- United States

- /

- Software

- /

- NasdaqGS:ZM

Zoom’s (NASDAQ:ZM) Track Record and Inside Ownership are Reasons for Optimism

Shares of Zoom Video Communications, Inc. (NASDAQ:ZM) have come under another wave of selling pressure after the company reported third quarter financial results. The results were better than expected, but the guidance pointed to a continuing slowdown. The growth outlook now looks less certain as the company struggles to build on the very high base it set for itself in 2020. But there are also good reasons for optimism about the future.

Third quarter financial highlights:

- Revenue up 35% YoY to $1.05bln, $30 mln better than expected.

- Non-GAAP EPS: $1.11 and $0.01 better than expected.

- Free cash flow down 3.6% to $374.8 mln.

- 4th quarter guidance: Revenue expected to be up ~19% YoY to $1.051 to $1.053 bln

The key number here is the 4th quarter guidance for revenue growth. Prior to the Covid-19 pandemic, Zoom’s sales were growing at 80%+, and this rate increased to 368% in the fourth quarter last year. The last two quarters have seen a sharp slowdown from 53% to 35%, with 19% expected in the current quarter.

Zoom’s share price is still trading at 54x earning per share and around 16x sales per share. These multiples are still quite steep if 19% is the new normal for annual sales growth, which means volatility may continue until the outlook is clearer.

Check out our latest analysis for Zoom Video Communications

Zoom’s transition to a platform company

Despite the uncertainty, there are reasons for optimism about the company’s future. While Zoom is primarily known as a video conferencing tool, the company is in the process of transitioning into a platform company. Zoom is doing this by adding new tools and acting as a platform for apps. Some of these initiatives include:

- Zoom Phone - A cloud phone solution with 2 million users

- Zoom Events - a platform for online events.

- Zoom Video Engagement Center - a soon to be launched platform for contact centers.

- Zoom Apps - there are already 67 apps and the company created a $100 million fund to support app developers.

- Tools for industry verticals like education, healthcare and finance.

A strong track record and serious skin in the game

It’s easy to dismiss Zoom’s success as a byproduct of the Covid-19 pandemic. But Zoom was already very successful prior to 2020. Zoom was already profitable when the company held its IPO in 2019 which is unusual for a SaaS (software as a service) company. By the end of 2019, quarterly revenue was already $188 million and growing at 80 to 100%.

Zoom wasn’t the first video conferencing solution around, but quickly managed to become a market leader by innovating. If the company can repeat this performance as a multi-tool platform, there is no reason that growth won’t accelerate once again.

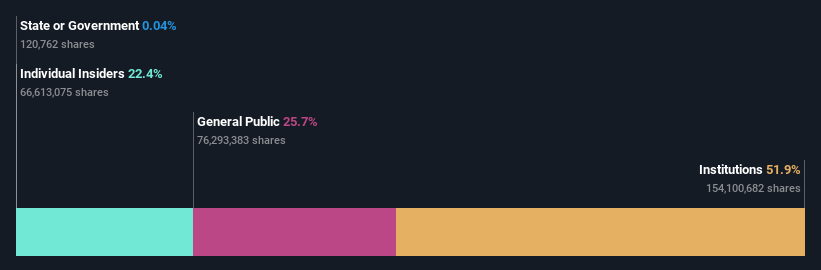

The other factor that shareholders should like is the fact that CEO and founder Eric Yuan has some serious skin in the game. With 23 million shares, he owns 7.8% of the company and is its biggest shareholder. This is a very large stake for the leader of a $61 billion company to own.

In total, company insiders own 22% of the company, meaning the CEO is not the only one incentivized to grow the company.

Next Steps:

There is still a lot of uncertainty around Zoom’s growth outlook, so the share price may remain volatile until a new trajectory emerges. However, the company’s track record and inside ownership should give some comfort to shareholders and good reasons to keep an eye on the company for potential investors.

In this post we have touched on two of the more ‘qualitative’ aspects of the company. For a more comprehensive overview have a look at our free analysis of Zoom, as well as a warning sign that you should be aware of.

Valuation is complex, but we're here to simplify it.

Discover if Zoom Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:ZM

Zoom Communications

Provides an Artificial Intelligence-first work platform for human connection in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives