- United States

- /

- IT

- /

- NasdaqGS:VRSN

VeriSign (VRSN) Reports Strong Q2 Earnings and Affirms Dividend of US$0.77

Reviewed by Simply Wall St

Recently, VeriSign (VRSN) reported its Q2 2025 earnings results, showing solid year-over-year growth in both sales and net income, alongside a cash dividend declaration. These financial improvements came as the broader market saw record highs in indexes like the S&P 500 and Nasdaq, buoyed by strong corporate earnings and positive economic data. Although VeriSign's 5% price rise this past quarter aligns with the upward market trend, the firm's removal from key index benchmarks on June 30 might have tempered some investor enthusiasm. Nonetheless, the earnings and dividend update likely bolstered confidence among some shareholders.

The recent earnings results and dividend declaration by VeriSign have solidified its stable financial position amidst broader market enthusiasm. However, the company's removal from key index benchmarks might slightly dampen its visibility among investors. Over the past year, VeriSign's total shareholder return, including dividends, was 56.14%, showcasing strong growth and confidence in its financial maneuvers. Comparatively, over the same period, the US IT industry experienced a return of 31.2%. This suggests that VeriSign outperformed its industry in the shorter term.

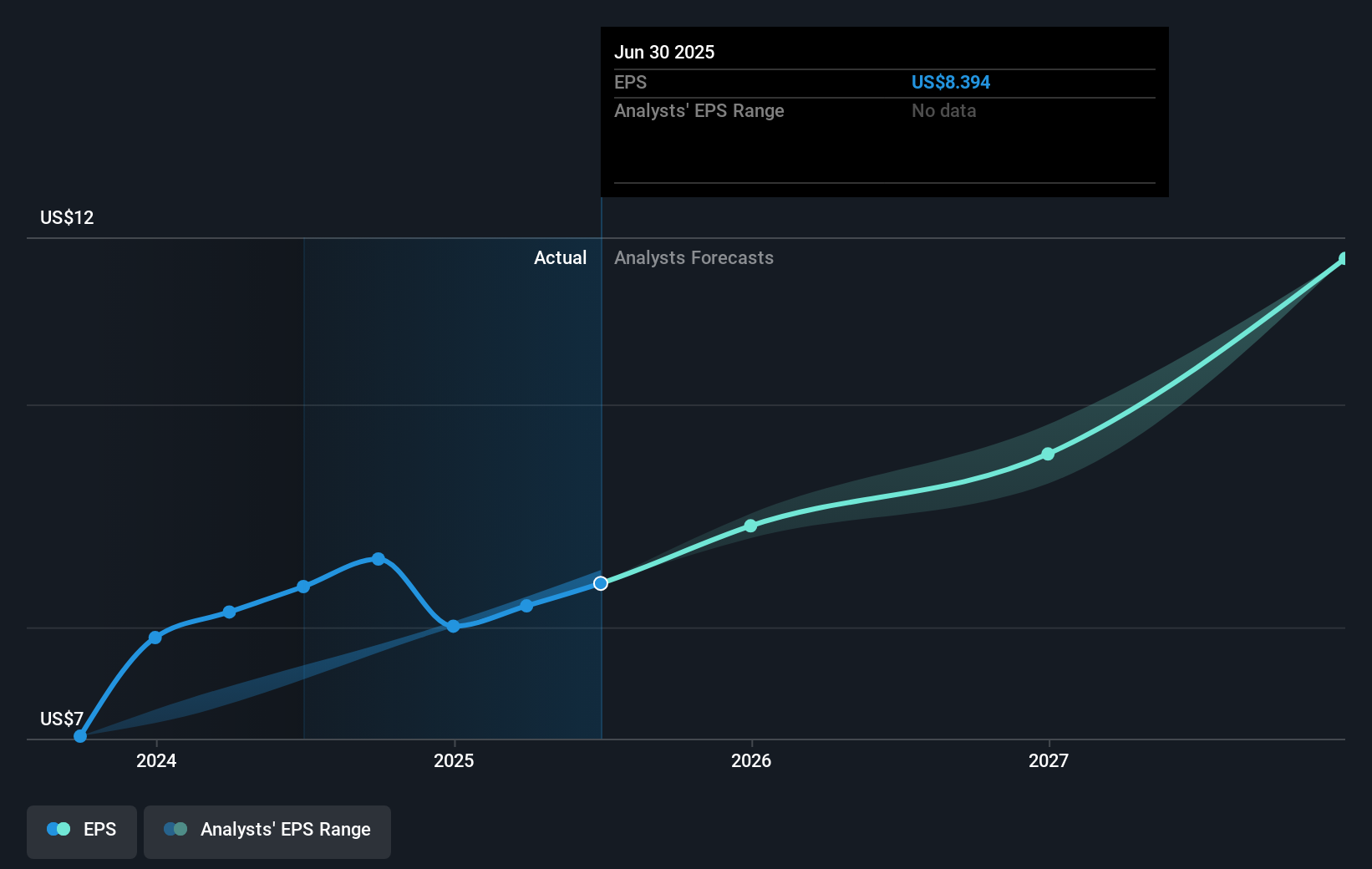

The positive quarterly results and the introduction of dividends may bolster expectations for future revenue and earnings growth. However, analysts have pegged a consensus price target of US$267.84, indicating a potential decline from the current share price of US$286.67. This suggests that despite recent performance, some market participants might consider the stock to be trading above its fair value. The focus remains on overcoming challenges in domain registry expansion, particularly the anticipated .web operations, which could unlock new revenue streams and aid long-term growth prospects. As always, investors should compare these forecasts with their own insights to make informed decisions.

Gain insights into VeriSign's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRSN

VeriSign

Provides internet infrastructure and domain name registry services that enables internet navigation for various recognized domain names worldwide.

Low with questionable track record.

Similar Companies

Market Insights

Community Narratives