- United States

- /

- Software

- /

- NasdaqGM:VERI

Veritone (VERI) Is Up 23.8% After Hyperscaler Contracts and $75M Equity Offering - What's Changed

Reviewed by Sasha Jovanovic

- Veritone, Inc. recently announced a series of major developments, including contract wins with leading hyperscalers for its Data Refinery platform and the launch of advanced AI-powered redaction features in its SaaS application, Veritone Redact, together with a US$75 million follow-on equity offering.

- These announcements highlight Veritone’s expanding role in the AI data management space and its response to evolving regulatory and compliance needs, particularly with unique features aimed at legal, law enforcement, and corporate sectors.

- We'll explore how the recent hyperscaler contracts and AI product advances could impact Veritone’s outlook for long-term AI-driven growth.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Veritone Investment Narrative Recap

To be a Veritone shareholder right now, you need to believe in the company’s ability to convert increasing demand for AI-powered data solutions, especially among top hyperscalers, into sustained revenue, improved margins, and a clear roadmap to profitability. The recent US$75 million equity offering brings needed liquidity but highlights persistent risks around ongoing net losses and potential shareholder dilution. In the short term, this capital raise has a material impact by addressing working capital needs, but it does not eliminate the pressure to demonstrate progress toward consistent operating profits. Among the latest announcements, Veritone’s major contract wins to deploy its Data Refinery platform with leading hyperscalers stand out. These deals have doubled the company’s near-term VDR pipeline to nearly US$40 million, directly addressing the most important growth catalyst: gaining traction with large-scale enterprise and model developer clients seeking to monetize unstructured data for advanced AI applications. Yet, on the other hand, the risk of continued net losses and further dilution remains a factor investors should be aware of...

Read the full narrative on Veritone (it's free!)

Veritone's narrative projects $158.0 million in revenue and $20.7 million in earnings by 2028. This requires a 20.2% yearly revenue growth and a $114.1 million increase in earnings from current earnings of -$93.4 million.

Uncover how Veritone's forecasts yield a $10.25 fair value, a 58% upside to its current price.

Exploring Other Perspectives

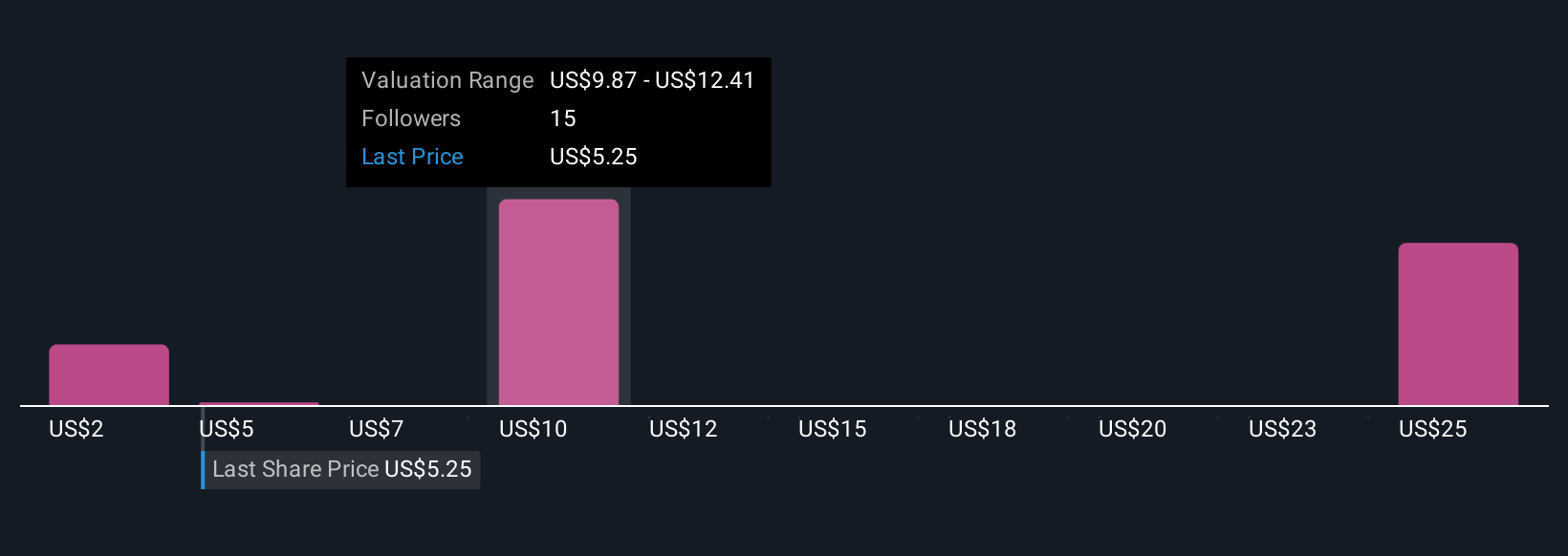

Simply Wall St Community fair value estimates for Veritone range sharply from US$2.24 to US$27.68 across 9 different views. With recent equity raises in focus, investors should consider how ongoing net losses and share dilution might affect the company’s path to higher valuations.

Explore 9 other fair value estimates on Veritone - why the stock might be worth less than half the current price!

Build Your Own Veritone Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Veritone research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Veritone research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Veritone's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VERI

Veritone

Engages in the provision of artificial intelligence (AI) computing solutions and services in the United States, the United Kingdom, France, Australia, Israel, and India.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion