand environment.

Want to know which growth lever could change everything for Accenture? The narrative hints at surprising optimism about margins and sustained profit momentum. Could a big shift be closer than investors think? Find out exactly which trends drive this bold fair value target.

Result: Fair Value of $202.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weaker bookings trends or prolonged decision cycles could quickly challenge even the most optimistic outlook for near-term growth and potential increases in valuation.

Find out about the key risks to this Accenture narrative.

Another View: Is Accenture Actually Undervalued?

While the fair value narrative suggests Accenture is overvalued, one alternative approach tells a different story. Our DCF model estimates Accenture’s intrinsic worth at around $274.50, which is about 11% above its current price. If the market is overlooking Accenture’s future cash flows, is there hidden upside here?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Accenture Narrative

If you want to dig deeper or run the numbers your own way, it’s fast and easy to interpret the data and build your own view. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Accenture.

Looking for More Smart Investment Ideas?

Don’t miss your next great opportunity. The Simply Wall Street Screener is packed with stocks driving real change, so you can make your next move confidently.

- Grab income you can count on with these 19 dividend stocks with yields > 3% that offer yields above 3%, ideal for investors seeking steady returns over time.

- Seize the momentum behind technological breakthroughs by searching among these 24 AI penny stocks that are propelling AI innovation to new heights.

- Capitalize on untapped value with these 907 undervalued stocks based on cash flows trading below their fair value, giving you an edge before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives