- United States

- /

- Software

- /

- NasdaqGS:ZM

Zoom Communications (NasdaqGS:ZM) Integrates With ServiceNow for AI-Driven Customer Service Enhancements

Reviewed by Simply Wall St

Zoom Communications (NasdaqGS:ZM) recently announced its integration plans with ServiceNow, enhancing customer service capabilities through AI and collaboration tools. This announcement likely played a significant role in the company's 15% price increase over the past month. While the market experienced mixed movements due to anticipation around Federal Reserve decisions and international trade discussions, Zoom's integration news would have added positive momentum to its stock amidst broader uncertainty. Other news, including legal settlements or accounting changes, seems less likely to have influenced the stock price as significantly as the integration announcement might have.

The integration between Zoom Communications and ServiceNow not only propelled a 15% rise in its recent share price but also aligns with Zoom’s ongoing shift towards an AI-first platform, enhancing its appeal in the enterprise sector. Over the past year leading up to today, May 7, 2025, Zoom has achieved a total shareholder return of 25.6%, outperforming the US software industry return of 14% and the broader US market return of 7.2% during the same period. This suggests that the company has been more successful in capturing investor confidence, possibly due to its AI-driven initiatives and significant partnerships.

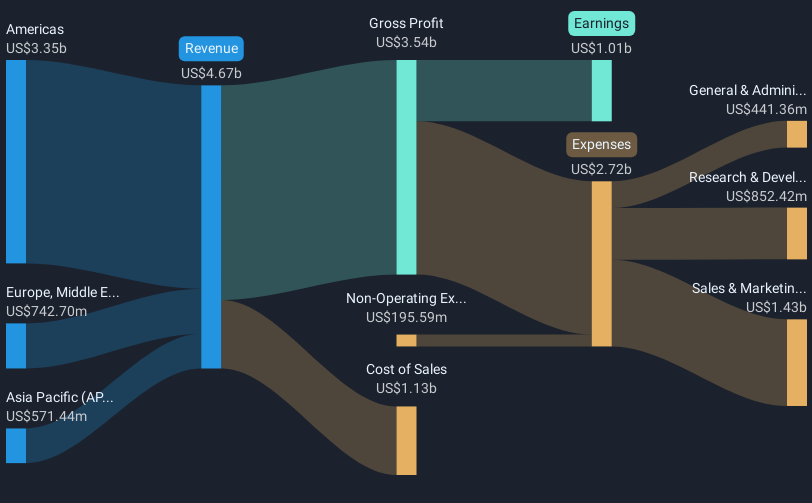

The integration news could potentially boost future revenue and earnings, as the collaboration with ServiceNow may attract new enterprise clients and create monetization opportunities through advanced AI solutions. However, analysts currently expect only a modest annual revenue growth of 3.3%, with earnings anticipated to decrease slightly to US$997.3 million by April 2028. Despite these forecasts, the current share price of US$77.55 is still below the consensus price target of US$88.48, indicating potential upside. Investors should consider whether the company's initiatives and market position align with these forecasts before forming a final opinion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Zoom Communications, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zoom Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZM

Zoom Communications

Provides an Artificial Intelligence-first work platform for human connection in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives