- United States

- /

- Semiconductors

- /

- NasdaqGS:PDFS

Insider-Favored Growth Stocks To Consider In July 2025

Reviewed by Simply Wall St

In the past week, the United States market has experienced a 2.1% rise, contributing to a 14% increase over the last year with earnings projected to grow by 15% annually. In this favorable climate, stocks with high insider ownership can be particularly appealing as they often signal confidence from those closest to the company and may align well with growth potential in today's market conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Zapp Electric Vehicles Group (ZAPP.F) | 16.1% | 170.8% |

| Super Micro Computer (SMCI) | 13.9% | 39.1% |

| Ryan Specialty Holdings (RYAN) | 15.6% | 95.3% |

| Prairie Operating (PROP) | 34.6% | 92.4% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 58.4% |

| Credo Technology Group Holding (CRDO) | 11.9% | 45% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 23.7% |

| Astera Labs (ALAB) | 13.1% | 44.4% |

| ARS Pharmaceuticals (SPRY) | 14.3% | 63.1% |

We'll examine a selection from our screener results.

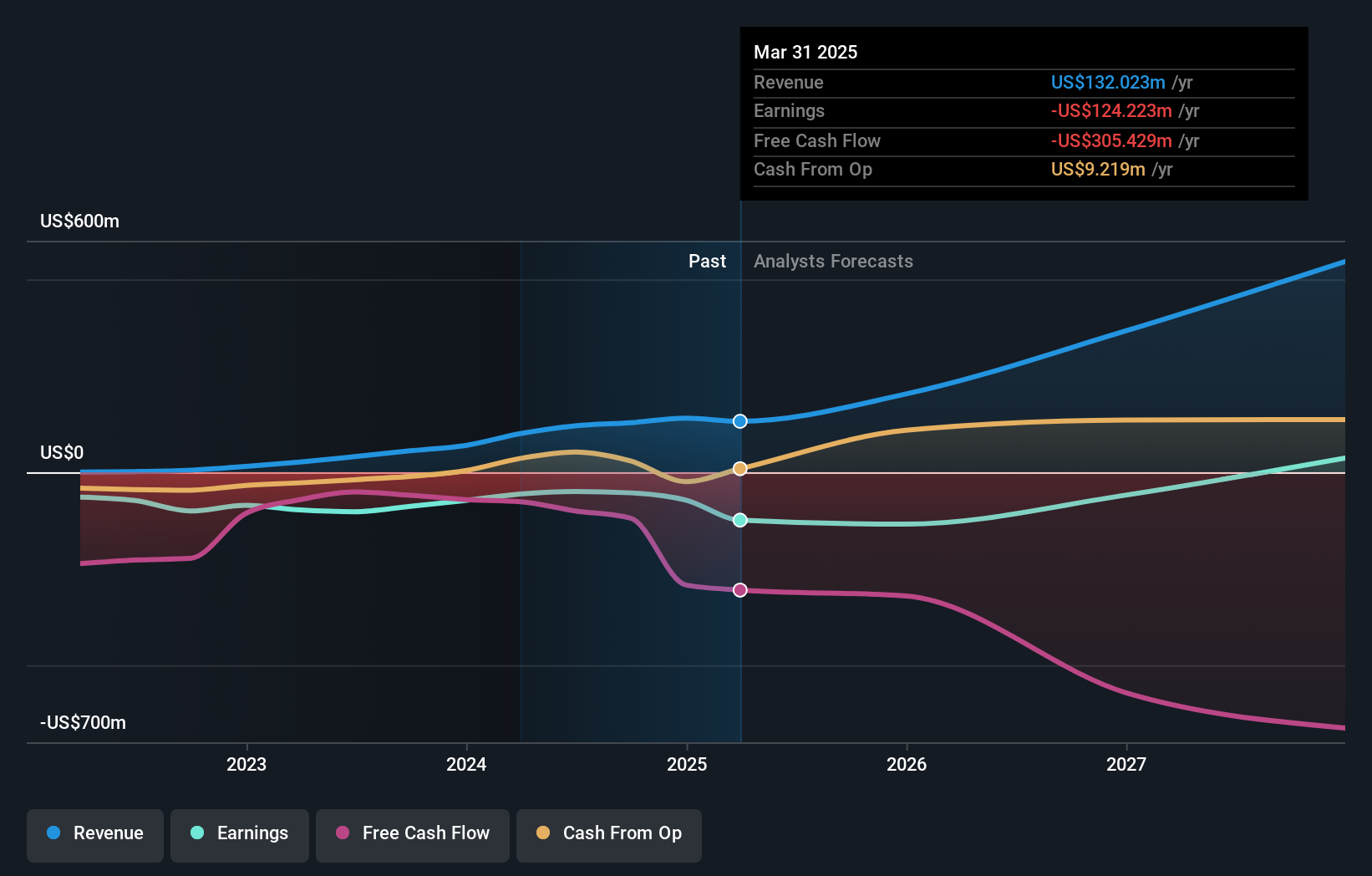

TeraWulf (WULF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TeraWulf Inc., along with its subsidiaries, operates as a digital asset technology company in the United States and has a market cap of approximately $2.02 billion.

Operations: The company generates revenue primarily from its digital currency mining segment, which amounts to $132.02 million.

Insider Ownership: 14.7%

Revenue Growth Forecast: 38.2% p.a.

TeraWulf is experiencing robust revenue growth, projected at 38.2% annually, surpassing the US market average. Despite a volatile share price and recent shareholder dilution, insider transactions have favored buying over selling in the past three months. The company aims for profitability within three years but faces financial challenges with less than a year of cash runway. Recent executive changes and shelf registrations totaling US$214.49 million indicate strategic positioning amid ongoing losses and a comprehensive share buyback program.

- Unlock comprehensive insights into our analysis of TeraWulf stock in this growth report.

- Our valuation report here indicates TeraWulf may be overvalued.

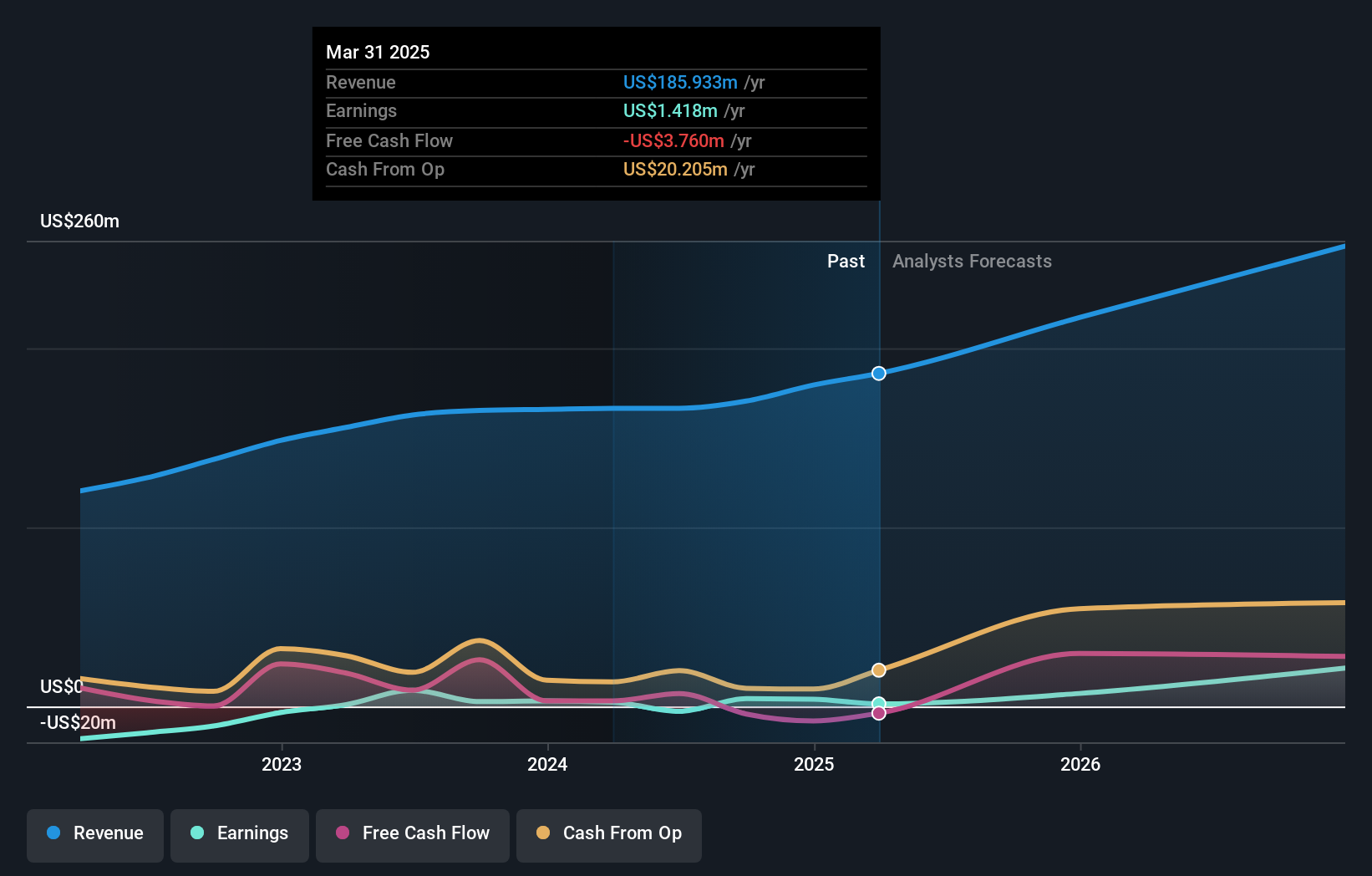

PDF Solutions (PDFS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PDF Solutions, Inc. offers proprietary software, intellectual property for integrated circuit designs, measurement hardware tools, and professional services globally with a market cap of approximately $899.82 million.

Operations: The company generates revenue primarily from its Software & Programming segment, which accounts for $185.93 million.

Insider Ownership: 17.3%

Revenue Growth Forecast: 18.4% p.a.

PDF Solutions is experiencing substantial insider buying, indicating confidence in its growth prospects. Despite a decrease in net profit margin from 1.4% to 0.8%, earnings are projected to grow significantly at over 115% annually, outpacing the US market average of 14.6%. Revenue is expected to increase by 18.4% per year, surpassing the market's growth rate of 8.7%. The company reaffirmed its revenue growth guidance of up to 23% for this year despite recent quarterly losses totaling US$3.03 million.

- Take a closer look at PDF Solutions' potential here in our earnings growth report.

- The analysis detailed in our PDF Solutions valuation report hints at an inflated share price compared to its estimated value.

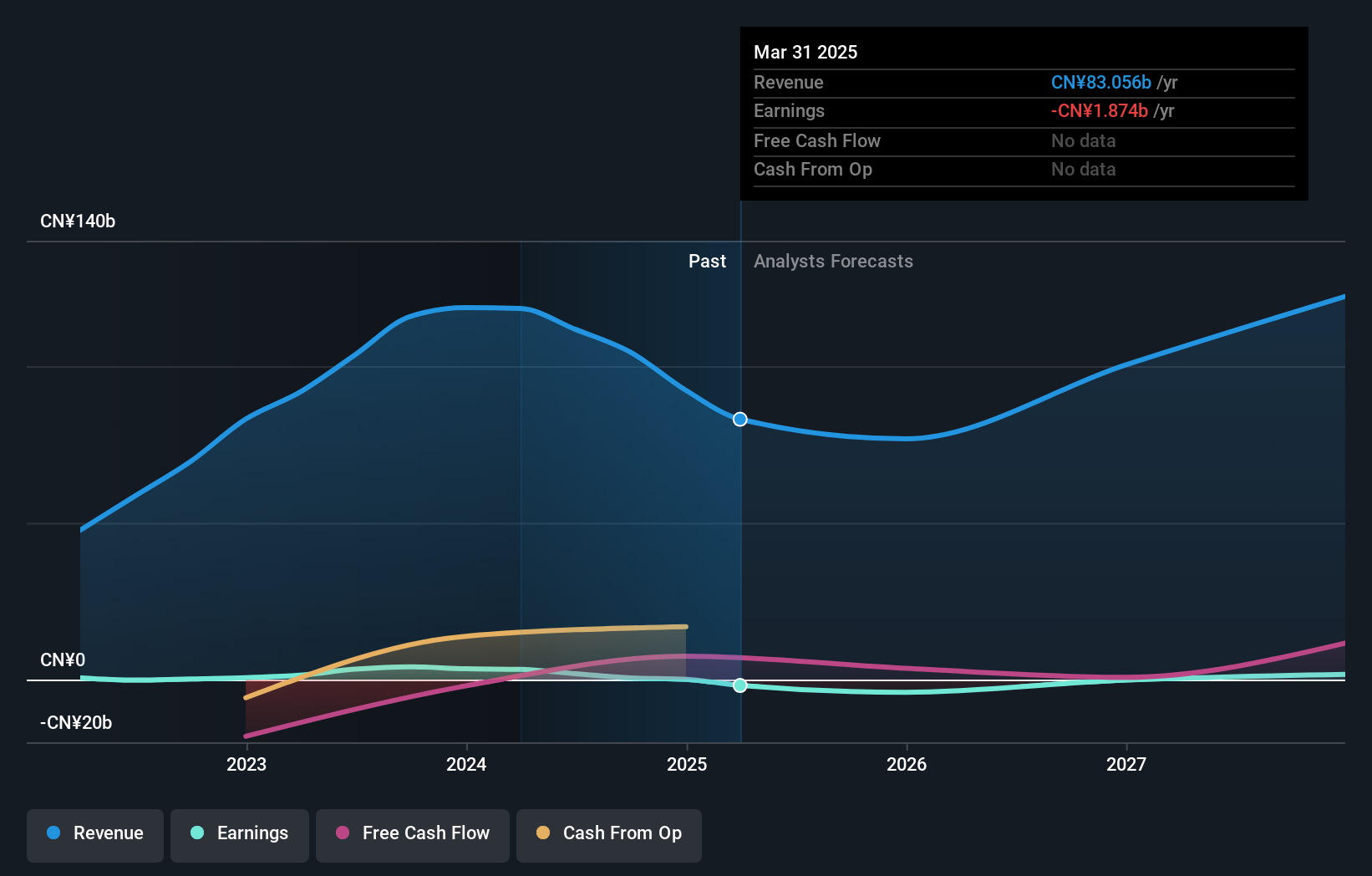

JinkoSolar Holding (JKS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JinkoSolar Holding Co., Ltd., along with its subsidiaries, is involved in the design, development, production, and marketing of photovoltaic products and has a market cap of approximately $1.25 billion.

Operations: The company generates revenue from its manufacturing segment, which amounted to CN¥83.06 billion.

Insider Ownership: 39.8%

Revenue Growth Forecast: 15.8% p.a.

JinkoSolar Holding's growth potential is underscored by its substantial insider ownership and strategic market positioning. Despite a recent net loss, the company is expected to become profitable in three years, with earnings projected to grow significantly at 76.44% annually. Its revenue growth of 15.8% per year outpaces the US market average of 8.7%. Recent achievements include delivering high-efficiency solar modules for Spain's Segovia solar cluster, highlighting its robust operational capabilities in renewable energy sectors.

- Click here and access our complete growth analysis report to understand the dynamics of JinkoSolar Holding.

- The analysis detailed in our JinkoSolar Holding valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Click this link to deep-dive into the 188 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PDFS

PDF Solutions

Provides proprietary software, physical intellectual property for integrated circuit designs, electrical measurement hardware tools, proven methodologies, and professional services in the United States, Japan, China, Taiwan, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives