- United States

- /

- Software

- /

- NasdaqGS:VRNT

What the Thoma Bravo Acquisition Means for Verint After This Year’s 24% Decline

Reviewed by Bailey Pemberton

If you have been watching Verint Systems lately, you are probably wondering what to make of the recent flurry of activity and where things could go next. The stock has not exactly been a headline-grabber this year, with a year-to-date drop of 24.2% and a five-year slide of 25.4%. However, things took a dramatic turn when news broke that Thoma Bravo plans to acquire Verint for $20.50 per share in cash. Since then, shares have hovered right around that deal price, and the market action has reflected both the promise of a buyout and a shift in risk perception. Analysts, including RBC Capital and Needham, quickly downgraded the stock, seeing less upside with the deal in play.

With a value score of 5 out of 6 across key measures, Verint stands out as significantly undervalued compared to its peers. Most companies rarely check this many boxes, and that suggests some deep potential, assuming the acquisition goes through as planned. So, is Verint a hidden gem being swept up at a bargain by private equity, or is the market telling us something else?

To help answer that, I will break down the main valuation approaches that underpin Verint’s compelling score. And stay tuned, as there is a more insightful way to look at all these numbers that I will share at the end of this analysis.

Why Verint Systems is lagging behind its peers

Approach 1: Verint Systems Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their present value using an appropriate rate. In Verint Systems' case, the current Free Cash Flow (FCF) stands at approximately $109.6 million. Projections suggest solid growth ahead, with analysts forecasting FCF to reach about $218.8 million by the year ending January 2030. These projections are based on analyst estimates for the next five years, with further extensions provided by Simply Wall St's extrapolations for the remainder of the decade.

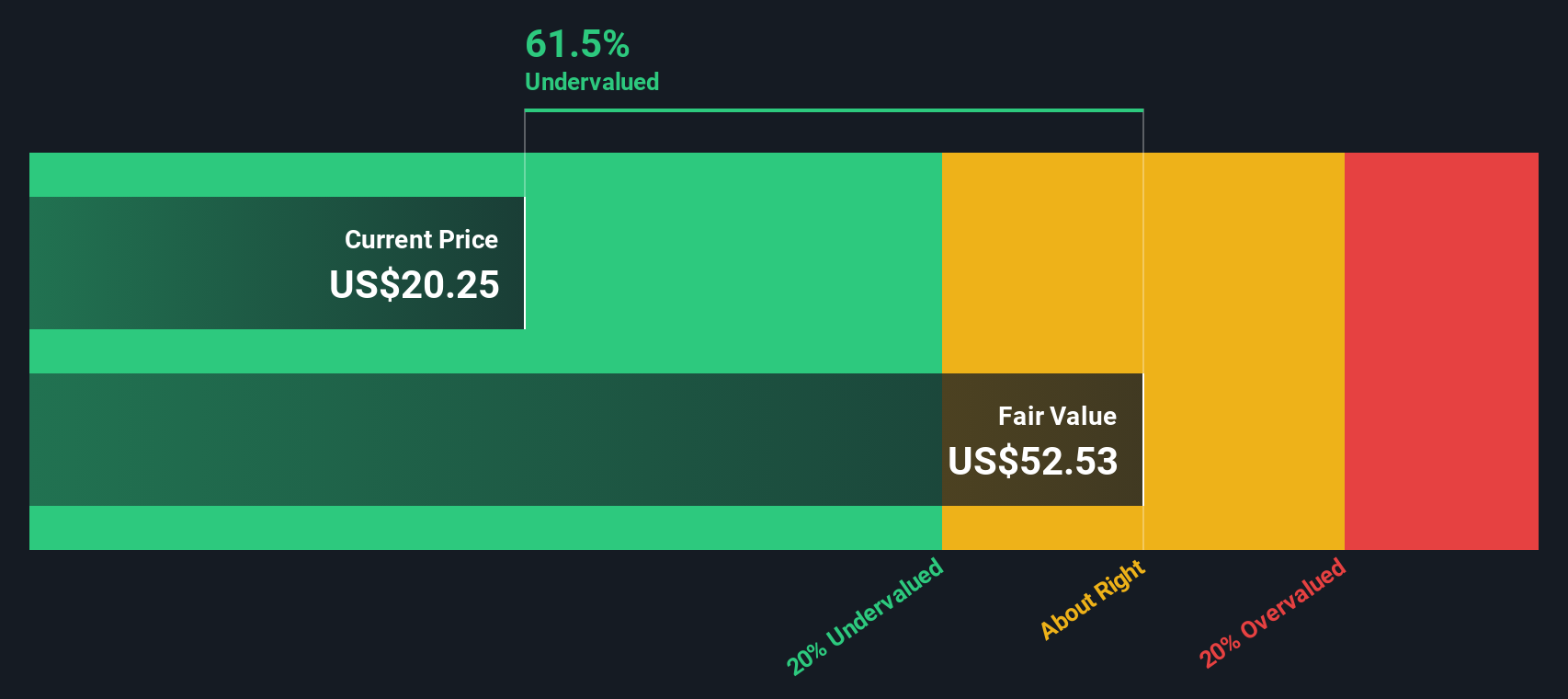

When these projected cash flows are discounted back to today, the DCF model yields an estimated fair value for Verint of $52.49 per share. This figure is notably higher than the current share price, which is trading at a steep 61.4% discount to this intrinsic value. Such a significant gap suggests that, based on the company's cash generation potential, the stock is dramatically undervalued relative to its current market price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Verint Systems is undervalued by 61.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Verint Systems Price vs Earnings

The Price-to-Earnings (PE) ratio is commonly used to value profitable companies because it directly relates a company’s market price to its actual earnings. For investors, the PE ratio quickly signals how much the market is willing to pay for each dollar of earnings, making it a key snapshot for companies like Verint Systems that reliably generate profits.

However, a “normal” or “fair” PE ratio is influenced by big-picture expectations and risks. High-growth businesses can justify higher PE ratios, as investors are willing to pay up for future potential, while slower growth or elevated risk leads to lower ratios. It is important, then, to put any company’s PE in context, not just with raw numbers but the story around them.

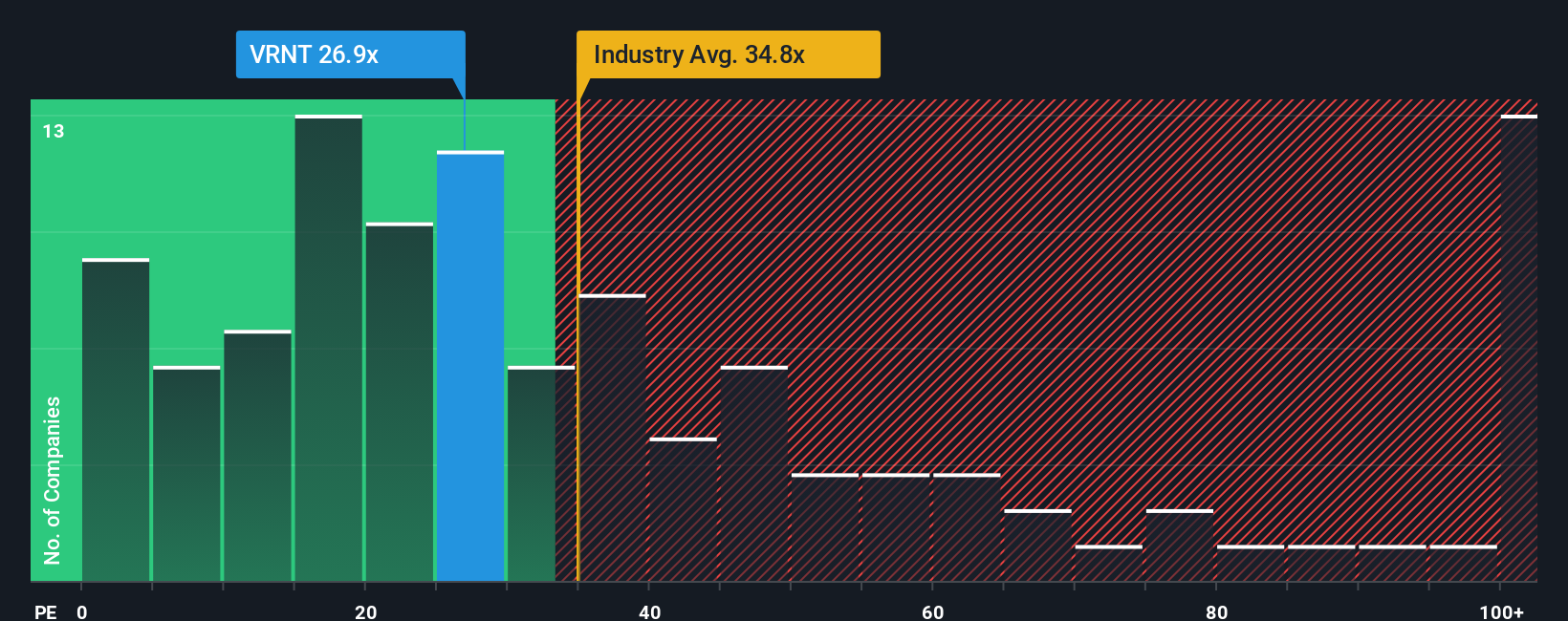

Verint Systems currently trades at a PE ratio of 26.9x. That is below the software industry average of 35.7x and well under the peer group average of 90.1x. But it is also essential to look beyond broad averages. Simply Wall St uses a “Fair Ratio” metric, which accounts for company-specific traits such as growth, margins, market cap and risk profile, alongside industry factors. For Verint, the calculated Fair Ratio is 45.3x. This is commonly a more useful benchmark than industry or peer comparisons alone, as it considers what a typical investor might be willing to pay given the company’s unique qualities and risks.

With Verint’s actual PE ratio sitting well below its Fair Ratio, the numbers suggest the stock is undervalued when assessed through this tailored lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Verint Systems Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your story about a company’s future, connecting what you believe about its strengths, risks, and industry shifts to the financial forecasts that drive fair value. Basically, it is the link between what you think will happen and the numbers that back it up.

Narratives turn investing from a numbers game into a personal, practical process, letting you build a perspective-backed forecast that is easy to create and update on Simply Wall St’s Community page. Once you have made your Narrative, you can compare its fair value with the current share price to see if it is time to buy or sell. Updates to company news or earnings automatically refresh your assumptions for you.

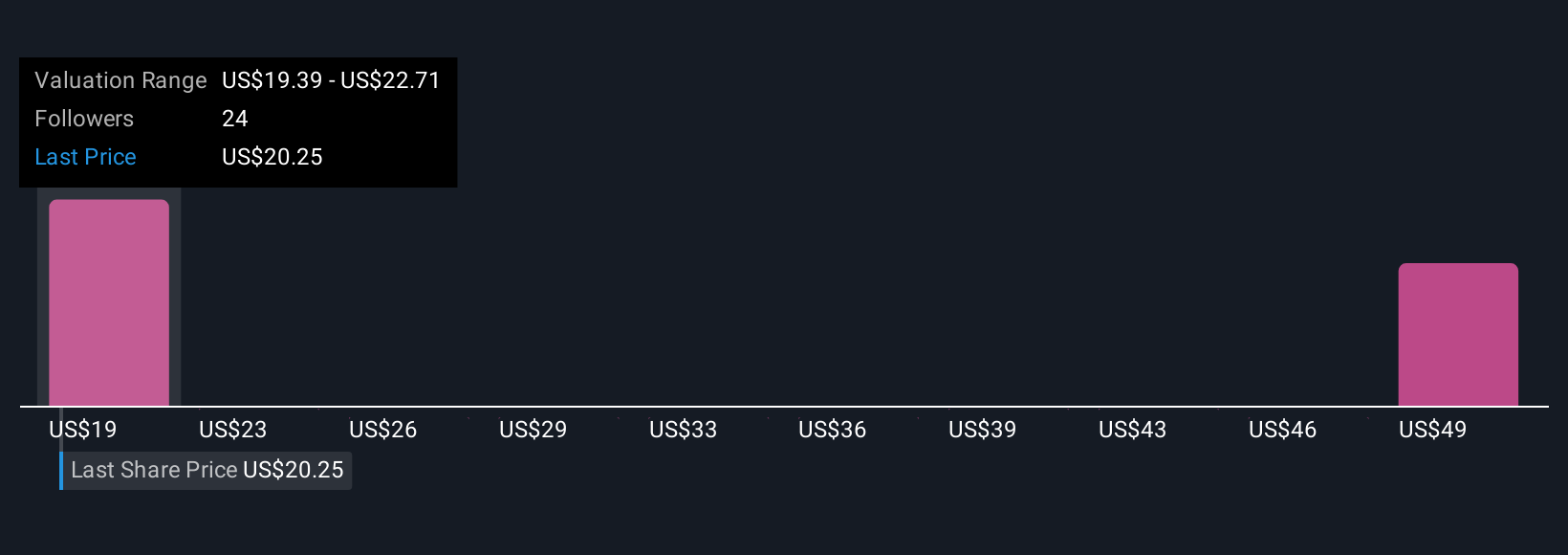

For example, one Verint Systems Narrative might reflect an optimistic view, projecting that AI adoption will ramp up annual revenue growth (as seen in the highest forecasts), boosting margins and supporting a fair value of $25.57 per share. Another, more cautious Narrative could emphasize uncertainty about new contract wins and margin pressure, predicting slower progress and a fair value as low as $20.50. Narratives help you decide which story you believe and what the numbers mean, putting you in control of your investment decisions.

Do you think there's more to the story for Verint Systems? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRNT

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)