- United States

- /

- Software

- /

- NasdaqGS:WDAY

Is Now the Right Time to Reassess Workday After Recent AI Partnership News?

Reviewed by Bailey Pemberton

- Ever wondered whether Workday stock is truly a bargain, or if it's just treading water amid the tech sector buzz? You're not alone. Plenty of investors are asking the same question right now.

- Recently, Workday's share price has dipped by 0.4% over the last week and fallen 5.8% in the past month, continuing a downward trend of -11.3% year-to-date and -17.7% over the past year, but still holding onto a three-year gain of 50.2%.

- Workday has been in the headlines lately due to new partnerships with industry leaders and the rollout of enhanced AI features designed to boost their enterprise software appeal. These strategic moves have caught the market's attention and could be shaping both the stock's risk profile and future growth narrative.

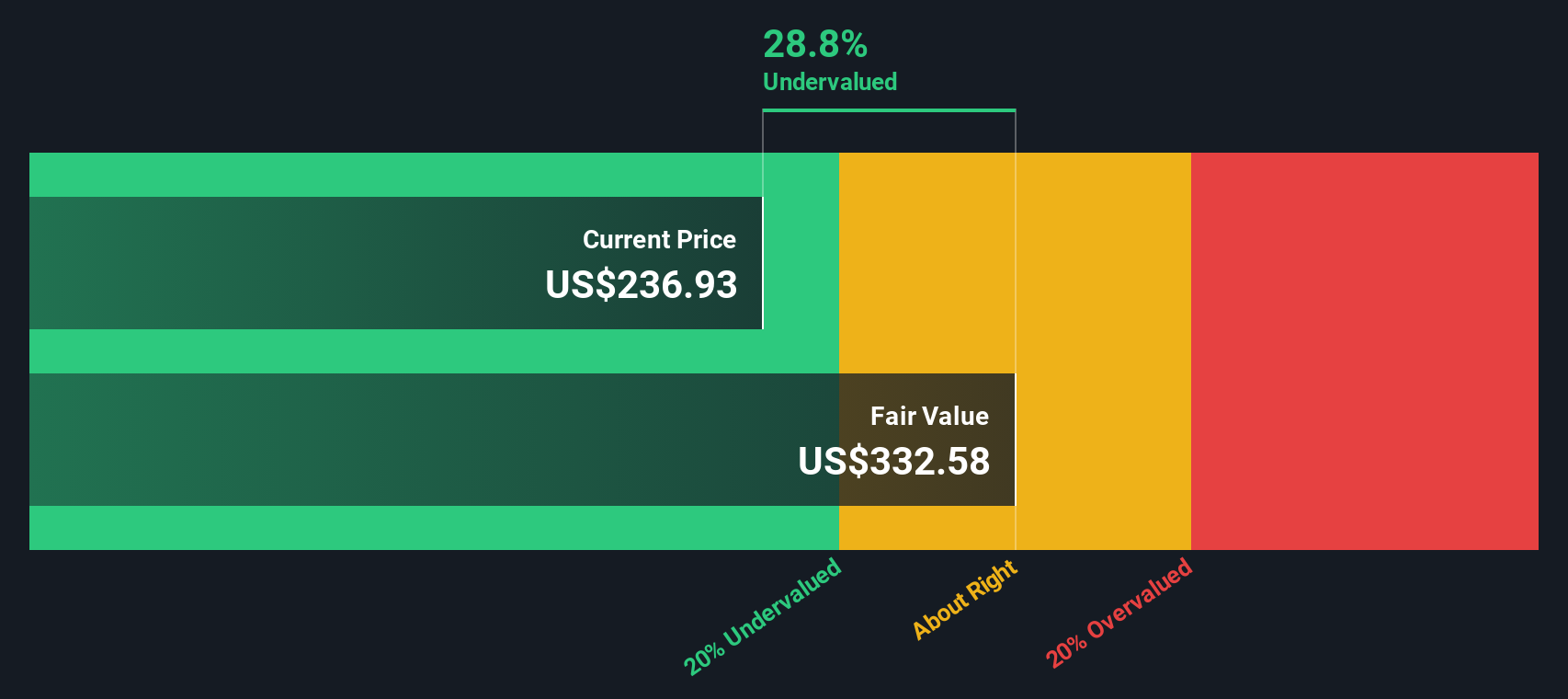

- According to our analysis, Workday scores a 3 out of 6 on our valuation checks, meaning the company appears undervalued in half of our categories. Let's unpack what that really means and why the real key to understanding value might come from looking beyond the headline numbers by the end of this article.

Find out why Workday's -17.7% return over the last year is lagging behind its peers.

Approach 1: Workday Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company's future cash flows and then discounts them back to today's value to estimate what the business is worth right now. This method is widely used because it looks past temporary market swings and focuses on the intrinsic value based on real cash generation.

For Workday, the current Free Cash Flow stands at approximately $2.32 Billion. Analysts have provided estimates for the next five years. Beyond that, projections are extrapolated by Simply Wall St for a full ten-year runway. By 2030, Workday's Free Cash Flow is expected to more than double and reach roughly $5.02 Billion.

Applying the DCF model, the estimated intrinsic value of Workday's shares comes out to $341.68 compared to the current market price, implying the stock is 34.6% undervalued. This suggests that, based on conservative cash flow growth and discount assumptions, the market may be missing Workday’s long-term earning power.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Workday is undervalued by 34.6%. Track this in your watchlist or portfolio, or discover 875 more undervalued stocks based on cash flows.

Approach 2: Workday Price vs Earnings (P/E Ratio)

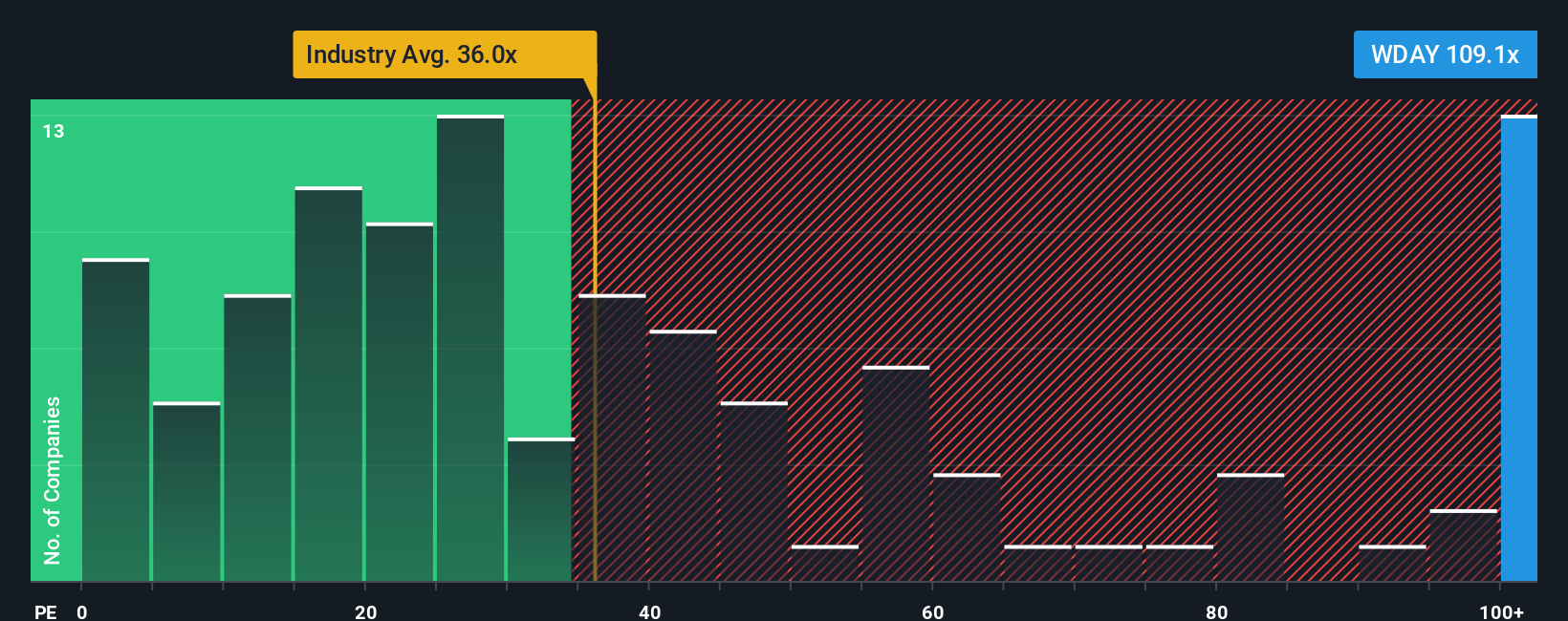

The Price-to-Earnings (P/E) ratio is a widely used valuation metric for profitable companies like Workday because it quickly reflects how much investors are willing to pay today for a dollar of the company's earnings. A high P/E can signal strong expected growth, while a lower P/E often points to more modest expectations or perceived risks.

Growth outlook and risk are key ingredients in what makes a “normal” or “fair” P/E for any given stock. Companies seen as safer or faster-growing typically command higher multiples. For context, Workday is currently trading at a 102.4x P/E ratio, which is much higher than both the Software industry average of 31.5x and the average for its peers at 58.8x.

To get a more tailored perspective, Simply Wall St uses a proprietary "Fair Ratio," which calculates what Workday’s P/E should be based on several factors, including its earnings growth prospects, profit margins, industry trends, market cap, and risks. This approach gives a more accurate sense of value than simply comparing to the industry or peers, as it adjusts for company-specific strengths and weaknesses.

Currently, Workday’s Fair Ratio is 52.6x, while the actual P/E is 102.4x. Since this difference is significant, it suggests the stock is priced well above what its fundamentals warrant at this time.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Workday Narrative

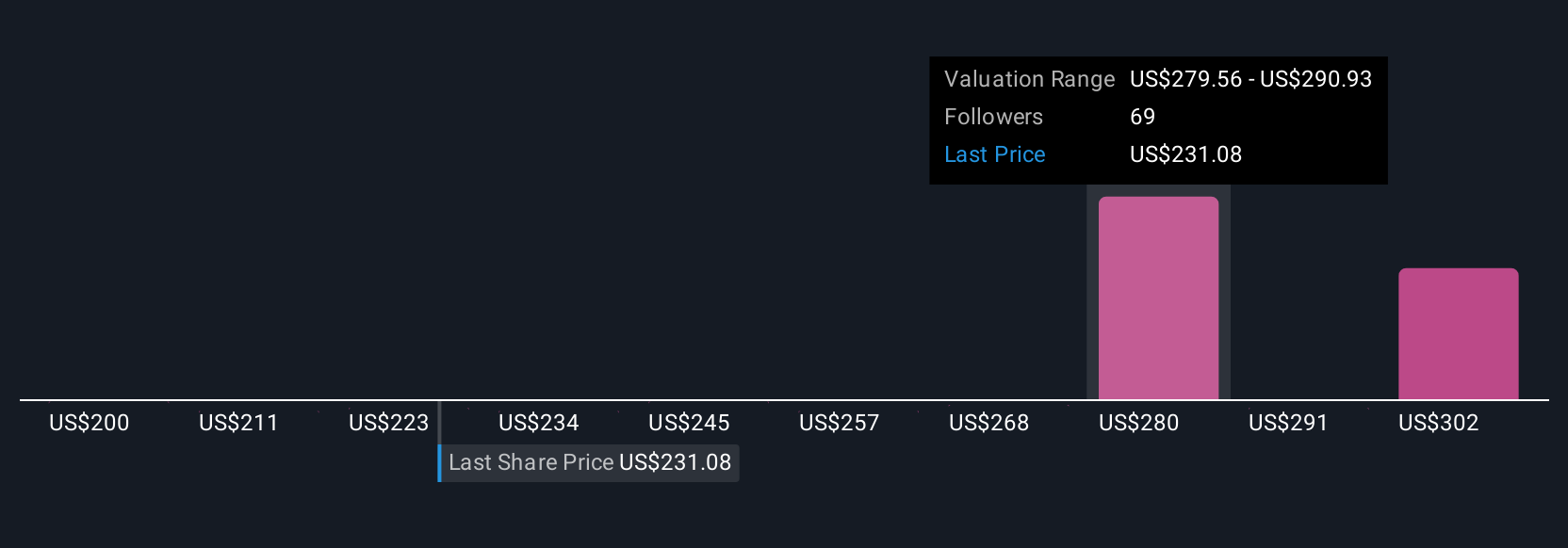

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative goes beyond just the numbers by connecting the company's broader story, your perspective about its future business, risks, and strengths, with a financial forecast and your own estimate of fair value. Narratives are an easy, accessible tool on Simply Wall St’s Community page, trusted by millions of investors, where you can build or explore different viewpoints on what a company is really worth and why.

Narratives help you decide when a stock is undervalued or overvalued by comparing current market price with your fair value, and the models automatically update as new earnings, news, or industry events emerge. For example, with Workday, some investors see strong AI adoption, global reach, and expanding markets justifying a bullish price target of $340, while more cautious investors highlight increasing competition and margin pressures, setting a bearish target as low as $220. By engaging with Narratives, you will have a clear, dynamic framework to make smarter buy or sell decisions, anchored in the story you believe and the numbers that support it.

Do you think there's more to the story for Workday? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDAY

Workday

Provides enterprise cloud applications in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives