- United States

- /

- Software

- /

- NasdaqGS:ZS

Zscaler (ZS): Evaluating Valuation Following Strong Q4 Results and Upbeat Fiscal 2026 Guidance

Reviewed by Kshitija Bhandaru

Zscaler (ZS) shares have drawn attention following its release of fiscal 2025 fourth-quarter results, with both earnings and revenues coming in ahead of Wall Street expectations. The company also shared its initial guidance for fiscal 2026, which indicates confidence in continued growth.

See our latest analysis for Zscaler.

The upbeat fourth-quarter earnings, stronger guidance, and fresh industry partnerships have put Zscaler back in the spotlight. Recent moves reflect renewed faith in its cloud security strategy. The stock’s one-year total shareholder return of nearly 76% suggests that long-term momentum is building again after some short-term ups and downs.

If security innovation is on your radar, now's a great moment to discover See the full list for free..

With shares surging and analyst targets still pointing higher, investors may wonder whether Zscaler’s recent gains have left little room for advantage or if its future growth has yet to be fully recognized in the price.

Most Popular Narrative: 5.9% Undervalued

Zscaler's most widely followed narrative values the stock above its last closing price, with the latest estimate pointing to more upside. Here's why this valuation stands out among the crowd.

Explosive growth in AI/ML traffic and emerging threats is creating new security challenges that Zscaler is rapidly addressing with differentiated AI security and agentic operations products. This positions the company to capture a rising share of incremental cyber budgets and expand recurring ARR over the long term.

Want to discover the forecast that drives this eye-catching price target? Analysts behind this narrative are projecting a future shift in margins and astonishing growth expectations. The full story reveals not just the headline numbers, but also the critical assumptions that set this valuation apart from the pack. Dive in to see what surprises are fueling these bold estimates.

Result: Fair Value of $324.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and rapid industry shifts could threaten Zscaler’s sustained growth. This may challenge its bullish outlook in coming quarters.

Find out about the key risks to this Zscaler narrative.

Another View: Sales Ratios Signal a Caution Flag

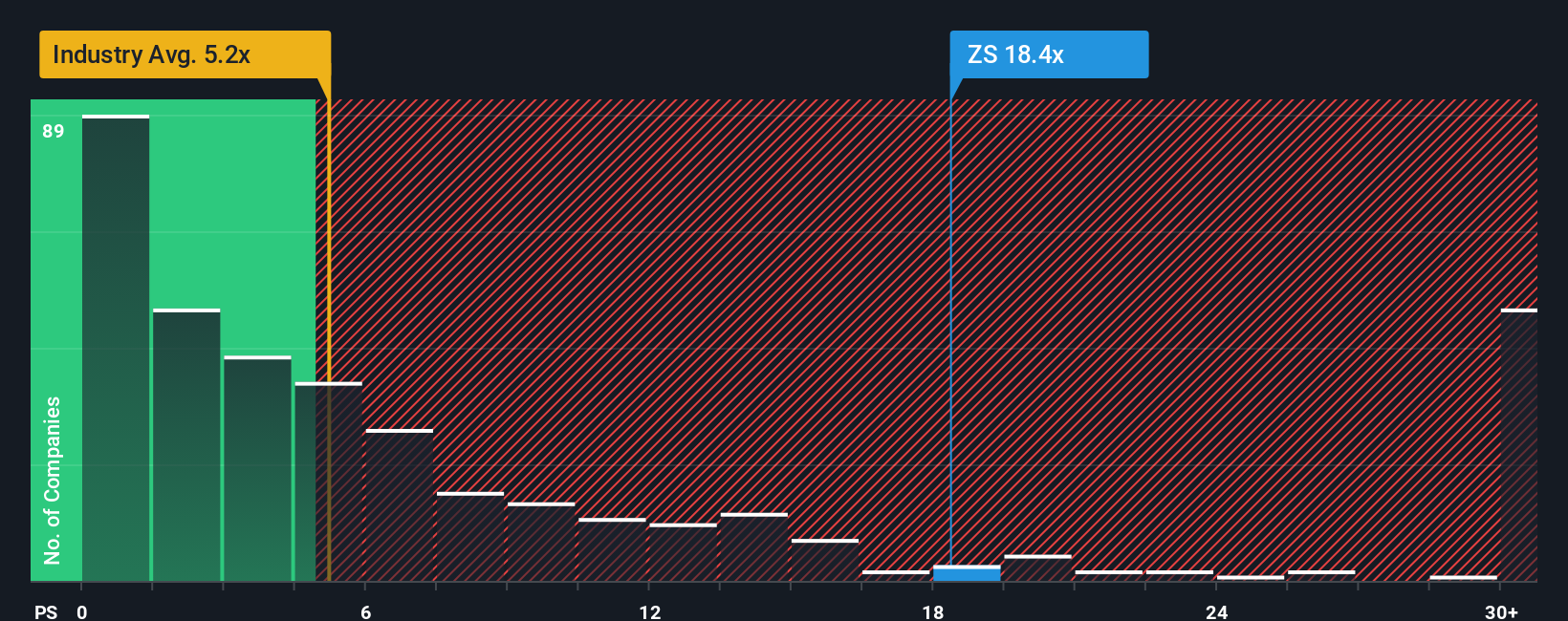

While analyst forecasts point to upside, our look at Zscaler’s price-to-sales ratio shows a more mixed picture. At 18.1x, it is much higher than the US Software industry average of 5.3x, and even beyond its estimated fair ratio of 13x. This means Zscaler is priced well above both peers and what the market could shift toward, highlighting a real risk of limited future upside if growth cools. Could such rich expectations set the stage for volatility?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zscaler Narrative

If you see things differently, or want to dive into the numbers yourself, you can build a personal narrative for Zscaler in just minutes by using Do it your way.

A great starting point for your Zscaler research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t sit on the sidelines while others seize tomorrow’s winners. Broaden your investing strategy using these hand-picked ideas from the Simply Wall Street Screener to give your portfolio a serious edge.

- Boost your search for future breakthroughs by uncovering these 24 AI penny stocks that are poised to transform industries with disruptive artificial intelligence technologies.

- Secure potential bargains by targeting these 896 undervalued stocks based on cash flows that stand out on fundamental value and offer room for upside as the market catches on.

- Capture passive income and financial stability when you check out these 19 dividend stocks with yields > 3% that consistently deliver healthy yields above 3% for shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZS

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives