- United States

- /

- Software

- /

- NasdaqCM:WULF

TeraWulf (WULF): Rethinking Valuation After Google-Backed Pivot to Zero-Carbon AI Data Centers

Reviewed by Simply Wall St

TeraWulf (WULF) just pivoted from pure bitcoin mining toward zero carbon powered AI data centers, backed by over $7.7 billion in contracted revenue and a deeper strategic tie up with Google and Fluidstack.

See our latest analysis for TeraWulf.

Despite a choppy week, with a 7 day share price return of minus 5.23 percent and a 1 day dip alongside the Google backstop headlines, TeraWulf’s 90 day share price return of 40.78 percent and year to date share price return of 165.57 percent, plus a three year total shareholder return of 1,701.47 percent, suggest momentum is still building as investors reprice its AI pivot and capital structure shake up.

If this AI infrastructure story has your attention, it may be a good time to explore other high growth tech names through high growth tech and AI stocks and see what else the market is starting to re rate.

With Google deepening its stake, billions in contracted AI revenue, and a looming capital structure shakeup, is TeraWulf still trading at a discount to its next chapter or already priced for outsized future growth?

Most Popular Narrative Narrative: 32.4% Undervalued

With the narrative fair value of $21.44 sitting well above the last close at $14.50, the valuation hinges on TeraWulf’s pivot from crypto cyclicality to long term contracted AI infrastructure cash flows.

Long term partnerships and investments from marquee players (Google's $1.8B lease backstop and equity stake) signal institutional validation, enhance creditworthiness, and are likely to lower WULF's future cost of capital, directly supporting margin expansion and accelerated infrastructure growth.

Want to see why this story leans so hard on future revenue acceleration and margin lift, plus a premium earnings multiple more typical of software leaders? The narrative spells out the growth runway, the profitability turning point, and the valuation math tying those assumptions back to today’s price, but leaves one crucial stretch assumption you will want to stress test for yourself.

Result: Fair Value of $21.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps or weaker than expected AI tenant demand could strain free cash flow and challenge the aggressive growth assumptions embedded in current valuations.

Find out about the key risks to this TeraWulf narrative.

Another View: Market Ratios Flash a Caution Signal

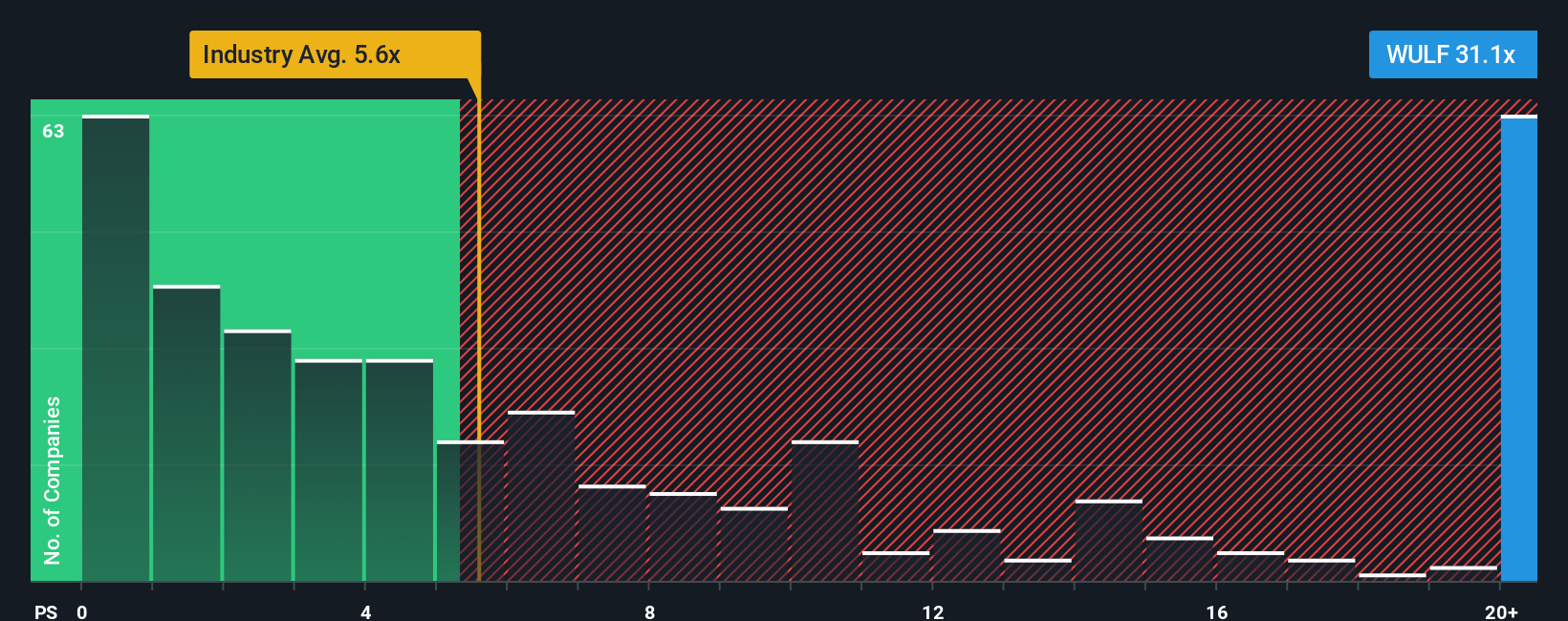

While the narrative fair value points to upside, the current price to sales ratio of 36.2 times towers over the US Software industry at 4.9 times and peers at 20.6 times, as well as the 13.7 times fair ratio our model suggests the market could drift back toward.

If sentiment cools or execution stumbles, that kind of gap can compress quickly and turn today’s AI upside story into a painful derating. How much valuation air are you comfortable sitting on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TeraWulf Narrative

If you see things differently or prefer to analyze the numbers yourself, you can create a custom view in minutes with Do it your way.

A great starting point for your TeraWulf research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next potential investment by scanning a few targeted stock ideas from the Simply Wall St Screener that fit your strategy.

- Target steady income potential by reviewing these 15 dividend stocks with yields > 3% that can reinforce your portfolio with regular cash returns.

- Consider powerful structural trends by focusing on these 30 healthcare AI stocks positioned at the intersection of medicine and technology.

- Explore early stage growth stories by examining these 3578 penny stocks with strong financials where current financials may indicate promising opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TeraWulf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:WULF

TeraWulf

Operates as a digital asset technology company in the United States.

High growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026