- United States

- /

- Diversified Financial

- /

- NasdaqGS:LSAK

Is Net 1 UEPS Technologies (NASDAQ:UEPS) A Risky Investment?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Net 1 UEPS Technologies, Inc. (NASDAQ:UEPS) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Net 1 UEPS Technologies

What Is Net 1 UEPS Technologies's Debt?

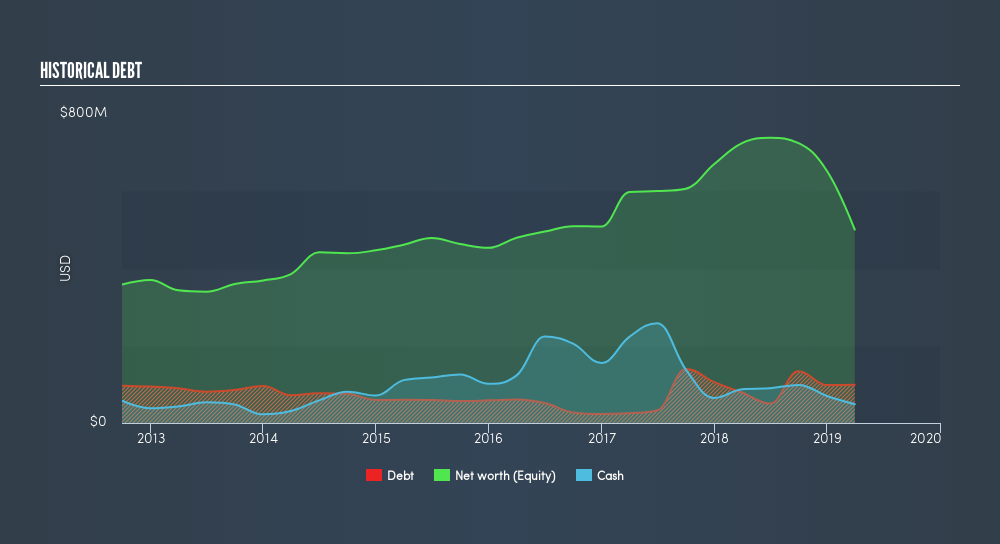

As you can see below, at the end of March 2019, Net 1 UEPS Technologies had US$98.9m of debt, up from US$78.9m a year ago. Click the image for more detail. On the flip side, it has US$48.8m in cash leading to net debt of about US$50.1m.

How Healthy Is Net 1 UEPS Technologies's Balance Sheet?

We can see from the most recent balance sheet that Net 1 UEPS Technologies had liabilities of US$222.7m falling due within a year, and liabilities of US$116.2m due beyond that. On the other hand, it had cash of US$48.8m and US$88.0m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$202.2m.

This is a mountain of leverage relative to its market capitalization of US$229.5m. So should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. Since Net 1 UEPS Technologies does have net debt, we think it is worthwhile for shareholders to keep an eye on the balance sheet, over time. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Net 1 UEPS Technologies's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Net 1 UEPS Technologies actually shrunk its revenue by 35%, to US$402m. That makes us nervous, to say the least.

Caveat Emptor

Not only did Net 1 UEPS Technologies's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost a very considerable US$50m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. For example, we would not want to see a repeat of last year's loss of-US$114.8m. So in short it's a really risky stock. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Net 1 UEPS Technologies insider transactions.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:LSAK

Lesaka Technologies

Operates as a Fintech company, provides financial services solutions and software in Southern Africa.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives