- United States

- /

- Software

- /

- NasdaqGS:WDAY

Workday (NASDAQ:WDAY) Is Looking To Continue Growing Its Returns On Capital

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. With that in mind, we've noticed some promising trends at Workday (NASDAQ:WDAY) so let's look a bit deeper.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Workday:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.023 = US$267m ÷ (US$16b - US$4.4b) (Based on the trailing twelve months to April 2024).

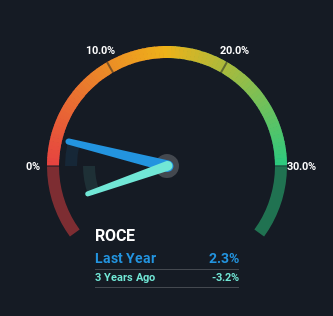

Therefore, Workday has an ROCE of 2.3%. Ultimately, that's a low return and it under-performs the Software industry average of 7.2%.

See our latest analysis for Workday

Above you can see how the current ROCE for Workday compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free analyst report for Workday .

The Trend Of ROCE

Workday has recently broken into profitability so their prior investments seem to be paying off. The company was generating losses five years ago, but now it's earning 2.3% which is a sight for sore eyes. In addition to that, Workday is employing 241% more capital than previously which is expected of a company that's trying to break into profitability. This can tell us that the company has plenty of reinvestment opportunities that are able to generate higher returns.

In another part of our analysis, we noticed that the company's ratio of current liabilities to total assets decreased to 28%, which broadly means the business is relying less on its suppliers or short-term creditors to fund its operations. So shareholders would be pleased that the growth in returns has mostly come from underlying business performance.

In Conclusion...

Overall, Workday gets a big tick from us thanks in most part to the fact that it is now profitable and is reinvesting in its business. Investors may not be impressed by the favorable underlying trends yet because over the last five years the stock has only returned 0.4% to shareholders. So exploring more about this stock could uncover a good opportunity, if the valuation and other metrics stack up.

On the other side of ROCE, we have to consider valuation. That's why we have a FREE intrinsic value estimation for WDAY on our platform that is definitely worth checking out.

While Workday isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:WDAY

Workday

Provides enterprise cloud applications in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Duolingo: Billion Dollar Business Hiding in Plain Sight

Kyocera: The Hidden AI Enabler

Santos: Undervalued After Takeover Fallout

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks