- United States

- /

- Software

- /

- NasdaqGS:ZS

What Zscaler, Inc.'s (NASDAQ:ZS) 25% Share Price Gain Is Not Telling You

Zscaler, Inc. (NASDAQ:ZS) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

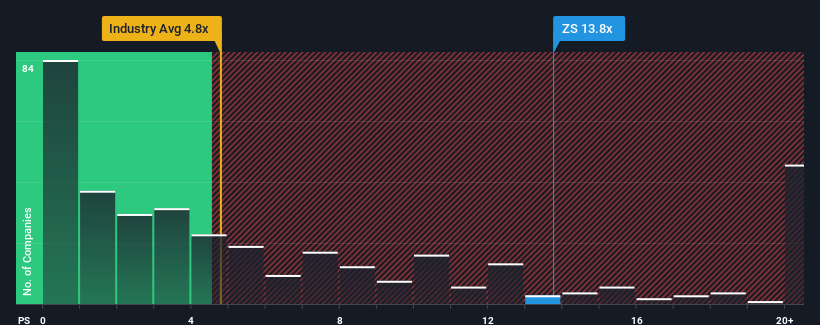

Following the firm bounce in price, Zscaler's price-to-sales (or "P/S") ratio of 13.8x might make it look like a strong sell right now compared to other companies in the Software industry in the United States, where around half of the companies have P/S ratios below 4.8x and even P/S below 1.8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Zscaler

What Does Zscaler's P/S Mean For Shareholders?

Recent times have been advantageous for Zscaler as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Zscaler will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Zscaler's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 34% gain to the company's top line. The latest three year period has also seen an excellent 222% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 21% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 19% each year, which is not materially different.

With this in consideration, we find it intriguing that Zscaler's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

Zscaler's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Analysts are forecasting Zscaler's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Zscaler that you need to be mindful of.

If these risks are making you reconsider your opinion on Zscaler, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ZS

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives