- United States

- /

- Software

- /

- NasdaqGS:WDAY

Workday (WDAY): Evaluating Valuation After Paradox Acquisition Expands AI Hiring Strength

Reviewed by Kshitija Bhandaru

Workday (WDAY) completed its acquisition of Paradox, a move that expands its AI-driven hiring solutions and signals the company’s serious push into streamlined recruitment tools. Investors are already tuning in to see how this shapes earnings potential.

See our latest analysis for Workday.

With momentum around its AI hiring suite and upbeat earnings outlook, Workday has attracted renewed investor attention in recent months. Although the latest share price return has been muted, a stellar 3-year total shareholder return of nearly 60% highlights its longer-term growth story as the business expands its reach and capabilities.

If news like Workday’s latest acquisition has you looking beyond the headline, this is a great chance to discover See the full list for free.

But with shares trailing their three-year performance and analyst targets still well above current levels, investors must ask if Workday is primed for a breakout or if today’s price already reflects tomorrow’s potential.

Most Popular Narrative: 16% Undervalued

Workday’s most widely followed narrative points to a fair value of $282, comfortably above the last close price of $236.48. The stage is set for bulls as the company’s future potential is mapped out by consensus voices in the market.

Broad adoption of Workday's AI-enabled HR and finance products (with over 70% of customers using Workday Illuminate and more than 75% of net new deals including at least one AI product), along with acquisitions like Paradox and Flowise, is fueling cross-sell and upsell activity, increasing average contract values and bolstering future topline growth.

Curious about what’s driving this bold upside? The secret sauce is hidden in aggressive profit forecasts, ambitious margin boosts, and an eye-watering future earnings multiple. The underlying growth projections go far beyond the obvious. See what’s behind this confident fair value.

Result: Fair Value of $282 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, competition from established players and emerging AI-driven software firms, as well as evolving data regulations, could threaten Workday’s momentum and long-term earnings outlook.

Find out about the key risks to this Workday narrative.

Another View: Valuation Through Multiples

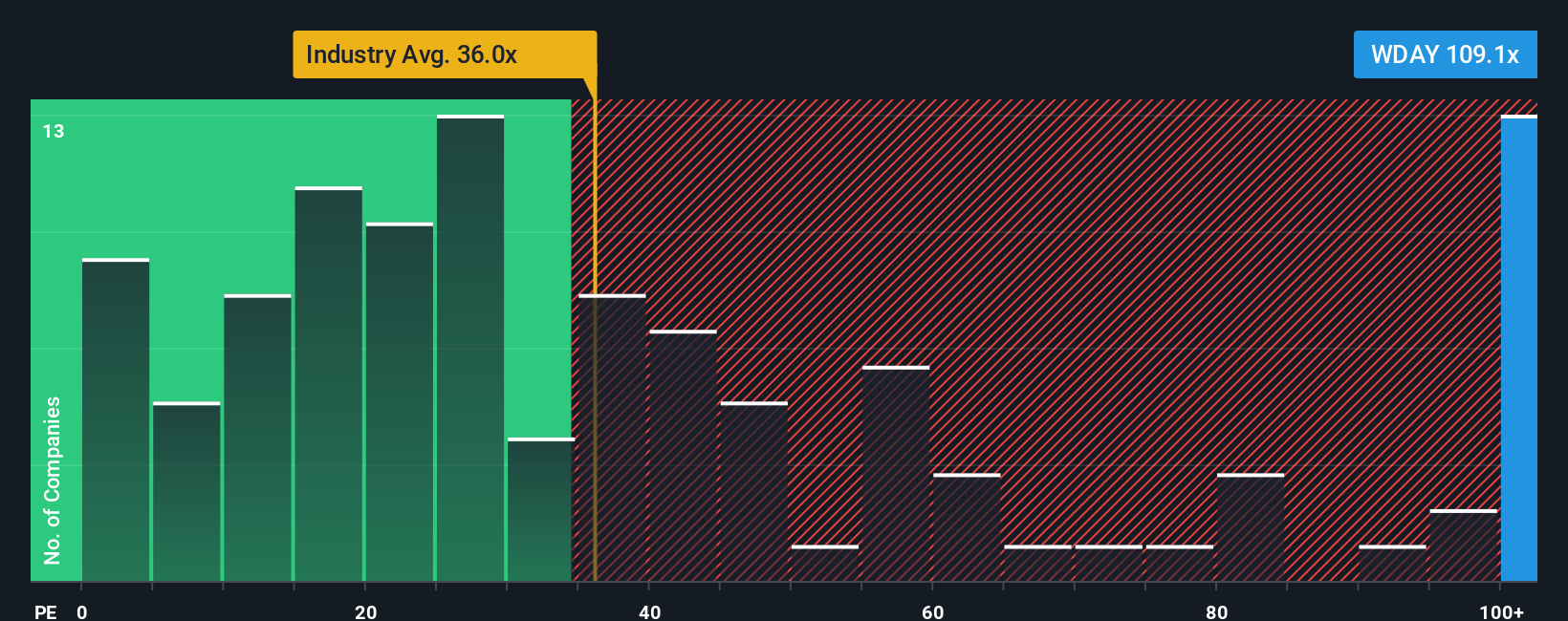

While some see Workday as undervalued based on future cash flows, the main price-to-earnings ratio paints a different picture. The current P/E stands at an elevated 108.3x, far above both industry peers at 35.7x and the fair ratio of 55.3x. This signals a premium and raises questions about upside potential versus valuation risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Workday Narrative

If you see this differently or want to dig into the numbers yourself, you can craft your own view in just a few minutes, Do it your way

A great starting point for your Workday research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take control of your financial future and beat the crowd by checking out other high-potential stocks using the Simply Wall Street Screener.

- Capitalize on robust cash flow opportunities by checking out these 886 undervalued stocks based on cash flows that may offer compelling value right now.

- Uncover promising healthcare breakthroughs by browsing these 32 healthcare AI stocks leading innovation with transformative AI solutions in the medical sector.

- Tap into the rise of digital wealth by reviewing these 78 cryptocurrency and blockchain stocks driving mainstream adoption of blockchain technology and cryptocurrency advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDAY

Workday

Provides enterprise cloud applications in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion