- United States

- /

- Auto Components

- /

- NasdaqGS:MPAA

Undiscovered Gems in the US Market for September 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a complex landscape of record highs and anticipated interest rate cuts, small-cap stocks present intriguing opportunities amid resilient consumer spending and fluctuating economic indicators. In this dynamic environment, identifying undiscovered gems requires a keen eye for companies that demonstrate strong fundamentals and adaptability to changing market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

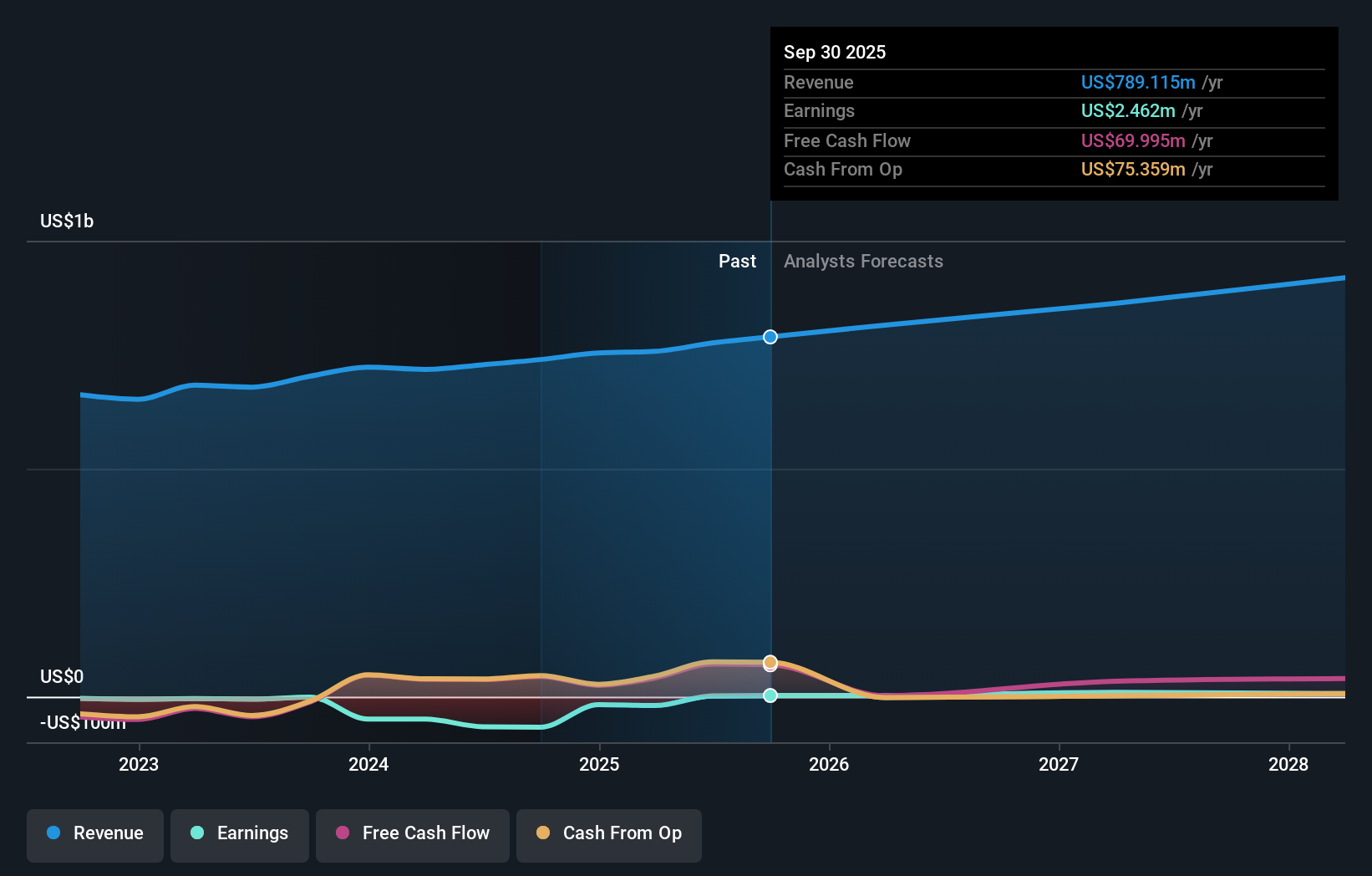

Motorcar Parts of America (MPAA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Motorcar Parts of America, Inc. focuses on manufacturing, remanufacturing, and distributing replacement parts for heavy-duty trucks, industrial machinery, marine equipment, and agricultural applications in the United States with a market capitalization of approximately $305.38 million.

Operations: The primary revenue stream for Motorcar Parts of America comes from its Hard Parts segment, generating $725.15 million.

Motorcar Parts of America (MPAA) has been making strides in the auto components sector, with its recent profitability marking a significant turnaround. The company's debt to equity ratio has improved slightly from 49.7% to 49.1% over five years, although its net debt to equity remains high at 43.5%. Despite this, MPAA is trading at a compelling value, approximately 91.1% below its estimated fair value, indicating potential for price appreciation. Recent buybacks have seen the company repurchase about 8.2% of shares for US$25.54 million since June 2016, reflecting confidence in its financial strategy and market position as it navigates industry challenges and opportunities in emerging markets like Mexico and Latin America.

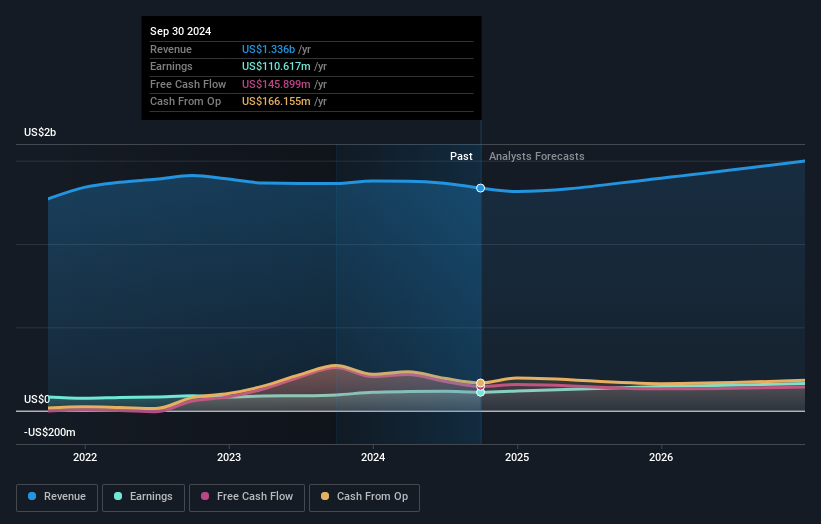

Gibraltar Industries (ROCK)

Simply Wall St Value Rating: ★★★★★★

Overview: Gibraltar Industries, Inc. is a company that manufactures and provides products and services for the residential, renewable energy, agtech, and infrastructure markets both in the United States and internationally, with a market cap of approximately $1.78 billion.

Operations: Gibraltar Industries generates revenue primarily from its residential segment at $793.34 million, followed by agtech at $183.41 million and infrastructure at $87.85 million. The company experiences a segment adjustment of $285.41 million in its financials, impacting overall revenue figures.

Gibraltar Industries is making strategic shifts, focusing on its core operations in infrastructure and Agtech markets while divesting from renewables. This realignment aims to capitalize on North American infrastructure demands, with earnings growing 20.7% over the past year, outpacing the building industry’s -3.8%. The company remains debt-free, enhancing its financial flexibility. Recent earnings showed a net income of US$26 million for Q2 2025 compared to US$32.2 million a year ago, with sales rising to US$309.52 million from US$273.62 million previously. Despite being dropped from several Russell indices, Gibraltar's future prospects hinge on successful M&A integration and market conditions impacting its projected target share price of $85 based on anticipated earnings growth.

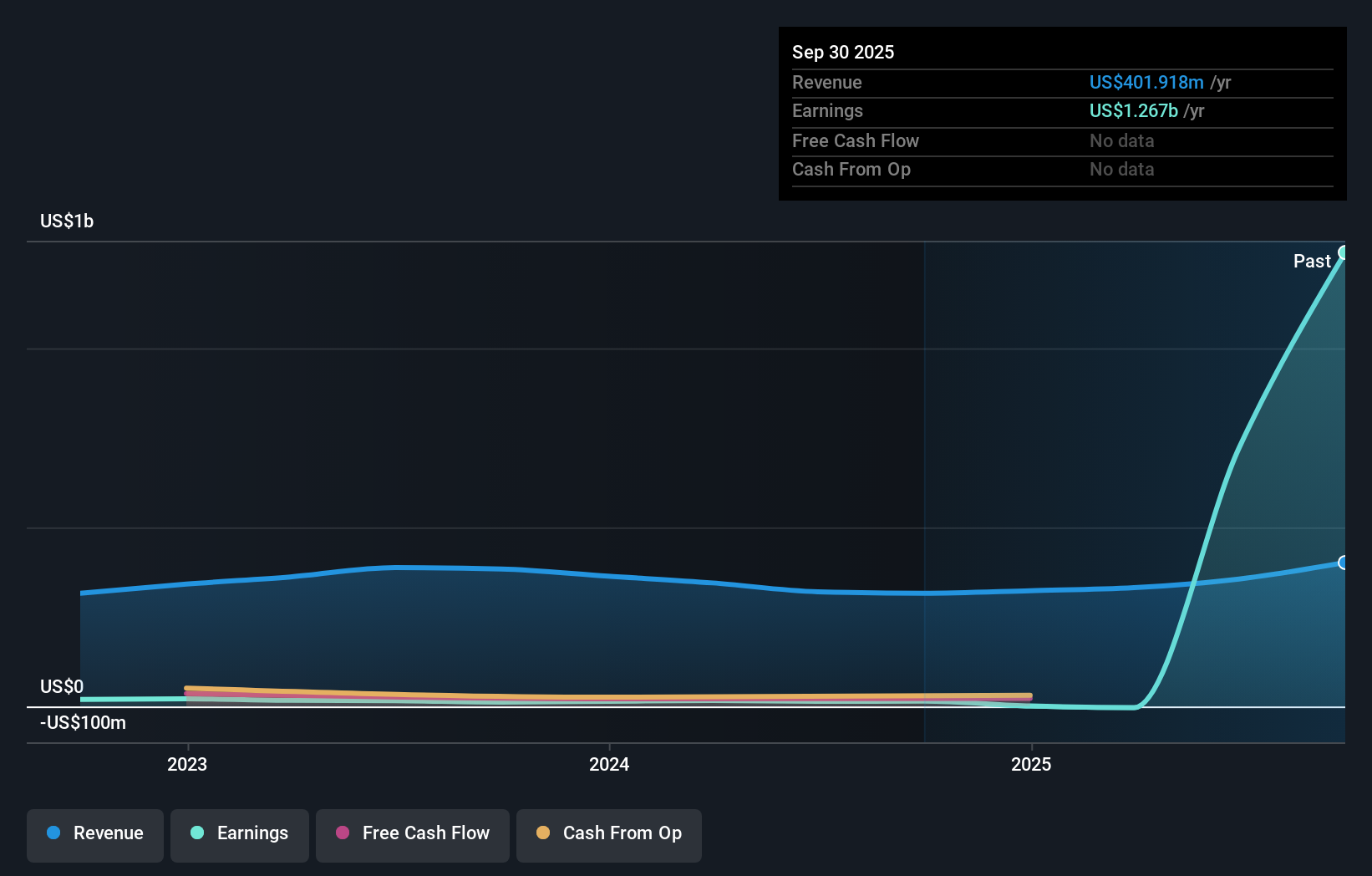

Xunlei (XNET)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Xunlei Limited, along with its subsidiaries, operates an internet platform for digital media content in the People's Republic of China and has a market cap of approximately $472.32 million.

Operations: Xunlei generates revenue primarily from the operation of its online media platform, amounting to $355.83 million.

Xunlei has demonstrated remarkable growth, with earnings skyrocketing by 4878.7% over the past year, far surpassing the software industry's average of 15.5%. The company's price-to-earnings ratio of 0.7x is notably lower than the US market's 19.2x, suggesting it could be undervalued. Despite a slight increase in its debt-to-equity ratio from 6.1% to 6.5% over five years, Xunlei maintains more cash than total debt, indicating financial stability. Recent earnings showed net income at US$727 million compared to US$2.76 million last year, reflecting its strong performance and potential as an investment opportunity in this space.

- Take a closer look at Xunlei's potential here in our health report.

Understand Xunlei's track record by examining our Past report.

Seize The Opportunity

- Get an in-depth perspective on all 285 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MPAA

Motorcar Parts of America

Manufactures, remanufactures, and distributes heavy-duty truck, industrial, marine, and agricultural application replacement parts in the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion