- United States

- /

- Software

- /

- NasdaqGS:ZM

How Competitors and Developing Tech are Pressuring Zoom's (NASDAQ:ZM) Future

Zoom Video Communications, Inc. (NASDAQ:ZM) recently released its latest earnings results, which is a great time to re-asses the company. In this article, we will focus on the future expectations as well as the risks and competitors for Zoom.

After the 2020 high of US$568, Zoom has been slowly bleeding price levels. Currently, the app has a market cap of US$36.6b and while some analysts are bullish on the future, others compare it to the GoPro hype in 2014 (NASDAQ:GPRO) which was heavily exposed to a trendy single-product risk.

That is why it is important to do a comparison of the risks and opportunities for Zoom.

Risk & Competition Analysis

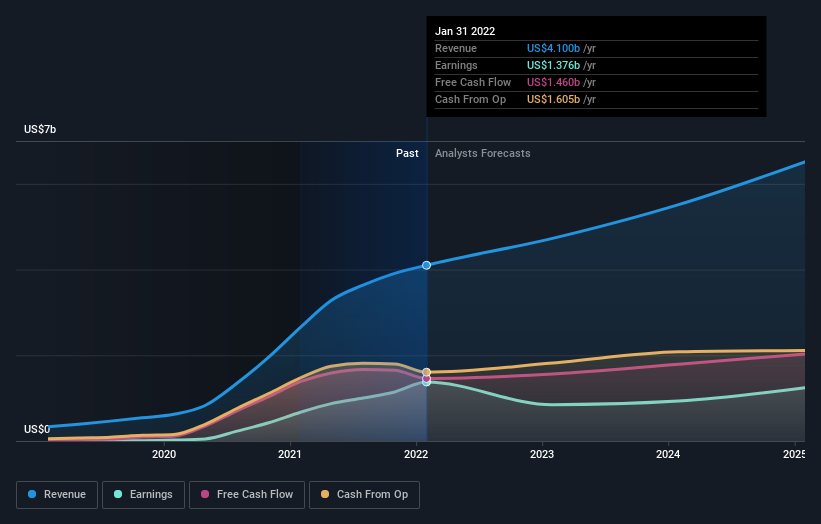

Looking at the cash flows from operations, we can notice a significant drop YoY from US$1.4b to US$604m in the last 12 months - This may be an indication that organic growth is stagnating.

This becomes further apparent when we see that the last 12-month revenue growth of 55% is less than the 3-year CAGR of 131%. Which seems appropriate, as the company did manage to push for worldwide coverage in 2020 and 2021. Now, they will likely have to focus on a distribution and enhance the quality of their service.

On the other side, cash outflows from investing are quite high for the company, with about US$3b spent on investments in the last 2 years. Reinvesting is a good thing and is arguably one of the main advantages of publicly traded SaaS companies vs private, open source or free products - The public companies can leverage cash from investors to further develop their business or product, while private companies rely on debt financing or personal equity to develop. These investments are meant to generate future growth and differentiate a product in order to be appealing to clients.

In a nutshell, Zoom is a single-service company that has both larger competitors and bottom up apps seeking to enter the video communications landscape.

Developing a single service does have some advantages - for example, the company has a main point of focus, and must maximize the quality of their service, pushing them to invest all their energy to improve and innovate Zoom. In this regard, slacking in quality and sales is immediately visible, and the company can course-correct faster than competitors.

Margins and competition are also closely tied. At the peak of their organic growth, Zoom had an EBIT and Net margin of 26.6% and 27.6% respectively. In the last quarter, the EBIT margin dropped to 25.9%, while the net margin rose to 33.6%. As Zoom is entering a different stage, the company will have to spend funds on distribution and competitors will put pressure on pricing. The cost to create technologies like this has also been decreasing, and bottom up competitors that offer cheap alternatives can pressure margins.

Check out our latest analysis for Zoom Video Communications

There are a few notable large scale competitors that have ramped up their video-communication software:

- Microsoft (NASDAQ:MSFT): Developing MS Teams as part of their productivity suite. Predominantly targets large enterprise clients that are part of their Office 265 ecosystem. Leverages Linkedin and Azure to acquire new clients and improve functionality. The main advantage is that it has a reliable software that comes as an add-on to Office. The main disadvantage, is that it is not optimized for individuals and the software is not as user-friendly (compared to Zoom).

- Meta (NASDAQ:FB): Develops the FB Messenger (and pushing Rooms), for communication between connected individuals. The main leverage is the vast FB user base, while the main drawback, is that it is not easily accessible to people outside a friend circle. This limits the application for businesses and educational institutions, but comes "natively" to mind for individuals.

- Google (NASDAQ:GOOGL): Develops Google Meet with an emphasis on easy integration with Gmail and high accessibility to users within and outside their ecosystem. The main advantage is that users are already partly onboarded by way of their Gmail accounts. It is also easily accessible to outsiders and is developed to be more user-friendly for in-browser use. The app is most suitable for sales channels, startups, individuals, and companies within the G-cloud ecosystem. The main disadvantage is that the Google productivity suite is tilted towards free users and may be hard to onboard paying customers.

- Honorable mention - Discord: a rising, community driven and popular app that supports quality video communications.

Decentralization - there is a movement developing that supports self-hosted/decentralized apps, which include video conferencing. The advantage of this technology is that it prevents vendor lock-in, which allows users and businesses to choose their communication app based on the quality and not on the associated services that a parent company offers. Additional advantages include full encryption, privacy and ownership of data. An example for this is Jami.

As we can see, competition is fierce, so let's tie that into how analysts are expecting Zoom to perform.

Future Estimates

The latest report was published on Monday 28th February and revenues were US$4.1b, approximately in line with what the analysts expected, although statutory earnings per share (EPS) crushed expectations, coming in at US$4.50, an impressive 26% ahead of estimates.

With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

Taking into account the latest results, the consensus forecast from Zoom Video Communications' 27 analysts is for revenues of US$4.73b in 2023, which would reflect a meaningful 15% growth in sales compared to the last 12 months. This is an even lower growth rate than what we have previously seen. While it is expected for companies to decelerate growth rates over time, the key story behind Zoom was, that once consumers realized the benefits of video communications, it would become widely adopted in the workplace. This may not be panning out, or competitors are eating up a larger chunk of the market.

Statutory earnings per share are forecast to drop 41% to US$2.73 in the same period. This primarily stems from the decrease of tax benefits in the future. The new management expects EPS for FY2023 to be between $3.45 and $3.51 (around $1b in net income), this might prompt more analysts to update to management's guidance soon.

With no major changes to earnings forecasts, the consensus price target fell 35% to US$172, suggesting that the price is still highly volatile.

There are also some variant perceptions on Zoom Video Communications, with the most bullish analyst valuing it at US$400 and the most bearish at US$130 per share.

Key Takeaways

Zoom is a large beneficiary from the 2020 crisis, however the company is still young and both competitors & technologies are rapidly developing.

The adaptation next year will reveal whether the stock has a viable long-term business that can provide cash flows to investors.

Growth is decelerating, and we will need to see if management can find a way to differentiate the product enough to allow it to be an essential part of businesses and revitalize demand.

Price target dropped 35%, which can be reflected in the short term movements for the stock.

Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Zoom Video Communications (1 doesn't sit too well with us) you should be aware of.

Valuation is complex, but we're here to simplify it.

Discover if Zoom Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:ZM

Zoom Communications

Provides an Artificial Intelligence-first work platform for human connection in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives