- United States

- /

- Diversified Financial

- /

- NasdaqGS:CHYM

November 2025's Top Growth Companies With Significant Insider Stakes

Reviewed by Simply Wall St

As the U.S. markets kick off a holiday-shortened week with significant gains, buoyed by optimism over potential Federal Reserve rate cuts, investors are eyeing growth opportunities amid the broader economic landscape. In this environment, companies that demonstrate robust growth potential coupled with high insider ownership can be particularly appealing, as they may indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 14.0% | 50.7% |

| StubHub Holdings (STUB) | 23.3% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| FTC Solar (FTCI) | 22.6% | 78.8% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Cloudflare (NET) | 10.4% | 43.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.2% |

| Astera Labs (ALAB) | 11.9% | 29.1% |

| AppLovin (APP) | 27.5% | 26.4% |

Underneath we present a selection of stocks filtered out by our screen.

AppLovin (APP)

Simply Wall St Growth Rating: ★★★★★★

Overview: AppLovin Corporation develops a software-based platform that aids advertisers in improving the marketing and monetization of their content both in the United States and internationally, with a market cap of $175.82 billion.

Operations: The company's revenue segments include $4.82 billion from Advertising and a Segment Adjustment of $1.49 billion.

Insider Ownership: 27.5%

AppLovin demonstrates strong growth potential with revenue forecasted to grow over 20% annually, outpacing the US market. Despite significant insider selling recently, the company maintains high insider ownership and has executed substantial share buybacks, enhancing shareholder value. Recent earnings results showed impressive sales of US$1.41 billion for Q3 2025, up from US$835 million a year ago. AppLovin's inclusion in multiple S&P indices underscores its growing prominence in the tech sector.

- Unlock comprehensive insights into our analysis of AppLovin stock in this growth report.

- Upon reviewing our latest valuation report, AppLovin's share price might be too optimistic.

Chime Financial (CHYM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chime Financial, Inc. is a financial technology company offering digital consumer banking and payment solutions with a market cap of approximately $6.91 billion.

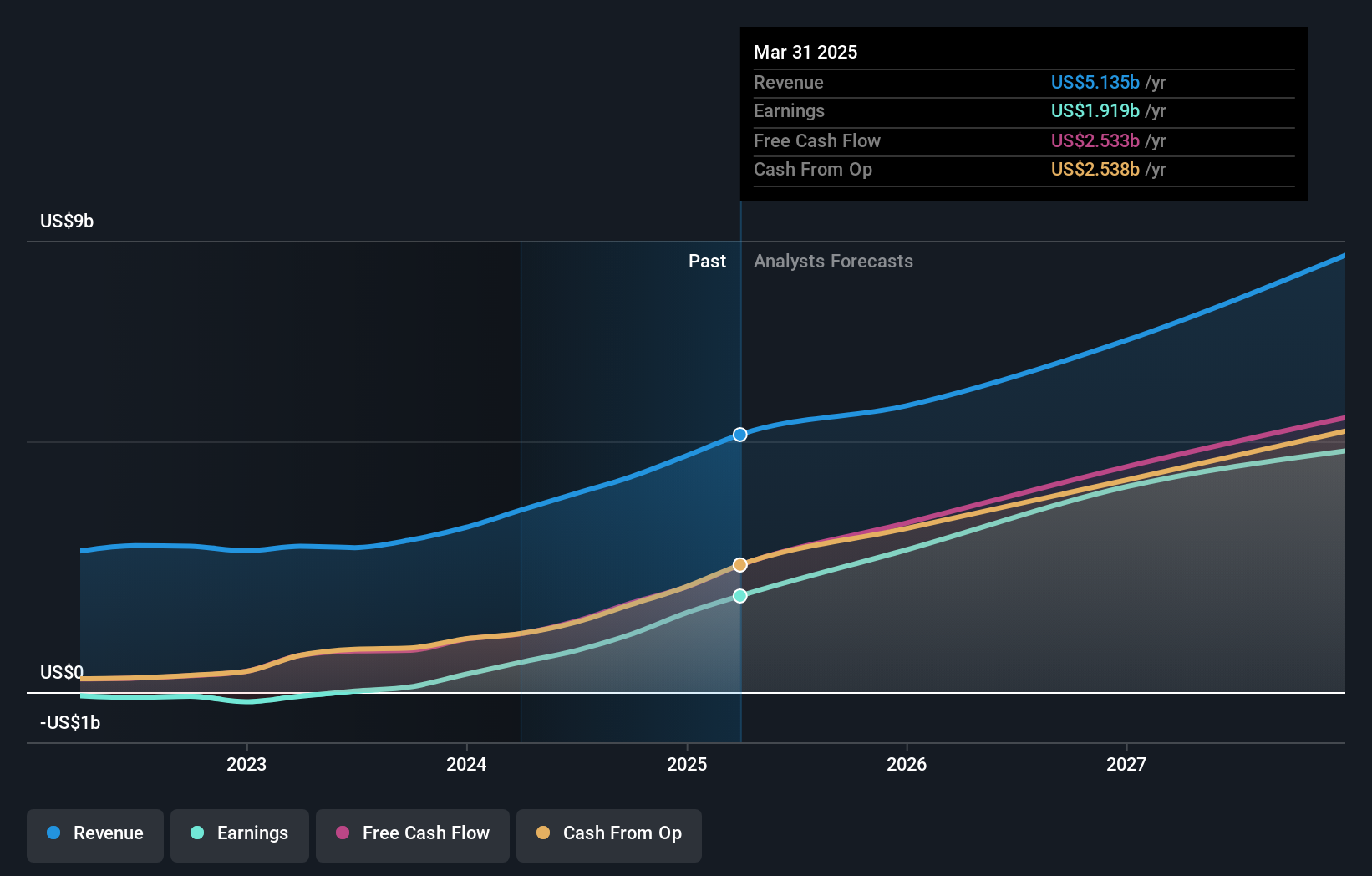

Operations: Chime Financial generates revenue primarily from its Business Services segment, which accounted for $2.07 billion.

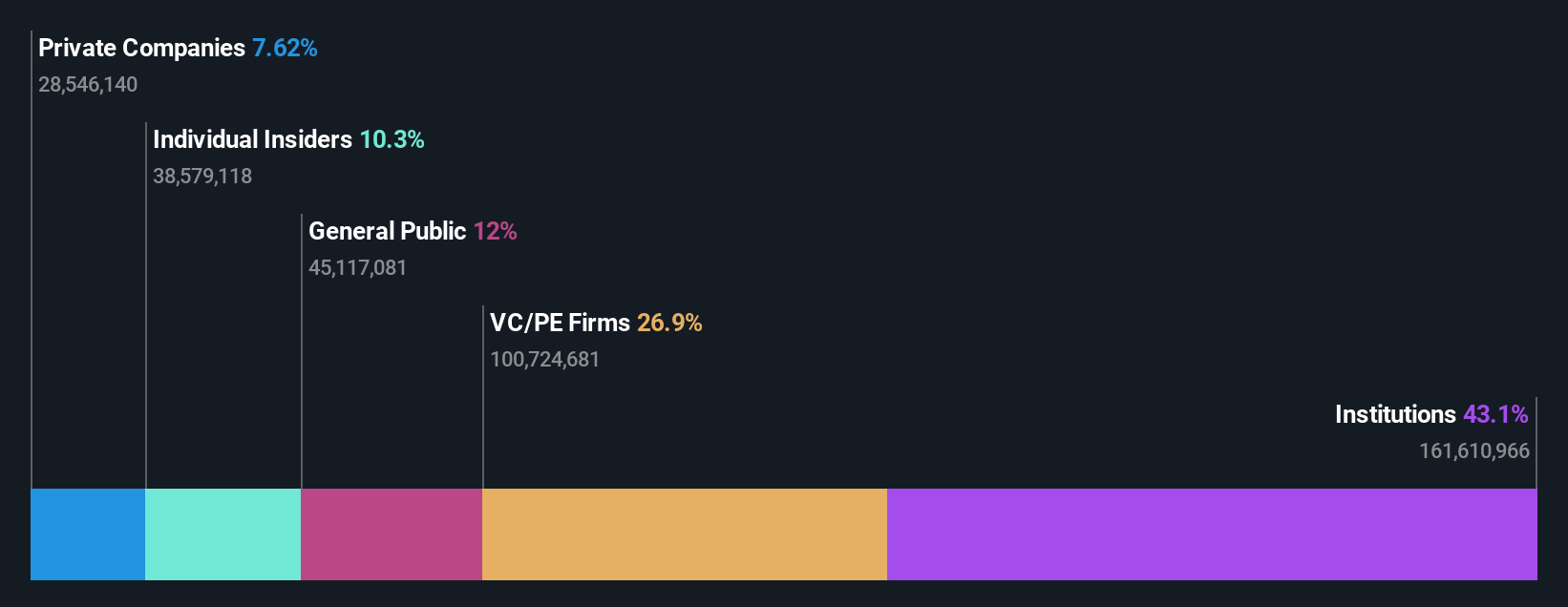

Insider Ownership: 10.3%

Chime Financial is positioned for robust growth, with revenue forecasted to increase at 17.9% annually, surpassing the US market average. Recent Q3 results showed a significant revenue rise to US$543.52 million, though net losses widened. The company raised its full-year guidance and introduced new products like the Chime Card to enhance user engagement. Despite no recent insider trading activity, high insider ownership remains a key feature supporting long-term strategic alignment and potential profitability within three years.

- Click here and access our complete growth analysis report to understand the dynamics of Chime Financial.

- Our comprehensive valuation report raises the possibility that Chime Financial is priced higher than what may be justified by its financials.

Workday (WDAY)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Workday, Inc. is a company that offers enterprise cloud applications both in the United States and internationally, with a market cap of $60.11 billion.

Operations: The company's revenue primarily comes from its cloud applications segment, which generated $8.96 billion.

Insider Ownership: 19.2%

Workday, Inc. is experiencing significant growth, with earnings projected to rise 32.1% annually, outpacing the US market average. The company trades below its estimated fair value and has formed strategic alliances with Google Cloud and Tabulera to enhance its offerings in HR and finance solutions. Despite a decrease in profit margins from last year, Workday's high insider ownership aligns management interests with shareholders, supporting long-term strategic goals amidst expanding partnerships and product innovations.

- Dive into the specifics of Workday here with our thorough growth forecast report.

- Our valuation report here indicates Workday may be undervalued.

Where To Now?

- Dive into all 200 of the Fast Growing US Companies With High Insider Ownership we have identified here.

- Curious About Other Options? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHYM

Chime Financial

A financial technology company, provides digital consumer banking and payment solutions.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success