- United States

- /

- Software

- /

- NasdaqGS:ZM

Zoom Video Communication's (NASDAQ:ZM) High P/E Reflects Optionality Combined With Impressive Track Record

Zoom Video Communications, Inc. ( NASDAQ:ZM ) will be reporting second quarter financial results later today. The stock price has been on a wild ride since March last year when it became apparent that Zoom would be a major beneficiary of the sudden increase in the number of people working remotely, and by October last year the stock price had risen 470%. It has since given up 40% of those gains in anticipation of slowing growth and increasing competition.

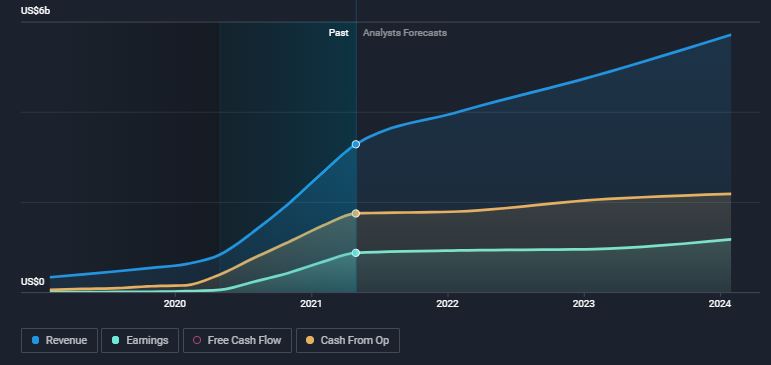

Zoom is expected to report revenue of around $990 million for the quarter, up 49% from the second quarter last year. This will be a dramatic slowdown from the July, October, and January quarters when year-on-year growth was well over 350%. It will also mark sequential growth of just 3.5%, compared to 8% in the previous quarter.

Quarterly EPS of $1.15 is expected, with a ‘whisper number’ as high as $1.25. Over the last five quarters EPS have been between 30 and 100% higher than expected, so a miss would probably disappoint the market.

The slowdown is expected, but Zoom’s results will give us an idea of the accuracy of analyst forecasts. The market may also be more interested in the commentary that comes with the results than the numbers themselves.

View our latest analysis for Zoom Video Communications

Are the market expectations too high?

While Zoom’s share price has given up nearly half of its gains, it is still trading on a price-to-earnings ratio (or "P/E's") of 112x, well above the 17x P/E of the average US stock. This would generally imply the market is expecting the very high growth rate to continue.

Interestingly, in January last year Zoom was trading on a P/E above 2,000. This valuation was the result of 80%+ revenue growth in 2019, and the fact that Zoom was one of very few profitable companies with that sort of growth.

Looking ahead, analysts are expecting a substantial showdown in revenue, earnings and free cash flow growth. In fact, EPS growth is expected to be broadly in line with the equity market over the next few years. On the face of it, the 112 P/E ratio may seem overly optimistic - but there are some other reasons to justify a higher multiple.

Zoom’s Track Record and Optionality

Zoom is widely viewed as a beneficiary of the Covid-19 pandemic, but the company actually had a very impressive track record before 2020. For a start, it was one of very few SaaS companies that was already profitable before the pandemic. In fact, Zoom was already profitable when its IPO was held in April 2019.

Secondly, Zoom’s management team has also been innovating and adding new features since long before the pandemic. Now that the company is facing increased competition from the likes of Microsoft and Google, Zoom is being transformed from an application to a platform company, offering multiple communication tools. Some of Zoom’s new products and initiatives include:

- The recent acquisition of Five9 , a cloud based contact center platform.

- Zoom Phone, a cloud phone service, launched in 2020.

- Zoom phone hardware, including an all one one phone and video communication system.

- Zoom Events, an application to manage and host online and hybrid events.

- A marketplace for apps.

- A $100 million fund for developers building apps to run on the Zoom platform.

- Industry specific tools for verticals like education, finance, government and healthcare.

These initiatives all give Zoom optionality to develop new products and markets as the digital economy evolves. Not every venture will succeed, but the chances of a few home runs is high with a business model like this.

Finally, as illustrated by this graphic of Zoom’s ownership structure , insiders, including CEO Eric Yuan, own 27.4% of the company. This means the management team has significant ‘skin in the game’.

When a company has so much optionality, a track record of delivering growth, and management has a real incentive to deliver, the valuation will typically appear excessive. That doesn’t mean there isn’t a speculative element to the share price, and Zoom is not without its risks ( more about those here ) , but it does help us reconcile the valuation with the current growth rate.

You might be able to find a better investment than Zoom Video Communications. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Zoom Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:ZM

Zoom Communications

Provides an Artificial Intelligence-first work platform for human connection in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026