- United States

- /

- Software

- /

- NasdaqCM:WULF

Investors Appear Satisfied With TeraWulf Inc.'s (NASDAQ:WULF) Prospects

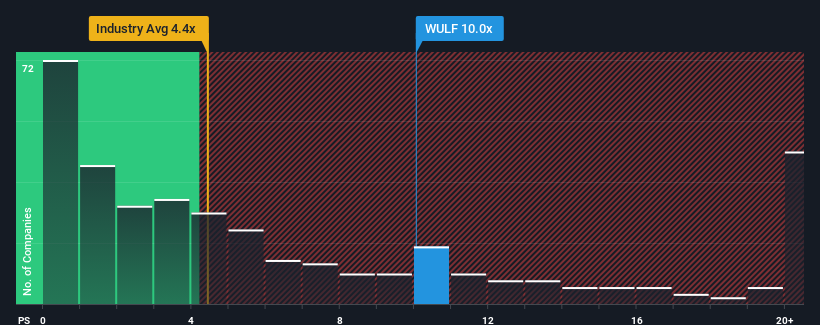

With a price-to-sales (or "P/S") ratio of 10x TeraWulf Inc. (NASDAQ:WULF) may be sending very bearish signals at the moment, given that almost half of all the Software companies in the United States have P/S ratios under 4.4x and even P/S lower than 1.8x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for TeraWulf

What Does TeraWulf's P/S Mean For Shareholders?

TeraWulf certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on TeraWulf.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, TeraWulf would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. In spite of this unbelievable short-term growth, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 116% over the next year. That's shaping up to be materially higher than the 15% growth forecast for the broader industry.

With this in mind, it's not hard to understand why TeraWulf's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From TeraWulf's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into TeraWulf shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for TeraWulf (2 are significant!) that we have uncovered.

If these risks are making you reconsider your opinion on TeraWulf, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if TeraWulf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:WULF

TeraWulf

Operates as a digital asset technology company in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives