- United States

- /

- Software

- /

- NasdaqGS:WDAY

Will 360Learning Integration Boost Workday's (WDAY) Position in AI-Powered Workforce Development?

- 360Learning recently announced the integration of its AI-powered Learning Experience Platform into Workday's Learning platform, enabling enterprise organizations to quickly create and deliver expert-led upskilling and collaborative learning through streamlined, real-time connections with Workday Human Capital Management.

- This partnership gives Workday Learning customers access to faster AI-driven content creation, administrative efficiencies, and seamless access to branded training academies, directly supporting workforce development goals.

- Let's examine how this move to enhance Workday's AI-powered ecosystem could influence the company's long-term investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Workday Investment Narrative Recap

To be a shareholder in Workday, you have to believe in the company's ability to deliver sustained growth by leading the shift toward AI-powered, cloud-based HR and finance platforms. The recent integration of 360Learning's AI learning tools expands Workday’s ecosystem, but it does not materially alter the most significant short-term catalyst, the continued adoption of Workday’s AI-enabled products across large enterprise clients. The biggest risk remains the threat of rapidly evolving, AI-focused competitors undermining pricing power; this announcement does not diminish that concern.

The Advocate Health go-live on Workday’s unified cloud platform is a solid example of how enterprises are leveraging Workday’s end-to-end capabilities to modernize and simplify operations. For investors, this milestone highlights ongoing execution on the main catalysts: expansion into new industry verticals and tangible revenue opportunities from broader platform adoption.

However, investors should also be alert to increased regulatory and data privacy requirements that...

Read the full narrative on Workday (it's free!)

Workday's outlook anticipates $12.9 billion in revenue and $1.8 billion in earnings by 2028. This is based on a 13.0% annual revenue growth rate and a $1.2 billion increase in earnings from the current $583 million.

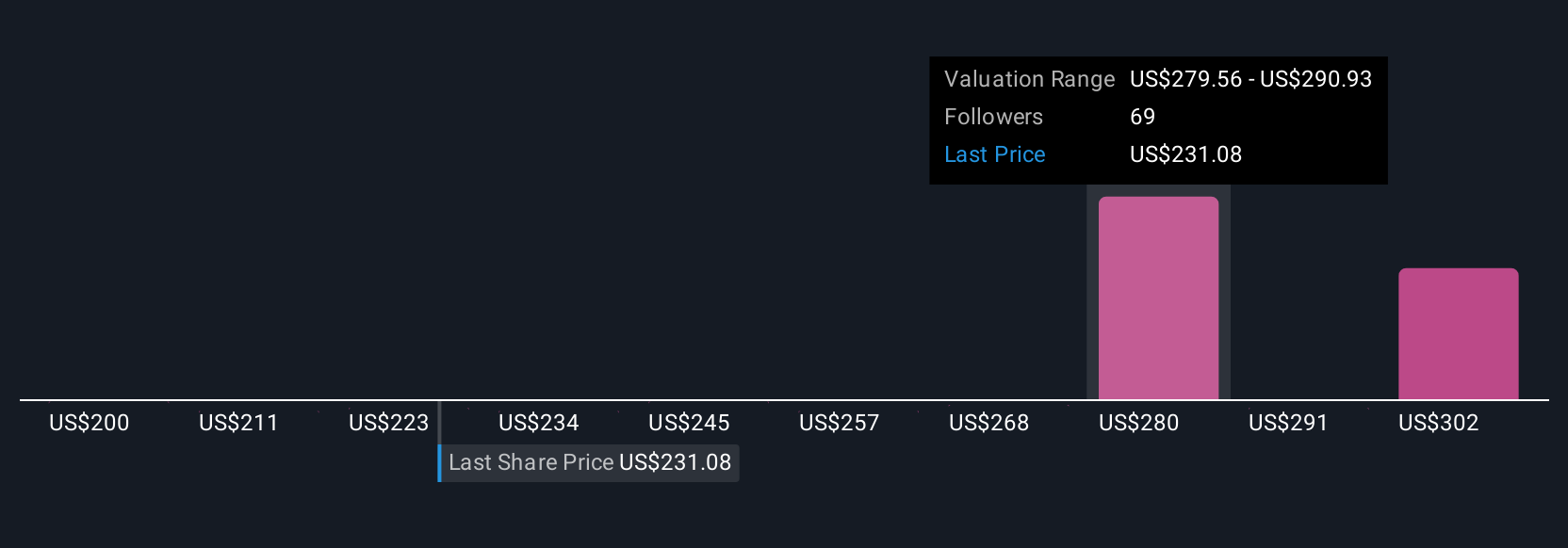

Uncover how Workday's forecasts yield a $282.05 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set fair value estimates for Workday between US$233 and US$343 based on 11 perspectives. With rising competition from AI-first SaaS start-ups threatening pricing power, market participants should consider these diverse views before reaching their own conclusions.

Explore 11 other fair value estimates on Workday - why the stock might be worth just $233.00!

Build Your Own Workday Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Workday research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Workday research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Workday's overall financial health at a glance.

No Opportunity In Workday?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDAY

Workday

Provides enterprise cloud applications in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Microsoft - A Fundamental and Historical Valuation

The Oncology Anchor: Why Merck’s 46% Discount Defies the Keytruda Cliff

The Architect of Sovereignty: Palantir’s Premium Paradox at $149

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.