- United States

- /

- Software

- /

- NasdaqGS:WDAY

Workday (WDAY): Evaluating Valuation After Latest Earnings Report and Market Reaction

Reviewed by Simply Wall St

See our latest analysis for Workday.

Workday’s share price has seen its ups and downs this year, with a 1-day gain of 0.3% following the earnings release but a 7-day drop of over 6%, signaling some short-term volatility. Looking at the bigger picture, recent price dip aside, momentum has faded since earlier in the year, and the total shareholder return remains down 12% over the past 12 months. However, the three-year total return still impresses at 43%.

If you’re curious about what else is making waves in the expanding tech space, take the next step and check out See the full list for free.

With shares pulling back, some valuation metrics point to potential upside for Workday. However, recent gains and analyst targets may reflect optimism already. Is there real value left for new investors, or has growth been fully priced in?

Most Popular Narrative: 20.2% Undervalued

Workday’s narrative fair value stands well above the current share price, signaling a confidence gap between market pricing and the story told by growth assumptions. This sets the stage for a closer look at what is fueling that valuation.

Workday is positioned to benefit from the accelerating demand for cloud-native and AI-powered enterprise solutions as organizations continue replacing legacy on-premise systems and prioritize digital transformation, driving sustained subscription revenue growth and expanding backlog.

Want to know the secret behind this bullish outlook? There is one highly ambitious growth forecast deeply built into the narrative’s projections. Discover which bold financial assumptions underpin this future price, and what sets Workday’s path apart from the crowd. The full story may surprise you.

Result: Fair Value of $282.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, swift innovation from AI-powered newcomers or increased regulatory demands could quickly challenge Workday’s pricing power and future growth expectations.

Find out about the key risks to this Workday narrative.

Another View: Market Ratios Send a Caution Signal

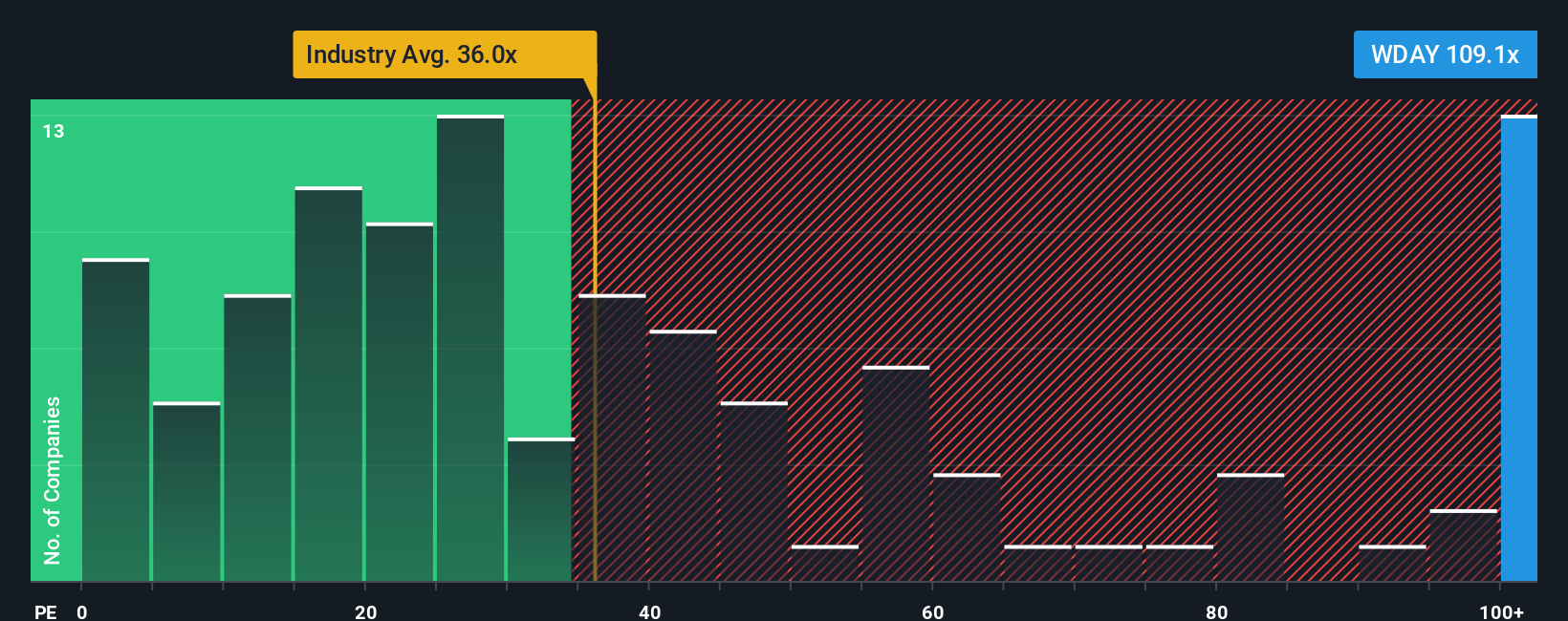

Looking at current market ratios, Workday appears expensive. Its price-to-earnings ratio stands at 103.1x, which is much higher than both the US Software industry average of 33.5x and the peer group’s 59.3x. The fair ratio suggests 52.6x as a possible target investors might eventually expect. This gap could indicate higher valuation risk if expectations are not met. Does the premium reflect true long-term growth, or is the stock priced for perfection?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Workday Narrative

If our narrative does not align with your perspective or you favor independent analysis, you can dive into the numbers and shape your own story in just a few minutes. Do it your way

A great starting point for your Workday research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t miss out on stocks making big moves across emerging sectors and new trends. Use the screener now to catch opportunities before the crowd does.

- Capture potential with strong financials and steady growth by checking out these 3587 penny stocks with strong financials poised to break out.

- Capitalize on powerful income streams by targeting these 16 dividend stocks with yields > 3% offering attractive yields over 3% for your portfolio.

- Ride the innovation wave and spot tomorrow’s game-changers among these 24 AI penny stocks pushing the boundaries of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDAY

Workday

Provides enterprise cloud applications in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives