- United States

- /

- IT

- /

- NasdaqGS:VNET

Is VNET Group (VNET) Pricing Reflect Recent Data Center Momentum Fairly?

- If you are wondering whether VNET Group shares are offering fair value at around US$11.20, you are not alone. This article is set up to help you frame that question clearly.

- The stock has returned 6.4% over the last 7 days, 7.5% over 30 days, 22.9% year to date and 24.4% over 1 year, while the 5 year return of 73.1% paints a different picture for longer term holders.

- Recent coverage of VNET Group has focused on its position in data center and cloud related services, as investors weigh how its business profile lines up with current sentiment toward the sector. This context helps explain why the recent share price moves are drawing attention from both newer and longer term shareholders.

- On our valuation checklist, VNET Group scores 4 out of 6. We will unpack this using several common valuation approaches, and then finish with a different way of looking at value that can give you a fuller picture of the stock.

Approach 1: VNET Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes estimates of the cash a business could generate in the future and discounts those amounts back into today’s money. The idea is simple: you are asking what all those future cash flows are worth right now.

For VNET Group, the model used is a 2 Stage Free Cash Flow to Equity approach, based on cash flow projections in CN¥. The latest twelve month free cash flow is a loss of CN¥3,026.33m. Analyst estimates guide the nearer term, with ten year projections then extended by Simply Wall St, reaching CN¥9,200.94m in 2035, which the model discounts to CN¥2,560.08m in today’s terms.

Adding up all discounted cash flows and adjusting for the share count gives an estimated intrinsic value of US$15.23 per share, compared with a recent share price of about US$11.20. That gap implies the stock trades at roughly a 26.4% discount to this DCF estimate, which points to a meaningful margin between price and modelled value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests VNET Group is undervalued by 26.4%. Track this in your watchlist or portfolio, or discover 53 more high quality undervalued stocks.

Approach 2: VNET Group Price vs Sales

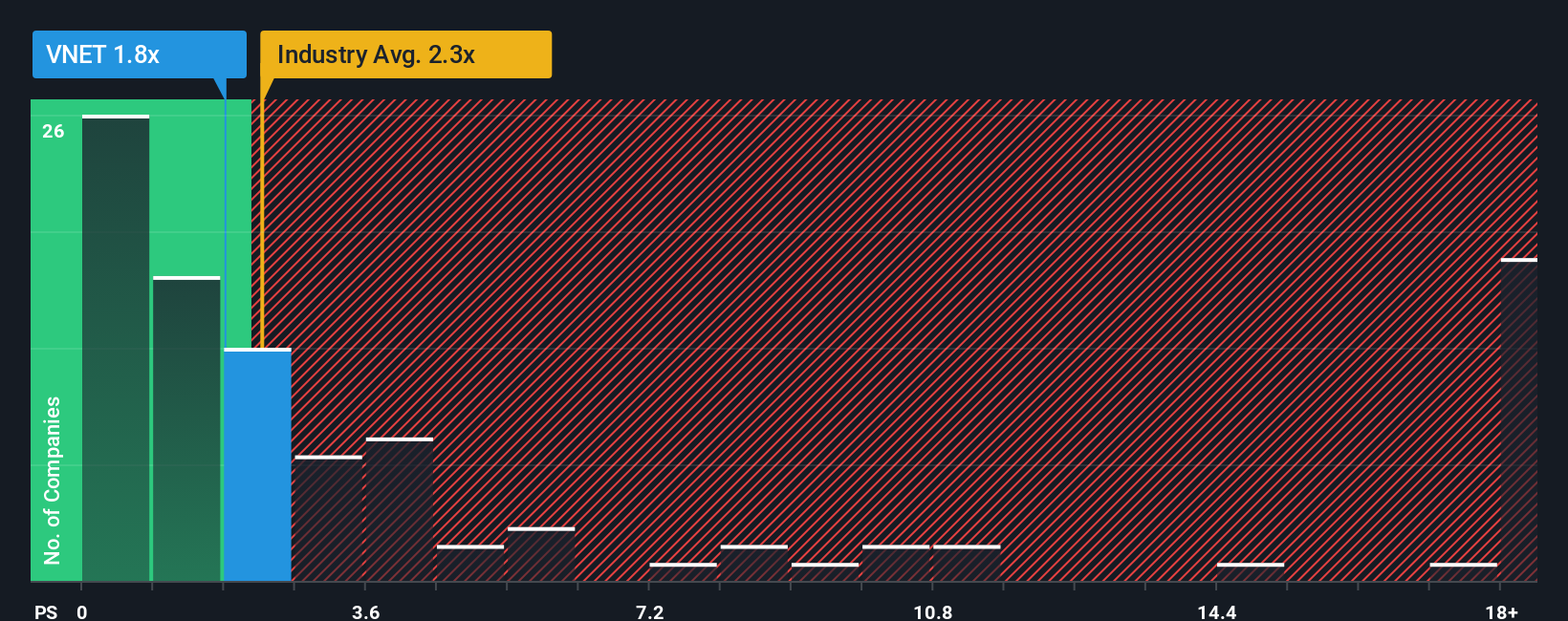

For companies where earnings are limited or volatile, the P/S ratio can be a useful way to think about value, because it ties the share price to revenue rather than profit. Investors often accept a higher or lower P/S depending on what they expect for future growth and how risky they think those sales are.

VNET Group currently trades on a P/S of 2.20x. That sits slightly above the broader IT industry average of 2.02x, and below the peer group average of 3.49x, so the stock is priced between the wider sector and closer direct comparables. Simply Wall St also provides a proprietary “Fair Ratio” of 2.37x, which is the P/S level it would expect given factors such as earnings growth, industry, profit margin, market cap and key risks.

This Fair Ratio can be more informative than a simple industry or peer comparison because it adjusts for the specific profile of the company rather than assuming all IT stocks deserve the same multiple. Compared with this 2.37x Fair Ratio, VNET Group’s current 2.20x P/S is lower, which points to the shares trading on a modest discount to that tailored benchmark.

Result: UNDERVALUED

P/S ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 22 top founder-led companies.

Upgrade Your Decision Making: Choose your VNET Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about VNET Group, written in numbers, where you set your own view of fair value and your assumptions for future revenue, earnings and margins. Instead of looking at ratios in isolation, a Narrative links what you believe about the company’s business to a forecast, and then to a fair value that you can compare with the current share price. On Simply Wall St, Narratives sit inside the Community page and are designed to be easy to use, even if you are not a professional analyst. They help you decide whether VNET Group looks attractive, fully priced, or expensive by lining up Fair Value against today’s Price, and they update automatically when new data, news or earnings are added to the platform. For VNET Group, one investor might see a relatively cautious fair value with modest growth, while another might expect stronger revenue and margin expansion and therefore a higher fair value.

Do you think there's more to the story for VNET Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VNET

VNET Group

An investment holding company, provides hosting and related services in China.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Alphabet - A Fundamental and Historical Valuation

The Compound Effect: From Acquisition to Integration

Future PE of 12.8x Shines Bright for FactSet Growth

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion