- United States

- /

- Software

- /

- NasdaqGS:ZM

Exceptional Financials and New Opportunities Should Stop Zoom's (NASDAQ:ZM) Decline

Few companies have seen a parabolic move in the turmoil of 2020, like Zoom Video Communications, Inc. (NASDAQ: ZM). Yet, after reaching an extraordinary value of over US$160b, the company spend the entirety of 2021 in decline, losing 40% of its value.

View our latest analysis for Zoom Video Communications

Zoom executives seem unphased by the share movement despite such a drastic drop. CFO Kelly Steckelberg recently stated that they are focusing on new products, not the stock price. Mrs.Steckelberg argued that the investors don't appreciate the expanding product set that will put the company in the central position of the new work-from-home economy.

Cathie Wood of ARK Invest backed Zoom, claiming that its revenues are a fraction of the total addressable market. Currently, ARK is one of the top 15 shareholders, holding a US$882.5m position in the company, 2.39% of their portfolio.

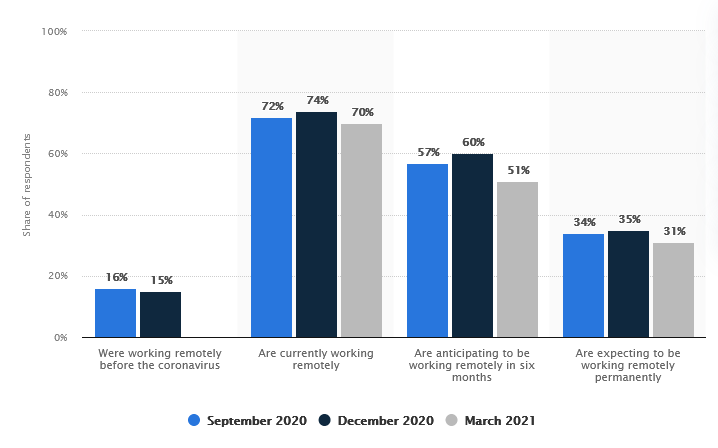

While the trend of remote work more than quadrupled through the COVID-19 Pandemic, once the work returns to normal, the new baseline should be double what it was before 2020.

Meanwhile, the company is expanding its bets beyond their products by investing in Genesys Cloud Services – a software provider for call centers, which recently raised US$580m at a US$21b valuation.

Interestingly, Five9 (NasdaqGM: FIVN), whose merger with Zoom fell through earlier this year, is one of Genesys' competitors.

What's the opportunity in Zoom Video Communications?

According to our valuation model, Zoom Video Communications seems to be reasonably priced at around 0.61% above the intrinsic value, which means if you buy Zoom Video Communications today, you'd be paying a relatively reasonable price for it.

What's more, Zoom Video Communications' share price may be more stable over time (relative to the market), as indicated by its low beta.

In addition, it is worth noting that the company has an exceptional balance sheet. It is debt-free., as it has been for years. Currently, it has US$5.4b in cash and short-term investments and only US$1.8b in liabilities.

What does the future of Zoom Video Communications look like?

Investors looking for growth in their portfolio may want to consider a company's prospects before buying its shares. Although value investors would argue that it's the intrinsic value relative to the price that matters the most, a more compelling investment thesis would be high growth potential at a low price.

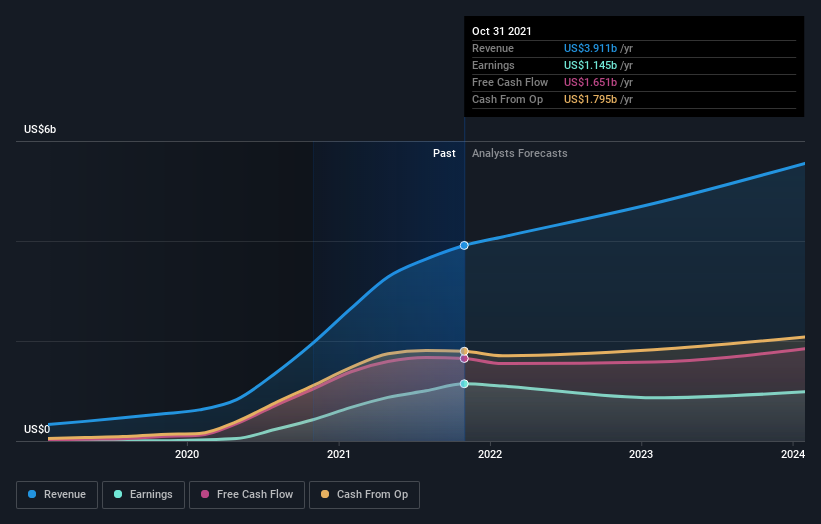

However, with a relatively muted profit growth of 8.8% expected over the next couple of years, growth doesn't seem like a critical driver for a buy decision for Zoom Video Communications, at least in the short term.

What this means for you:

Are you a shareholder? It seems like the market has already priced in ZM's future outlook, with shares trading around their fair value. Yet, there are also other important factors which we haven't considered today, such as the track record of its management team. Have these factors changed since the last time you looked at the stock?

Are you a potential investor? If you've been keeping tabs on ZM, now may not be the most optimal time to buy, given it is trading around its fair value. Despite the exponential growth in the total addressable market, the billion-dollar question is how much of it will be there after the remote work returns to a new baseline. Furthermore, there is also a worry of improving competition and the risk of the company losing its focus if it starts chasing too much expansion too fast.

The positive outlook means it's worth further examining other factors such as the strength of its balance sheet to take advantage of the next price drop.

If you'd like to know more about Zoom Video Communications as a business, it's important to be aware of any risks it's facing. In terms of investment risks, we've identified 2 warning signs with Zoom Video Communications, and understanding them should be part of your investment process.

If you are no longer interested in Zoom Video Communications, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Valuation is complex, but we're here to simplify it.

Discover if Zoom Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:ZM

Zoom Communications

Provides an Artificial Intelligence-first work platform for human connection in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives