- United States

- /

- Software

- /

- NasdaqGS:ZM

Is Now the Right Moment to Reassess Zoom After Its 17.9% Rally in 2025?

Reviewed by Bailey Pemberton

If you have ever debated what to do with your Zoom Communications shares, you are definitely not alone. Even investors just watching from the sidelines have seen this stock zigzag its way through wild highs and frustrating lows. Over the last five years, Zoom has tumbled an astonishing 83.6%, erasing a huge chunk of its pandemic-era gains. But in the past year alone, it has actually jumped by 17.9%, a sign that market sentiment is shifting and people are rethinking what Zoom could be worth in a changing tech landscape. In the last week and month, movement has been down a bit. These shorter-term dips are common in fast-evolving technology names, especially as industry trends and competition spark new debates about the company’s role going forward.

Despite the ups and downs, there is more to this story than just price charts. By looking at the numbers, Zoom earns a solid value score of 5. This means it is considered undervalued in 5 out of 6 valuation checks. That kind of result typically grabs value-focused investors' attention, hinting at a company that Wall Street might be underestimating right now.

So, how do these different valuation methods actually stack up, and what exactly are they telling us about where Zoom could be headed next? Let us dive into those details. Then, we will explore an even better way to look at valuation for smart investing decisions.

Why Zoom Communications is lagging behind its peers

Approach 1: Zoom Communications Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting those flows back to their present value. This approach helps investors assess what a business is worth today, based on its long-term potential rather than market mood swings.

For Zoom Communications, the current free cash flow stands at $1.79 Billion. Analysts provide estimates for the next five years, with projections continuing through to 2035 based on long-term growth assumptions. By 2030, Zoom’s free cash flow is expected to reach approximately $2.11 Billion. These numbers reflect both analyst expectations and extrapolations made by Simply Wall St, offering a comprehensive look at the company’s ability to generate cash over time.

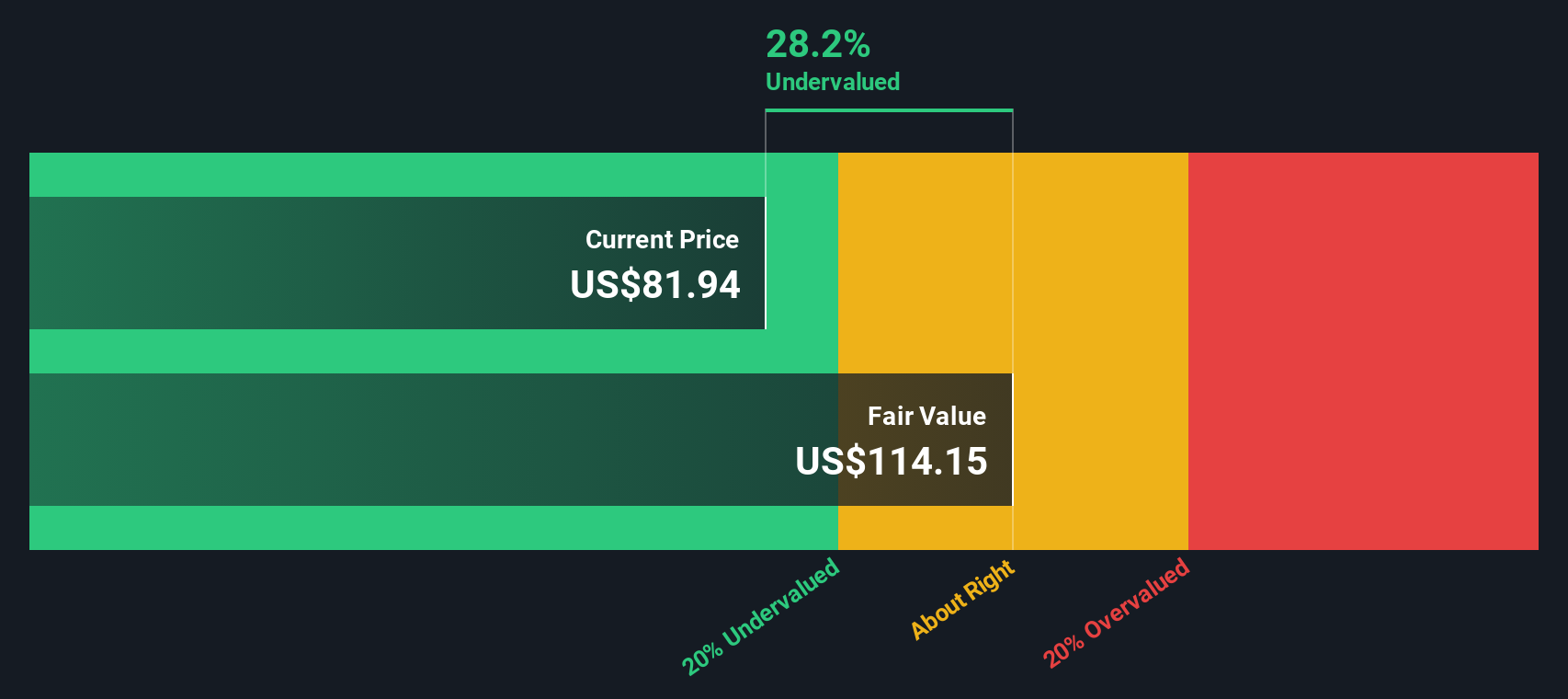

The DCF model values the company at $116.22 per share. This suggests the stock is currently trading at a 30.3% discount to its intrinsic value. In other words, Zoom Communications appears to be meaningfully undervalued compared to what its future cash flow stream could justify.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Zoom Communications is undervalued by 30.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Zoom Communications Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is widely used to value profitable companies like Zoom Communications, as it compares a company’s share price to its per-share earnings. This makes it a direct way to gauge how much investors are willing to pay for each dollar of profit, an especially relevant metric when the company generates consistent earnings.

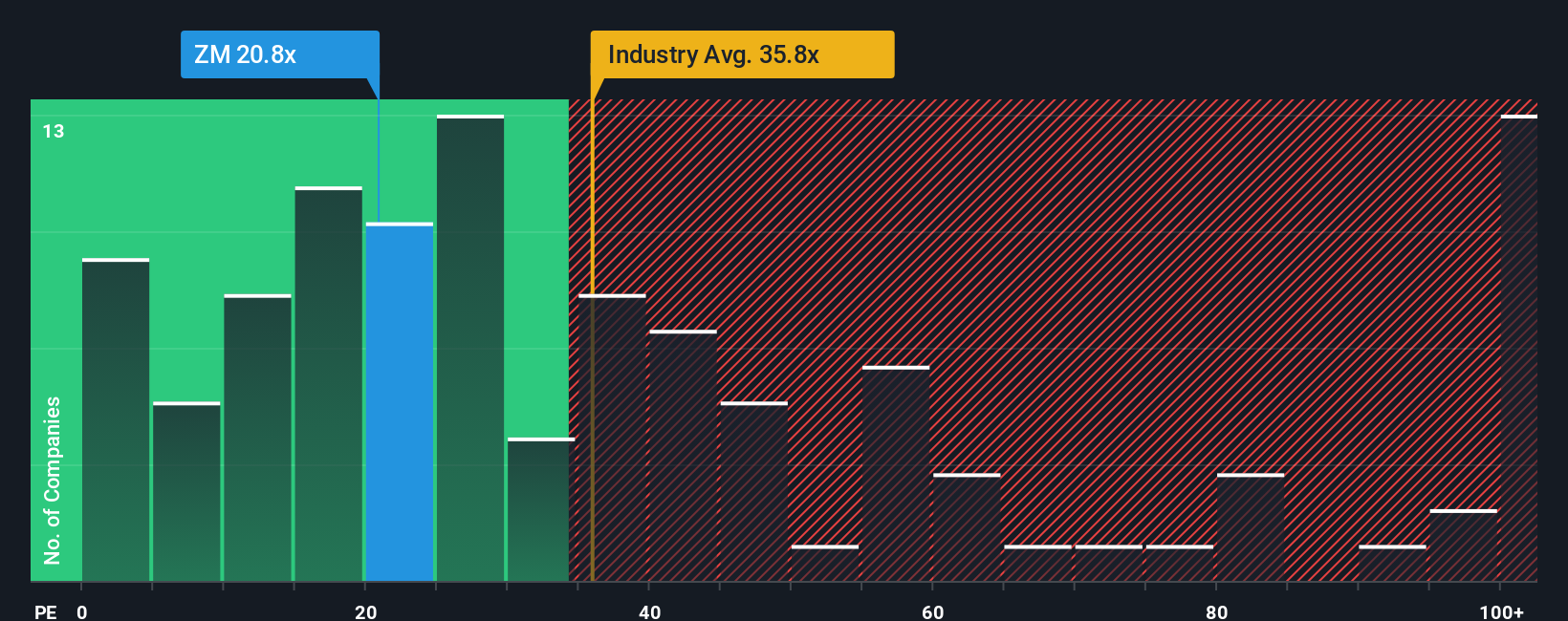

What counts as a “fair” PE ratio depends on factors like expected growth and risk. Companies with strong growth prospects or lower risk typically justify higher PE ratios, while slower-growing or riskier firms trade at lower multiples. Right now, Zoom’s PE ratio is 20.4x. This is markedly below the Software industry average of 35.7x and well under the peer group average of 73.8x. This underscores just how conservatively the market is currently pricing the stock’s earnings.

Simply Wall St’s “Fair Ratio” aims to improve upon traditional comparisons by considering Zoom’s specific earnings growth, industry dynamics, profit margin, market capitalization, and company-specific risks. Unlike broad market or industry averages, this Fair Ratio is tailored to what’s reasonable for Zoom’s unique business case, making it a more nuanced and accurate valuation reference.

With a Fair Ratio of 28.0x, compared to an actual PE of 20.4x, Zoom trades well below what the data suggests is a fair price for its earnings. This implies the company is currently undervalued.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Zoom Communications Narrative

Earlier, we mentioned an even better way to understand valuation, so let's introduce you to Narratives, an innovative tool that links a company's story directly to a financial forecast and a fair value. This approach makes investment decisions feel as intuitive as they are informed.

A Narrative is simply your perspective on a company. It’s where you set out your assumptions for future growth, earnings, and margins, and explain, in plain English, the reasoning behind those numbers. Instead of just crunching ratios, Narratives let you connect the “why” and “how” behind your estimates, turning forecasts into meaningful stories that reflect your unique viewpoint.

Narratives are a core feature of Simply Wall St’s Community page, making it easy for millions of everyday investors to craft, compare, and refine their outlooks alongside peers. By comparing a Narrative’s Fair Value (based on your forecast) to the current market price, you can see instantly whether you’d choose to buy, hold, or sell, grounded in your own reasoning and not just market sentiment.

Because Narratives automatically update as news or financial results roll in, they help you respond quickly and confidently to changing events. For Zoom Communications, you might find one Narrative forecasting robust AI-driven growth and a Fair Value above $115 per share, while another, more cautious perspective puts fair value closer to $67. This demonstrates how powerful your individual insights can be.

Do you think there's more to the story for Zoom Communications? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zoom Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZM

Zoom Communications

Provides an Artificial Intelligence-first work platform for human connection in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives