- United States

- /

- Software

- /

- NasdaqGS:XNET

Improved Revenues Required Before Xunlei Limited (NASDAQ:XNET) Stock's 34% Jump Looks Justified

Xunlei Limited (NASDAQ:XNET) shares have continued their recent momentum with a 34% gain in the last month alone. The annual gain comes to 164% following the latest surge, making investors sit up and take notice.

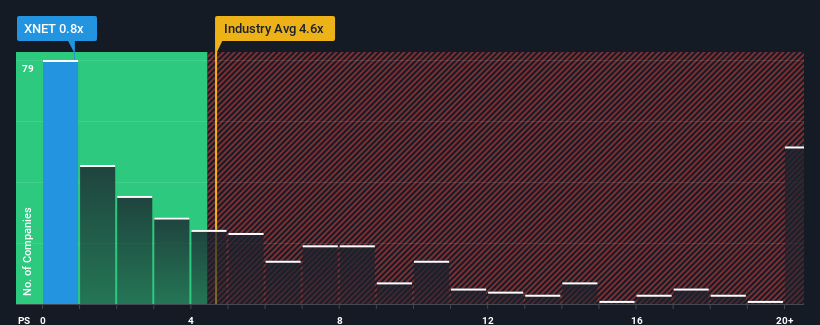

Although its price has surged higher, Xunlei's price-to-sales (or "P/S") ratio of 0.8x might still make it look like a strong buy right now compared to the wider Software industry in the United States, where around half of the companies have P/S ratios above 4.6x and even P/S above 10x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Xunlei

What Does Xunlei's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Xunlei over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Xunlei will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Xunlei, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Xunlei?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Xunlei's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. Even so, admirably revenue has lifted 35% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that to the industry, which is predicted to deliver 15% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in consideration, it's easy to understand why Xunlei's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

Xunlei's recent share price jump still sees fails to bring its P/S alongside the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Xunlei revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Xunlei has 3 warning signs (and 1 which is potentially serious) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:XNET

Xunlei

Operates an internet platform for digital media content in the People's Republic of China.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives