- United States

- /

- Software

- /

- NasdaqGM:VERX

Does Vertex's (VERX) Global E-Invoicing and AI Push Redefine Its Long-Term Competitive Edge?

Reviewed by Sasha Jovanovic

- At the recent Goldman Sachs Communacopia+ Technology Conference, Vertex Inc. reiterated its commitment to expanding global e-invoicing coverage and investing in artificial intelligence through new products and the acquisition of Kitsugi.

- Vertex aims to unlock an additional US$100 million in revenue by achieving 100% country coverage for e-invoicing, while its AI initiatives are designed to boost efficiency and strengthen its competitive position.

- We'll explore how Vertex's expanded AI investments, highlighted at the conference, could influence its long-term growth outlook and investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Vertex Investment Narrative Recap

To hold Vertex stock, you need to believe its push for global e-invoicing leadership and AI-powered tax automation will overcome extended enterprise sales cycles and margin pressures from rising competition. The recent conference reaffirmed these priorities but did not materially alter the biggest near-term catalyst, regulatory-driven e-invoicing adoption in Europe, nor the main risk, which remains sluggish deal closures due to macro uncertainty and delayed ERP migrations.

Of all recent announcements, Vertex’s launch of new certified ERP and e-commerce integrations, including expanded AI-powered features such as Vertex Copilot, stands out. This directly supports the e-invoicing catalyst by making Vertex’s solutions easier to adopt at scale, aiming to boost customer uptake and recurring revenue ahead of pending regulatory deadlines in core markets.

But investors should also be aware that, despite these growth moves, the risk of delayed enterprise sales cycles still looms large...

Read the full narrative on Vertex (it's free!)

Vertex's narrative projects $1.1 billion revenue and $71.6 million earnings by 2028. This requires 14.6% yearly revenue growth and a $122 million increase in earnings from -$50.4 million currently.

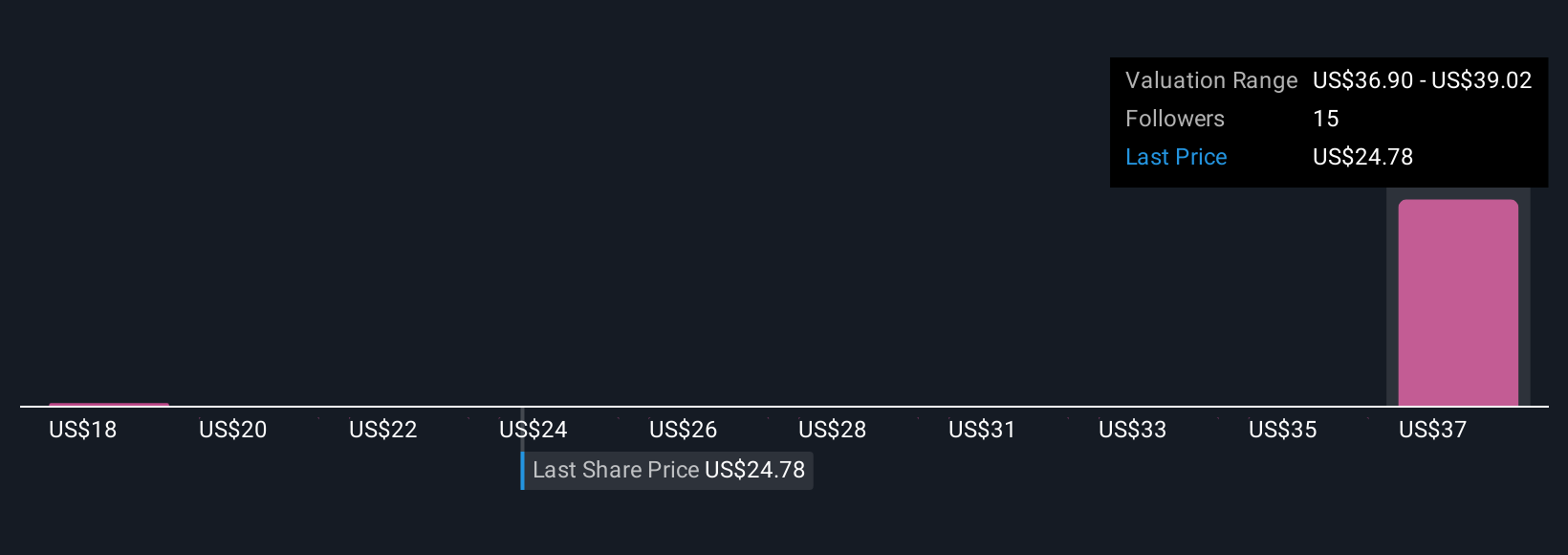

Uncover how Vertex's forecasts yield a $37.23 fair value, a 48% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set Vertex’s fair values between US$17.84 and US$38.99 across three estimates, reflecting wide-ranging opinions on its prospects. While many see promise in mandatory e-invoicing in Europe, these outlooks remind you just how much market performance hinges on timely deal execution and adoption, check out what others are thinking and why their expectations differ.

Explore 3 other fair value estimates on Vertex - why the stock might be worth as much as 55% more than the current price!

Build Your Own Vertex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vertex research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Vertex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vertex's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 34 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VERX

Vertex

Provides enterprise tax technology solutions for retail trade, wholesale trade, and manufacturing industries in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives